You donât want an actual property license to search out your dream house, however it does lend a hand to develop into conversant in actual property jargon it’s possible you’ll come upon throughout the method. When on the lookout for a house or making use of for a loan, you could listen your actual property agent or lender use any of the phrases or acronyms beneath.

Stay this five-part information to hand â youâll be fluent within the language of house purchasing sooner than you are aware of it.

Actual property phrases to grasp while youâve began home looking

1. Affordability

Affordability or house affordability refers to the amount of cash you’ll very easily have enough money to spend on a house. House affordability takes under consideration your revenue, down fee, and per month money owed. Check out our affordability calculator to peer how a lot home you may be able to have enough money.

2. Purchase-rent breakeven horizon

A concrete level at which purchasing a house makes extra monetary sense than renting one. Learn extra concerning the Purchase-Hire Breakeven Horizon right here.Â

3. Patrons marketplace

Marketplace stipulations that exist when properties on the market outnumber patrons. Houses can take a seat in the marketplace for a very long time, and costs have a tendency to drop.

4. Comparative marketplace research (CMA)

An in-depth research, ready through an actual property agent, that determines the estimated cost of a house in keeping with lately bought properties of identical situation, dimension, options and age which are situated in the similar space.

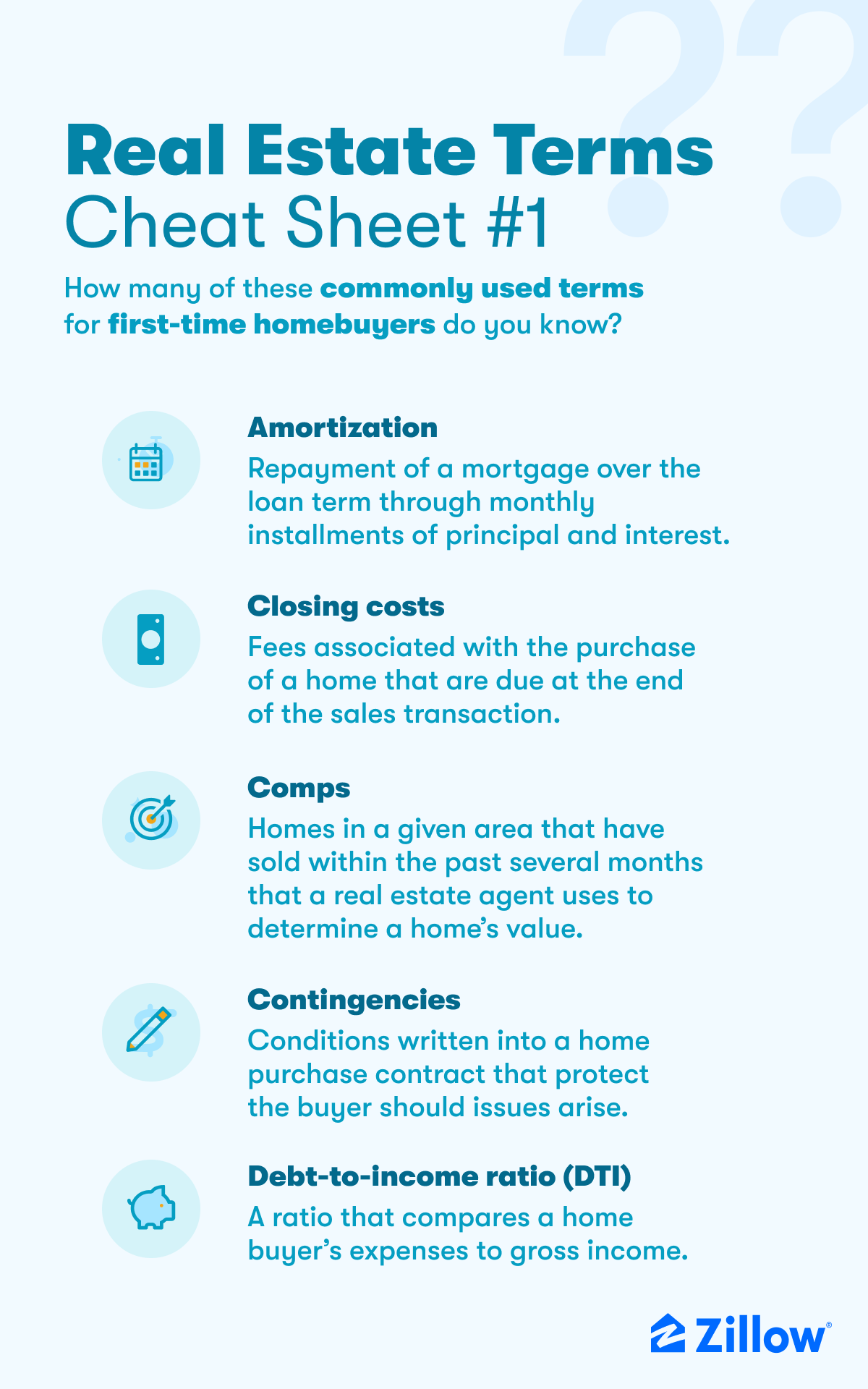

5. CompsÂ

Or similar gross sales, are properties in a given space that experience bought inside the previous a number of months that an actual property agent makes use of to resolve a houseâs cost.

6. Days on marketplace (DOM)Â

The selection of days a estate list is regarded as energetic.

7. List worth

The cost of a house, as set through the vendor.

8. More than one list provider (MLS)Â

A database the place actual property brokers record houses on the market.

9. Dealers marketplace

Marketplace stipulations that exist when patrons outnumber properties on the market. Bidding wars are commonplace. Costs are continuously upper than moderate.

10. Quick sale

The sale of a house through an proprietor who owes extra at the house than itâs value. The landlordâs financial institution should approve a decrease list worth sooner than the house will also be bought. Be informed extra about quick gross sales right here.Â

@zillow Quick sale = the vendor owes greater than the house is value. (Satirically, purchasing one can take some time) #zillow #homebuying #realestate #awkward #facepalm ⬠authentic sound â Zillow

Be informed those definitions sooner than you get started looking for a loan

11. Typical mortgageÂ

A house mortgage now not assured through a central authority company, such because the FHA or the VA. Learn extra about standard loans right here.Â

12. Down feeÂ

A definite portion of the houseâs acquire worth {that a} purchaser should pay. A minimal requirement is continuously dictated through the mortgage sort. Be informed extra about down bills right here.Â

13. Fannie Mae®Â

A central authority-sponsored endeavor chartered in 1938 to lend a hand be sure that a competent and reasonably priced provide of loan budget right through the rustic.

14. Federal Housing Management (FHA)Â

A central authority company created through the Nationwide Housing Act of 1934 that insures loans made through personal lenders. The Federal Housing Management is a part of the U.S. Division of Housing and City Construction.Â

15. FHA 203(okay)Â

A rehabilitation mortgage sponsored through the government that allows house patrons to finance cash right into a loan to fix, beef up or improve a house.

16. FHA mortgage

Loans from personal lenders which are regulated and insured through the Federal Housing Management (FHA). FHA loans are other from standard loans as a result of they may be able to be licensed for debtors with decrease credits rankings and would possibly permit for down bills as little as 3.5 % of the full mortgage quantity. Most mortgage quantities can range through county. Learn extra about FHA loans right here.

17. Fastened-Fee Loan

A loan with primary and pastime bills that stay the similar right through the lifetime of the mortgage since the rate of interest does now not trade.

18. Foreclosures

A estate repossessed through a financial institution when the landlord fails to make loan bills. Be informed extra about foreclosures right here.Â

19. Freddie Mac®

A central authority company chartered through Congress in 1970 to supply a continuing supply of loan investment for the countryâs housing markets.

20. Loan Banker

Person who originates, sells, and products and services loan loans and resells them to secondary loan lenders corresponding to Fannie Mae or Freddie Mac.

21. Loan dealer

An authorized skilled who works on behalf of the consumer to safe financing thru a financial institution or different lending establishment.

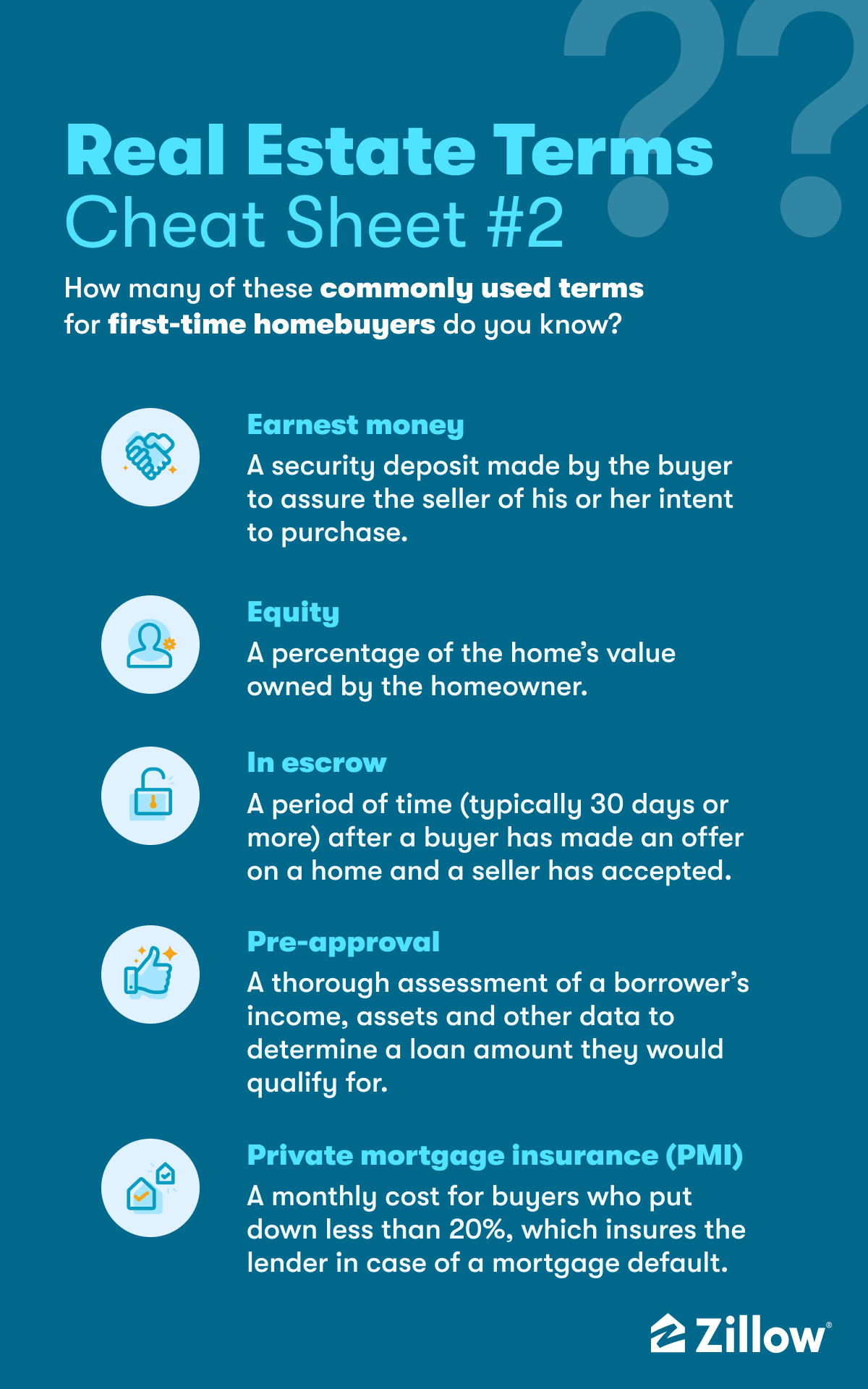

22. Non-public Loan Insurance coverage

Non-public Loan Insurance coverage or PMI, is a per month loan insurance coverage top rate paid through a borrower for a loan insurance coverage. Loan insurance coverage protects the lender if the borrower defaults at the loan mortgage. Loan insurance coverage is most often required on a traditional loan mortgage and the down fee is not up to 20 % of the sale worth. Learn extra about loan insurance coverage.

23. Loan rate of interest

The cost of borrowing cash. The bottom price is ready through the Federal Reserve after which custom designed in line with borrower, in keeping with credits ranking, down fee, estate sort and issues the consumer will pay to decrease the velocity.

24. Piggyback mortgage

A mixture of loans bundled to steer clear of personal loan insurance coverage. One mortgage covers 80% of the houseâs cost, every other mortgage covers 10% to fifteen% of the houseâs cost, and the consumer contributes the remaining.

25. Prepayment penalty

A prepayment penalty is a charge some lenders would possibly fee in the event you repay some or your entire loan early. No longer all mortgages lift a prepayment penalty. You’ll want to learn the tremendous print moderately.

26. High price

High price is the rate of interest charged through a lender to consumers who’re the least prone to default on their loans. Essentially the most credit-worthy consumers (basically huge firms), obtain the most productive or lowest price that the lender would supply any of its consumers. Each and every lending establishment units its personal high price. In most cases, maximum customersâ loan rate of interest goes to be upper than the high price.

27. Important, pastime, estate taxes and house owners insurance coverage (PITI)

The parts of a per month loan fee.

28. Non-public loan insurance coverage (PMI)

A charge charged to debtors who make a down fee this is not up to 20% of the houseâs cost. The cost, 0.3% to one.5% of the once a year mortgage quantity, will also be canceled in positive instances when the borrower reaches 20% fairness. Learn extra about PMI right here.

29. Issues

Pay as you go pastime owed at last, with one level representing 1% of the mortgage. Paying issues, which might be tax deductible, will decrease the per month loan fee.

Learn about those actual property phrases while youâre making use of for a loan

30. Adjustable-rate loan (ARM)

An adjustable-rate loan, or ARM, has an introductory rate of interest that lasts a suite time frame and adjusts each and every six months thereafter for the rest mortgage time period. After the set time frame your rate of interest will trade and so will your per month fee. Be informed extra about adjustable-rate mortgages right here.

31. Again-end ratioÂ

One among two debt-to-income ratios {that a} lender analyzes to resolve a borrowerâs eligibility for a house mortgage. The ratio compares the borrowerâs per month debt bills to gross revenue. Learn extra about back-end ratio right here.

32. Last disclosure

32. Last disclosure

It is a remark a borrower will obtain from their lender a minimum of 3 days sooner than last on a house. The road pieces will have to glance very similar to what a borrower sees on their mortgage estimate when first making use of â there are limits to how a lot any charges can trade within the time frame between utility and shutting day, so debtors will have to evaluate their last disclosure carefully and ask their lender about any adjustments.

33. Depository establishments

Banks, financial savings and loans, and credits unions. Those establishments underwrite in addition to set house mortgage pricing in-house.

34. Debt-to-income ratio (DTI)

A ratio that compares a house purchaserâs bills to gross revenue. Check out our debt-to-income calculator to be informed extra.Â

35. Housing ratio

One among two debt-to-income ratios {that a} lender analyzes to resolve a borrowerâs eligibility for a house mortgage. The ratio compares overall housing price (primary, house owners insurance coverage, taxes and personal loan insurance coverage) to gross revenue.

36. Mortgage estimate

A 3-page record despatched to an applicant 3 days when they follow for a house mortgage. The record contains mortgage phrases, per month fee and shutting prices. A mortgage estimate can lend a hand debtors store and examine prices of loans with lenders. You don’t seem to be obligated to just accept the mortgage simply since you won a mortgage estimate. Good loan consumers follow for no less than two loans and use the mortgage estimates to resolve which lender they need to use.

37. Mortgage-to-value ratio (LTV)Â

The volume of the mortgage divided through the cost of the home. Lenders praise decrease LTV ratios.

38. Origination charge

A charge, charged through a dealer or lender, to underwrite and procedure a house mortgage utility. An origination charge isn’t a unmarried charge. Itâs a suite of lender-specific charges which are a part of your prices when last a loan mortgage. Learn extra about origination charges right here.Â

39. Pre-approvalÂ

An intensive evaluation of a borrowerâs revenue, belongings and different knowledge to resolve a mortgage quantity they’d qualify for. An actual property agent will request a pre-approval or pre-qualification letter sooner than appearing a purchaser a house. Be informed extra about pre-approval right here.Â

40. Pre-qualificationÂ

A fundamental evaluation of revenue, belongings and credits ranking to resolve what, if any, mortgage techniques a borrower may qualify for. An actual property agent will request a pre-approval or pre-qualification letter sooner than appearing a purchaser a house. Learn extra about pre-qualification right here.Â

41. UnderwritingÂ

A procedure a lender follows to evaluate a house mortgage applicantâs revenue, belongings and credits, and the chance all for providing the applicant a loan.

Actual property phrases it’s possible you’ll listen while youâve had your be offering authorised

42. American Society of House Inspectors (ASHI)

A not-for-profit skilled affiliation that units and promotes requirements for estate inspections. Search for this accreditation or one thing identical when looking for a house inspector.

43. Money-value coverage

A house owners insurance coverage that will pay the alternative price of a house, minus depreciation, will have to harm happen.

44. Last prices

Charges related to the acquisition of a house which are due on the finish of the gross sales transaction. Charges would possibly come with the appraisal, the house inspection, a identify seek, a pest inspection and extra. Patrons will have to finances for an quantity this is 2% to five% of the houseâs acquire worth. Learn extra about last prices right here.Â

45. Contingencies

Stipulations written into a house acquire contract that give protection to the consumer will have to problems get up with financing, the house inspection, and so forth.

46. Earnest cash

A safety deposit made through the consumer to guarantee the vendor of his or her intent to buy.

47. Escalation clause

A clause or addendum to an actual property contract or be offering that states a purchaser is keen to boost his or her be offering worth to a predetermined quantity if the vendor receives a better competing be offering for the valuables. Learn extra about escalation clauses and making an be offering on a house.

48. Loan escrow account

An account required through a lender and funded through a purchaserâs loan fee to pay the consumerâs house owners insurance coverage and estate taxes. A portion of your per month fee is going into the escrow account to hide taxes and insurance coverage. In case your loan doesnât have an escrow account, you could pay the property-related bills at once.

@zillow Escrow: the length in a sale the place the consumerâs cash is held through a 3rd celebration in an escrow account. #zillow #homebuying #realestate #awkward #facepalm ⬠authentic sound â Zillow

49. Escrow state

A state during which an escrow agent is answerable for last.

50. House inspection

A visible analysis carried out through an authorized house inspector to search for any doable defects or pieces of notice associated with the valuables, development(s), and the techniques in a house. Inspection happens when the house is underneath contract or in escrow.

51. Householders insurance coverage

A coverage that protects the construction of the house, its contents, damage to others and dwelling bills will have to harm happen. Be informed extra about house owners insurance coverage right here.

52. In escrow

A time frame (usually 30 days or extra) after a purchaser has made an be offering on a house and a vendor has authorised. All over this time, the house is inspected and appraised, and the identify looked for liens, and so forth.

53. Name insurance coverage

Insurance coverage that protects the consumer and lender will have to a person or entity step ahead with a declare that was once connected to the valuables sooner than the vendor transferred prison possession of the valuables or âidentifyâ to the consumer.

54. Switch taxes

Charges imposed through the state, county or municipality on switch of identify.

55. Below contractÂ

A time frame (usually 30 days or extra) after a purchaser has made an be offering on a house and a vendor has authorised. All over this time, the house is inspected and appraised, and the identify is looked for liens, and so forth.

56. Walkthrough

A purchaserâs ultimate inspection of a house sooner than last.

Phrases to grasp while you personal a house

57. Amortization

Reimbursement of a loan over the mortgage time period thru common per month installments of primary and pastime, in keeping with an amortization agenda. In case you have made your desired per month bills, on the finish of the mortgage time period (e.g., 15 or 30 yr loan), you’re going to personal your house. Check out our amortization calculator to be informed extra.Â

58. Deed

A deed is the prison record that establishes possession of actual estate, and could also be used to switch the possession of actual estate to someone else or entity.

59. Fairness

A proportion of the houseâs cost owned through the home-owner.

60. Householders affiliation (HOA)

The governing frame of a housing building, apartment or townhome complicated that units laws and rules. They fee dues used to deal with commonplace spaces. Be informed extra about HOAs right here.Â

61. Lien

A lien is any prison declare upon a estate for a debt or a non-monetary pastime within the estate. A lien is a safety pastime that can provide a creditor the appropriate to take ownership of a estate secured through a mortgage, corresponding to a loan, when the borrower defaults at the mortgage duties. Maximum lenders would require identify insurance coverage to offer protection to their pursuits will have to there be exceptional liens at the estate securing their safety pastime.

62. Belongings tax exemption

A discount in taxes in keeping with particular standards, corresponding to set up of a renewable power gadget or rehabilitation of a ancient house.

63. Refinancing

The act of paying off one mortgage through acquiring every other. Refinancing is in most cases performed to safe higher mortgage phrases, corresponding to a decrease rate of interest. Be informed extra about refinancing right here.Â

64. Tax lien

The federal governmentâs prison declare towards estate when the home-owner neglects or fails to pay a tax debt.