Paul Morigi

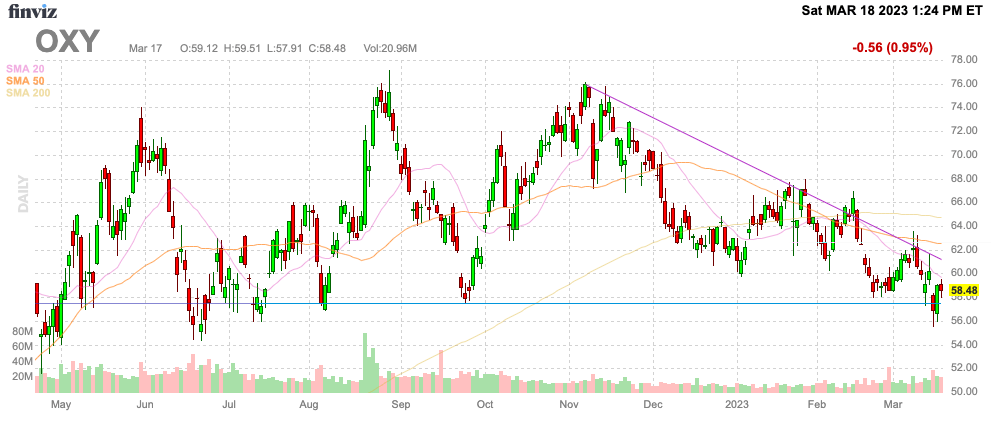

After more than one warnings to traders that one mustn’t overpay for Occidental Petroleum Company (NYSE:OXY), even Warren Buffett and Berkshire Hathaway (BRK.B, BRK.A) overpaid for the inventory. The impartial power corporate now faces plunging power costs that in most cases happen throughout susceptible financial classes. My funding thesis is extra Bearish at the inventory till oil costs shake out at decrease costs.

Supply: Finviz

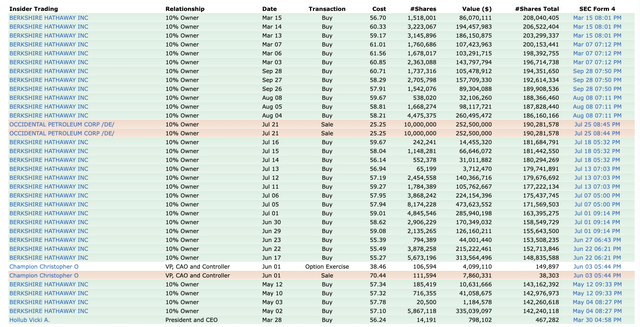

Buffett Nonetheless Loading Up

My unique caution on OXY used to be for traders not to chase the inventory into the $60s and particularly the $70s because of Buffett no longer purchasing many stocks above $60. Berkshire Hathaway did not acquire any stocks for over 5 months after the inventory spent the Iciness most commonly buying and selling above $60.

Remaining week by myself, the funding company purchased 7.9 million stocks for almost $500 million. For the reason that get started of March, Buffett has purchased 13.7 million stocks at costs in most cases above $60.

The issue now could be that in spite of Buffett prudently no longer chasing the inventory upper, many of the purchases within the remaining 12 months are in reality underwater. No longer most effective had been traders harmed through chasing the inventory, but additionally traders are actually shedding cash through purchasing OXY anytime because the Russian invasion of Ukraine.

Buffett’s Berkshire Hathaway just lately boosted their stake to 23.1% with a place of 208 million stocks. The funding company additionally owns 100,000 stocks of collection A most popular stocks and warrants for an extra 83.9 million stocks at an workout worth of $59.624.

Disappearing Income

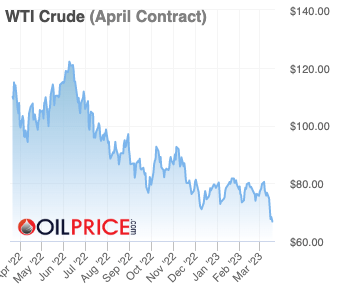

The power corporate spent 2022 benefitting from increased power costs because of the Russian aggression. Now, the worldwide banking disaster has WTI costs down underneath $70 after spending a just right a part of 2022 above $100.

Supply: OilPrice.com

Simply a few weeks in the past, OXY reported This autumn’22 income the place EPS estimates ignored analyst goals through a large $0.22. The power corporate reported a quarterly EPS of $1.61, already down just about 50% from the Q2’22 height EPS of $3.16.

With power costs collapsing, traders want a large reminder of ways OXY most effective earned $1.62 in all of 2019 when the corporate remaining reported a blank 12 months. This 12 months used to be the remaining one with out the covid affect or the Russian spice up.

In This autumn’22, OXY had the next reasonable discovered power costs:

- Crude oil – $83.64 according to barrel.

- Herbal fuel liquids – $26.35 according to barrel.

- Home discovered Nat fuel costs – $4.45 according to Mcf.

Traders most effective wish to take a look at oil costs buying and selling underneath $70 when it comes to WTI and home herbal fuel costs at most effective $2.52 according to Mcf to peer how the equation has modified.

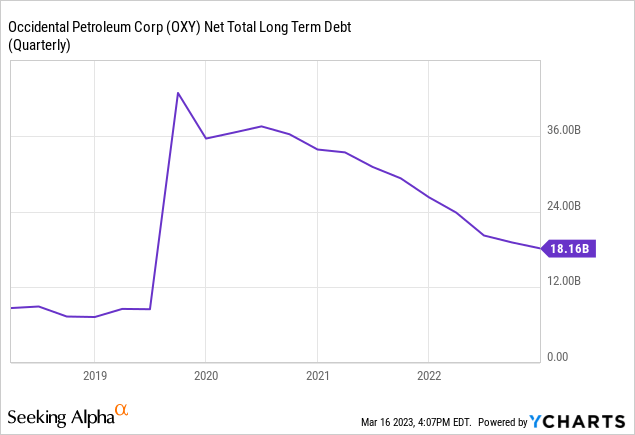

The funding tale is certainly other now with the steadiness sheet advanced from the huge income because of the Russian invasion sending oil costs hovering. Because of internet debt dipping to simply $18 billion, OXY mustn’t face the similar drawback chance of the inventory falling into the $20s very similar to the covid weak point.

OXY used to be a $40 inventory previous to covid and the corporate most likely mustn’t face the similar drawback chance. One factor is the disappearing income circulation, despite the fact that analysts oddly nonetheless forecast a $6+ EPS in 2023 most effective dipping to fairly underneath $6 in 2024.

Not anything concerning the present power costs is supportive of OXY generating top class income going ahead. A chief instance of the place income are headed used to be the Q3’21 quarter when the power corporate generated a $0.87 quarterly benefit at the following discovered power costs:

- Crude oil – $68.74 according to barrel.

- Herbal fuel liquids – $34.01 according to barrel.

- Home discovered Nat fuel costs – $3.35 according to Mcf.

The entire present power costs are both at equivalent ranges when it comes to WTI or a lot decrease when it comes to NGL and domestics nat. fuel. A few of these power costs may well be at unsustainably low costs, however a home recession will obviously drive WTI and home nat. fuel costs for some time.

The inventory trades at just about $60 and OXY seems to simply have an income circulation within the $3 to $4 according to proportion stage, assuming WTI costs do not fall additional. The inventory is just too dear at as much as 20x EPS goals. Additionally take into accout, this valuation is according to 950 million stocks exceptional (up from 900 million in Q3’21) and the corporate has the potential of considerably extra stocks exceptional by means of changing the most popular stocks and warrants.

Takeaway

The important thing investor takeaway is that traders can do worse than purchasing along Buffett. Sadly, the power marketplace is susceptible and OXY in reality seems very dear at those ranges. The inventory wishes some other $5 to $10 dip to turn into interesting, particularly making an allowance for the marketplace does not seem in a position for the most obvious EPS reset to decrease ranges.