Whether or not extra patrons go back to the marketplace relies in large part on how the Fed reacts to unrest within the banking trade along power inflation. If the Fed presses pause on interest-rate hikes subsequent week or declares only a small building up, loan charges will drop.Â

Some homebuyers are returning to the marketplace as loan charges decline from the four-month top they reached remaining week. Day by day reasonable loan charges dropped from 7% to about 6.5% over the weekend within the wake of Silicon Valley Financial institutionâs cave in. U.S. house costs additionally fell, shedding 1.8% yr over yr throughout the 4 weeks finishing March 12, the largest decline in over a decade.Â

Sidelined patrons reacted briefly: Bay Fairness, Redfinâs mortgage-lending corporate, locked a price on extra loans this previous Friday (March 10) than another day to this point this yr. Total, U.S. mortgage-purchase programs higher 7% from the week sooner than throughout the week finishing March 10.Â

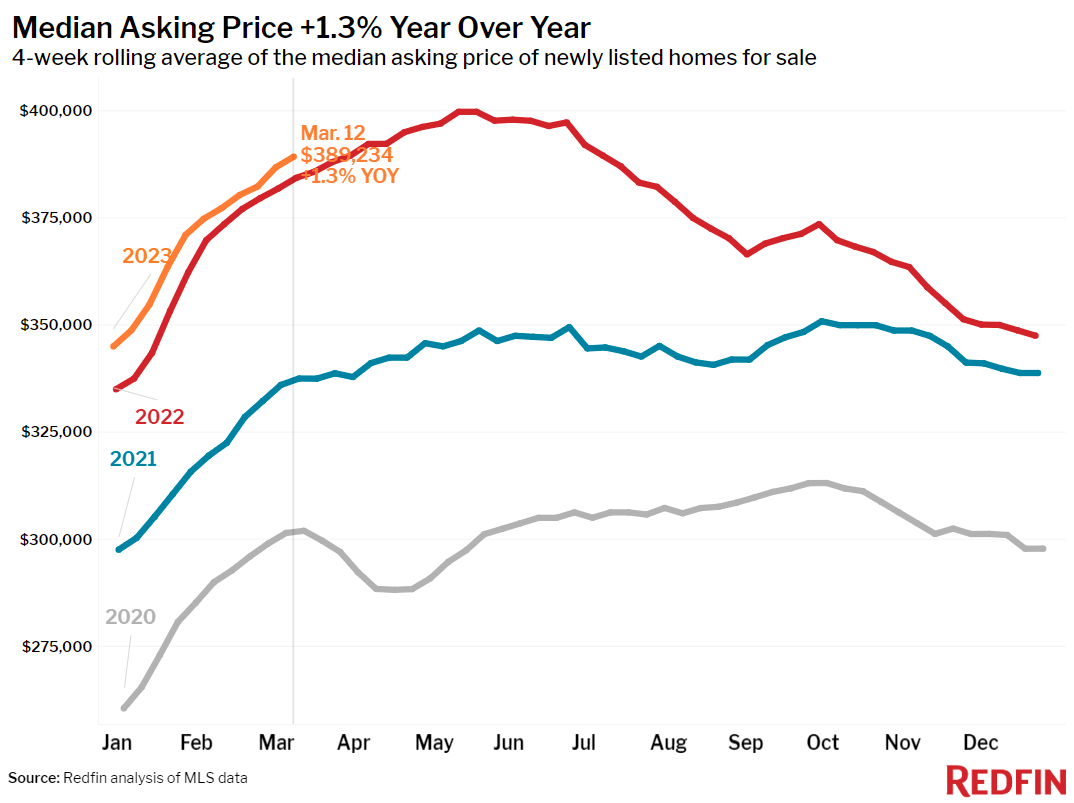

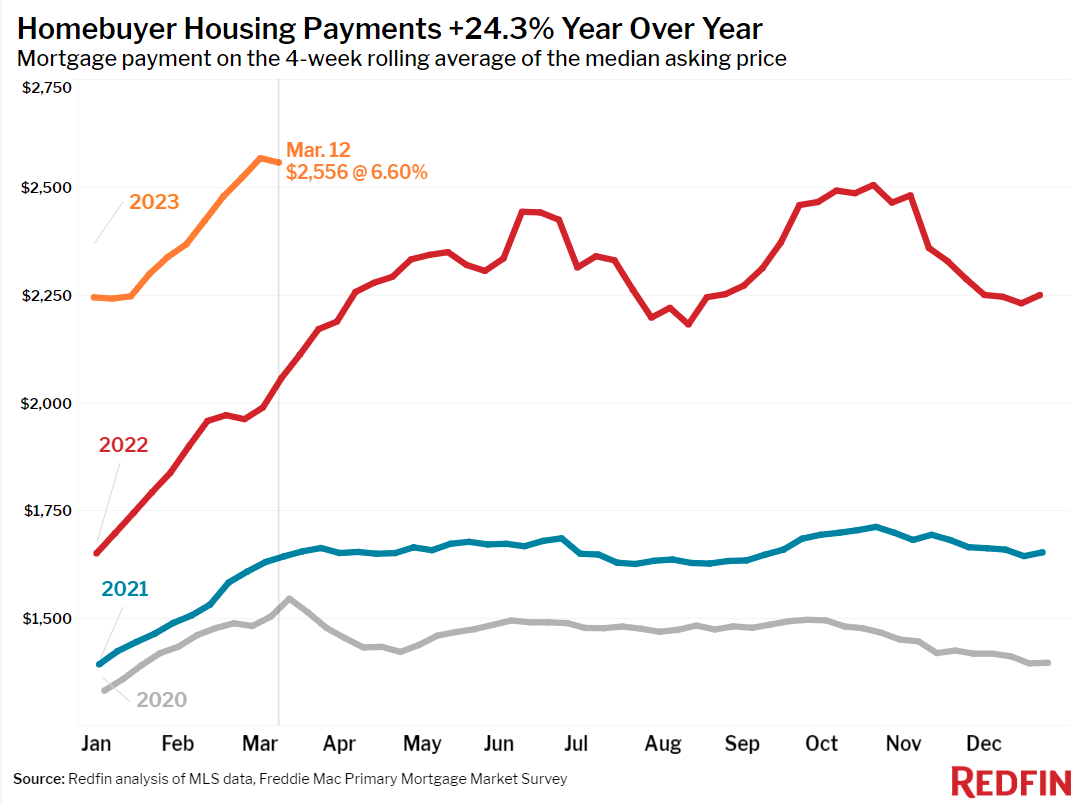

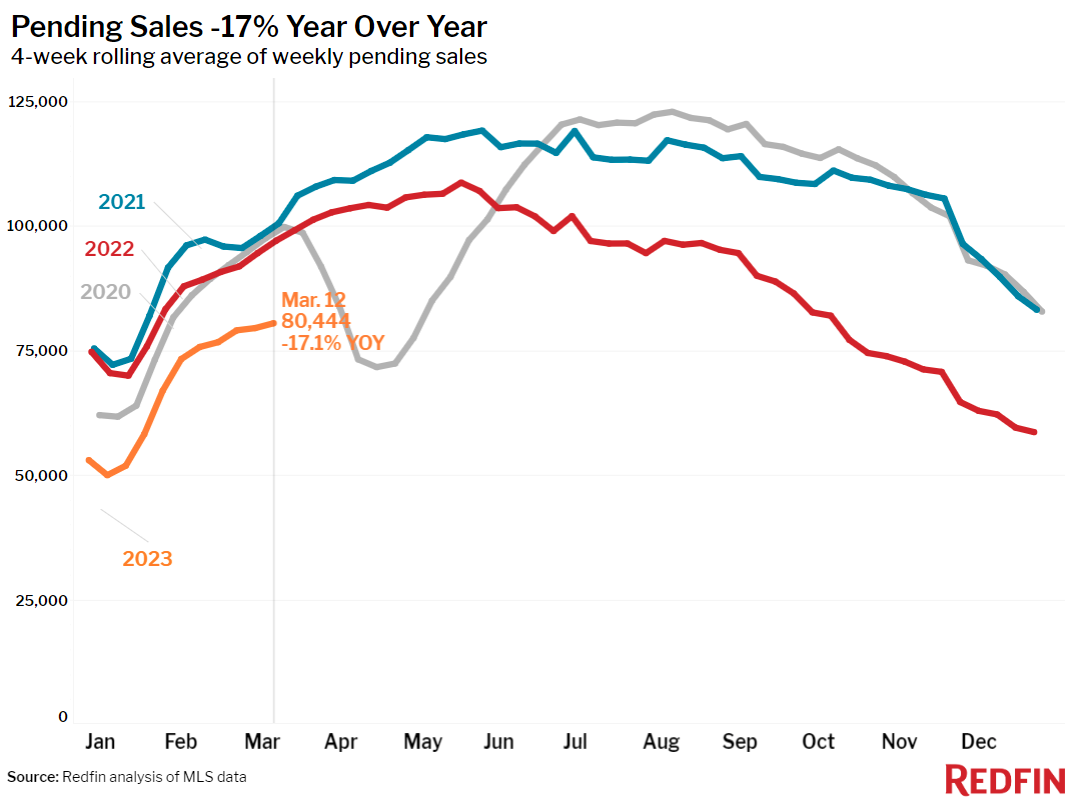

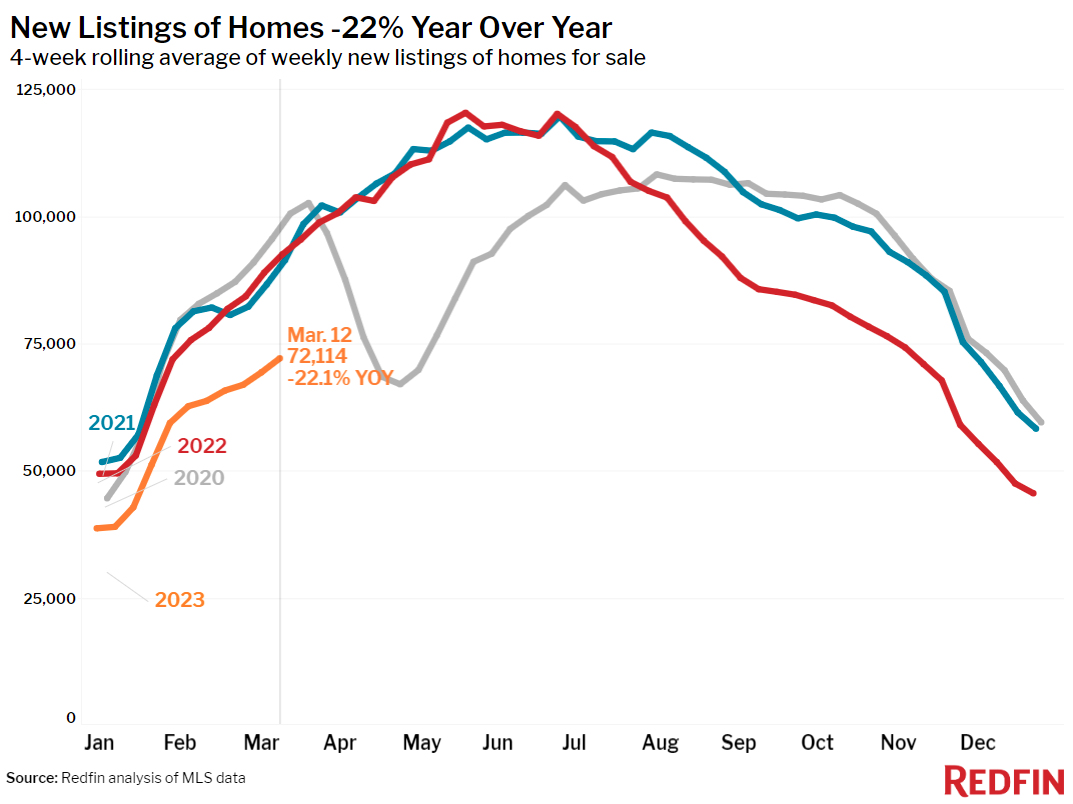

However general homebuying call for stays tepid, particularly when put next with the similar length remaining yr. Thatâs in large part as a result of housing bills are nonetheless close to ancient highs: The everyday homebuyerâs per month loan fee is $2,556, down marginally from remaining weekâs document top however up 24% from a yr in the past. Pending house gross sales are down 17% yr over yr, the largest decline in six weeks. Call for may be restricted by means of low provide; new listings of houses on the market posted their largest annual drop in just about 3 months.Â

âPatrons pounced when charges fell as a result of theyâre so risky presently, which displays that there are many other people ready within the wings for the fitting time to go into the marketplace. The place loan charges pass from right here in large part is determined by how the Fed reacts to chaos within the banking trade within the U.S. and out of the country, along stubbornly top inflation,â stated Redfin Economics Analysis Lead Chen Zhao. âThe Fedâs purpose at its assembly subsequent week is to reach a balancing act: Combat inflation whilst conserving the banking device intact. Even if the Eu Central Financial institution hiked rates of interest greater than anticipated this morning, itâs not likely the Fed will apply go well with. As a substitute, we think them to both elevate charges modestly or press pause in the intervening time, the latter of which might ship loan charges down and convey again many sidelined patrons and dealers.â

Whilst the unrest within the banking device might decrease charges and convey again some patrons in lots of the nation, itâs prone to additional spook patrons in positive spaces. Housing markets within the Bay House and New York, house to the 3 regional banks that experience tumbled over the past weekâin conjunction with many tech staff who’ve both been laid off or are fearful about being laid offâare already feeling the ache.Â

âSome patrons are canceling their contracts or bowing out in their house seek as a result of they paintings in tech they usuallyâre fearful about dropping their jobs,â stated Bay House Redfin supervisor Shelley Rocha. âThe surge in tech layoffs was once already inflicting jitters, and now the financial institution screw ups are including to patronsâ nerves.â

Main signs of homebuying job:

- For the week finishing March 16, reasonable 30-year mounted loan charges dropped to 6.6%, the primary decline after 5 directly weeks of will increase. The day by day reasonable was once 6.54% on March 16.

- Loan-purchase programs throughout the week finishing March 10 higher 7% from every week previous, seasonally adjusted. Acquire programs had been down 38% from a yr previous.Â

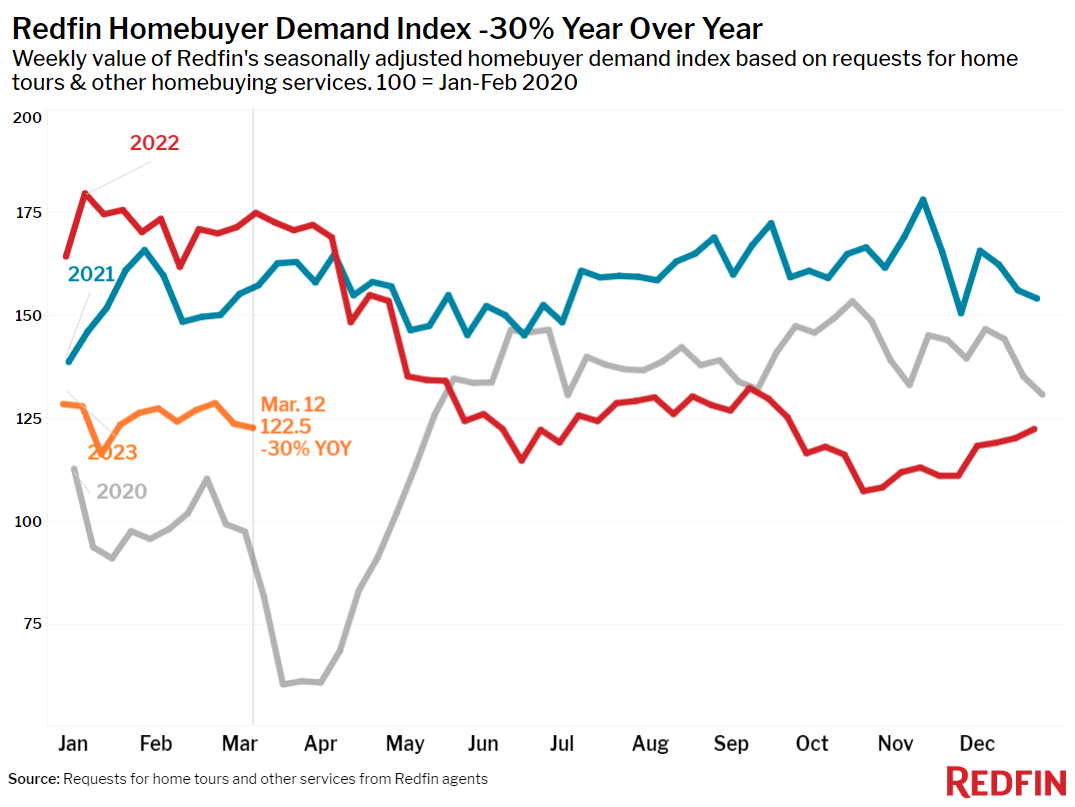

- The seasonally adjusted Redfin Homebuyer Call for Indexâa measure of requests for house excursions and different homebuying products and services from Redfin brokersâwas once necessarily flat from every week previous (down -0.8%) throughout the week finishing March 12. It was once down 30% from a yr previous.Â

- Google searches for âhouses on the marketâ had been up about 40% from the trough they hit in December throughout the week finishing March 11, however down about 14% from a yr previous.

- Traveling job as of March 11 was once up about 19% from the beginning of the yr, when put next with a 22% building up on the similar time remaining yr, consistent with house excursion generation corporate ShowingTime.Â

Key housing marketplace takeaways for 400+ U.S. metro spaces:

Until in a different way famous, the knowledge on this record covers the four-week length finishing March 12. Redfinâs weekly housing marketplace knowledge is going again thru 2015.

Information according to houses indexed and/or bought throughout the length:

- The median house sale fee was once $355,668, down 1.8% from a yr previous. Thatâs the largest decline in no less than a decade, consistent with Redfinâs per month dataset, which works again thru 2012.

- Median sale costs fell in 24 of the 50 maximum populous U.S. metros, with the largest drops in northern California. San Jose, CA (-17.2% YoY) skilled the largest decline, adopted by means of Austin, TX (-13%), San Francisco (-11%), Oakland, CA (-10.9%) and Sacramento, CA (-8.6%). Thatâs the largest sale-price drop since no less than 2015 for San Jose, Austin and Sacramento.Â

- Sale costs higher maximum in West Palm Seashore, FL (12.7%), Milwaukee (9%), Citadel Lauderdale, FL (7.2%), Virginia Seashore, VA (6.9%) and Miami (6.8%).Â

- The median asking fee of newly indexed houses was once $389,234, up 1.3% yr over yr.

- The per month loan fee at the median-asking-price house was once $2556 at a 6.6% loan price, the present weekly reasonable. Per month loan bills are up 24% ($499) from a yr in the past.

- Pending house gross sales had been down 17.1% yr over yr.

- Pending house gross sales fell in all 50 of probably the most populous U.S. metros. They fell maximum in Las Vegas (-53.5% YoY), Portland, OR (-48%), Sacramento (-47.8%), Riverside, CA (-45.9%), and Seattle (-44.1%).

- New listings of houses on the market fell 22.1% yr over yr, the largest decline in just about 3 months.Â

- New listings declined in all however probably the most 50 of probably the most populous U.S. metros, with the largest declines in Milwaukee (-65% YoY), Sacramento (-48.1%), Oakland (-45.9%), San Francisco (-42.6%) and San Jose (-41.8%). They higher 2.6% in Nashville.Â

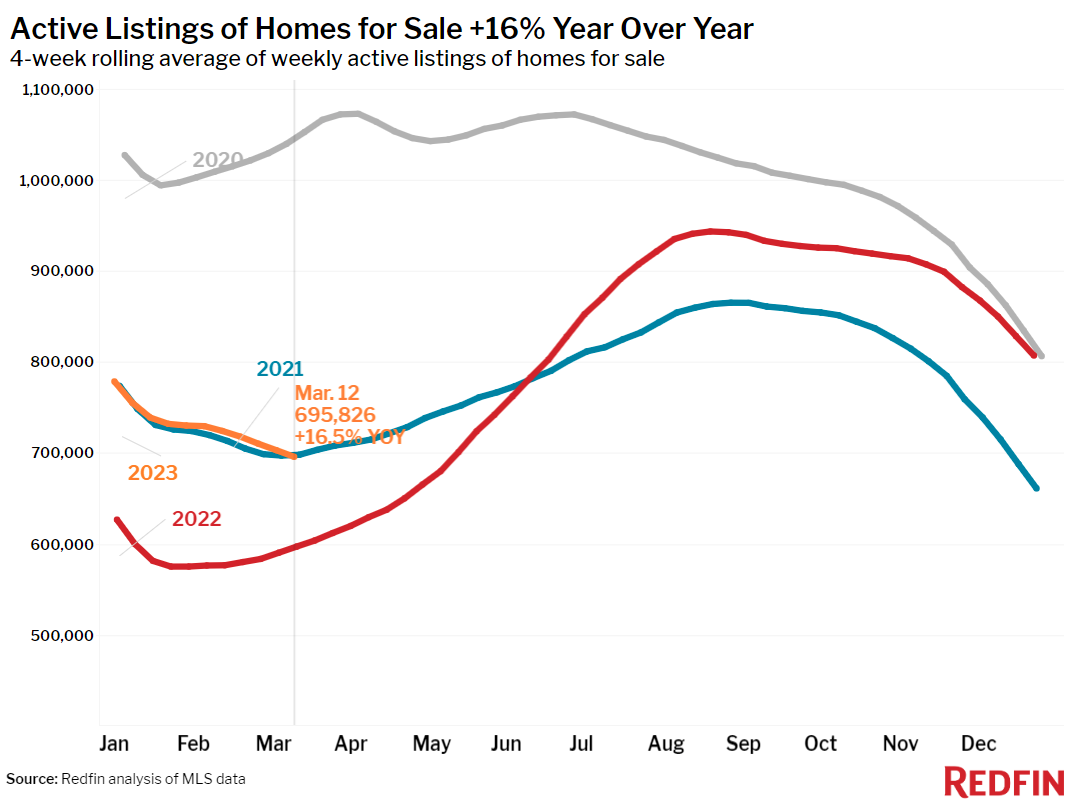

- Energetic listings (the selection of houses indexed on the market at any level throughout the length) had been up 16.5% from a yr previous, the smallest building up in additional than 3 months.

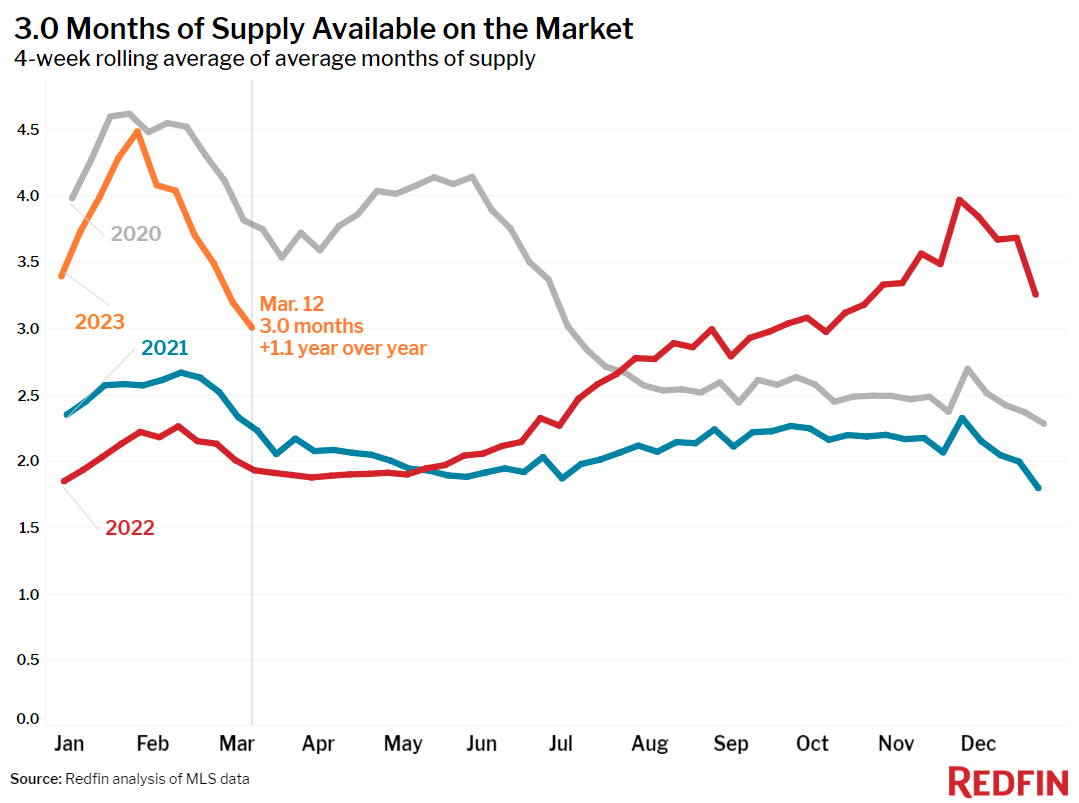

- Months of provideâa measure of the steadiness between provide and insist, calculated by means of the selection of months it will take for the present stock to promote on the present gross sales tempoâwas once 3 months, down from 4 months a month previous and up from 1.9 months a yr previous.Â

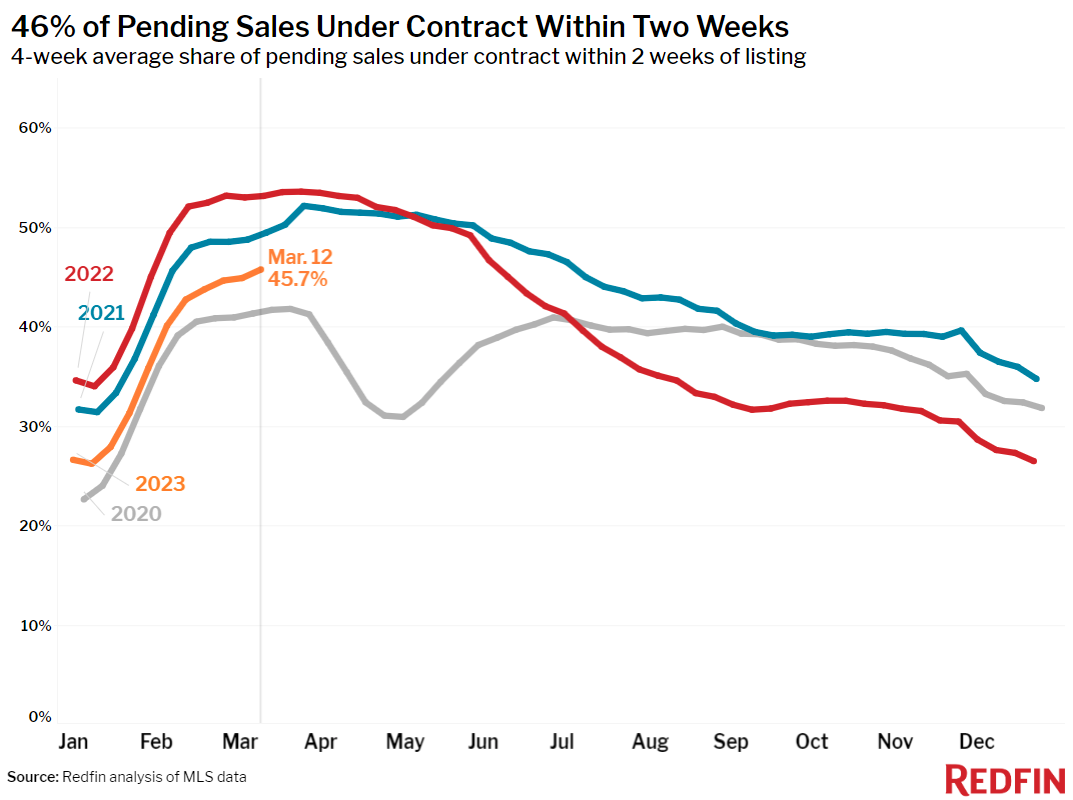

- 46% of houses that went underneath contract had an accredited be offering inside the first two weeks in the marketplace, the very best degree since June, however down from 53% a yr previous.Â

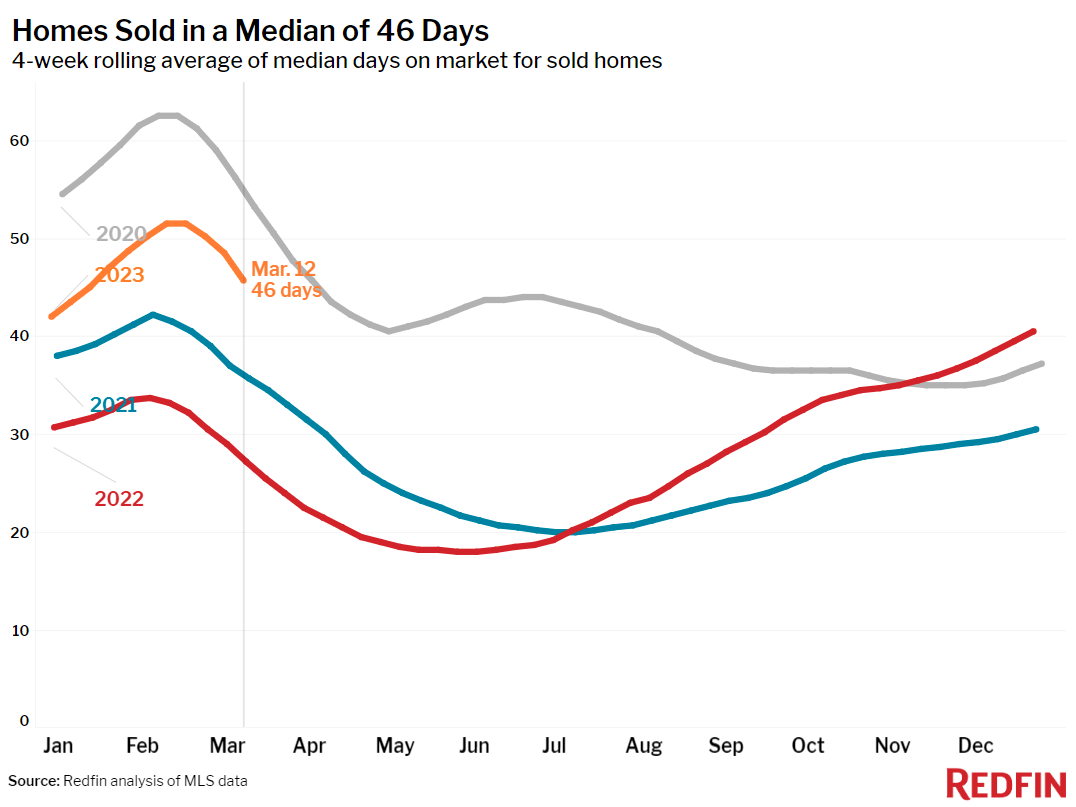

- Houses that bought had been in the marketplace for a mean of 46 days. Thatâs up from 27 days a yr previous and the document low of 18 days set in Might.

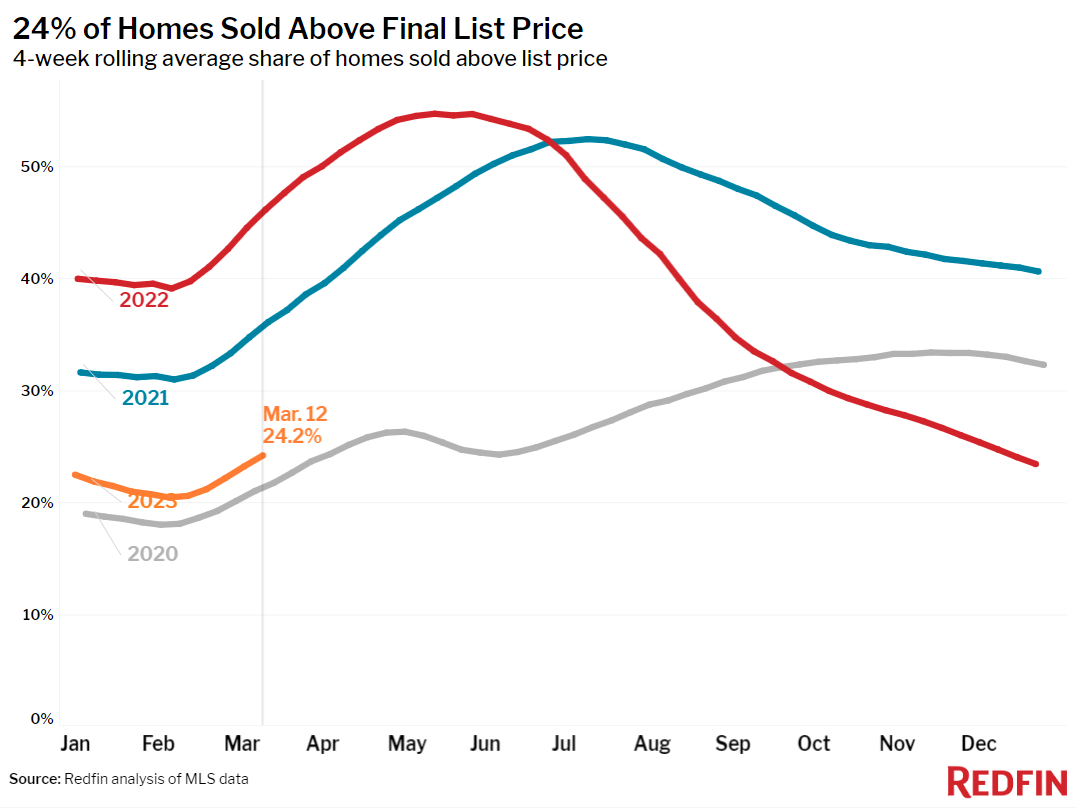

- 24% of houses bought above their ultimate listing fee, down from 45% a yr previous.

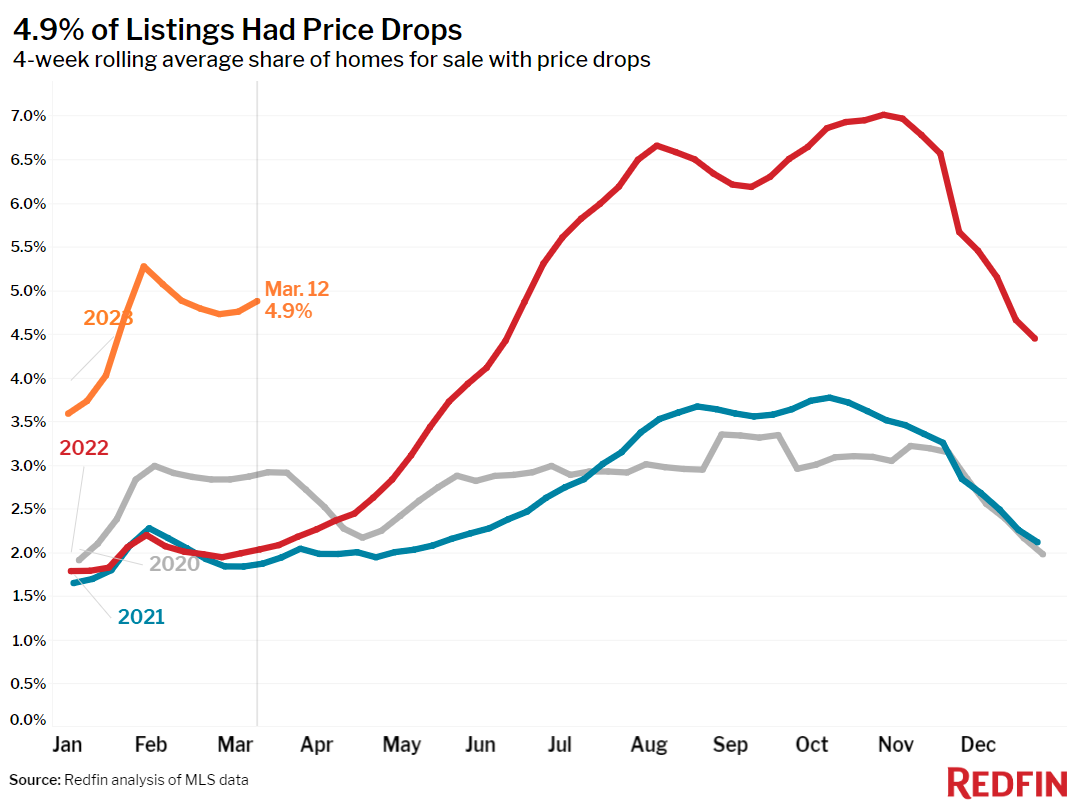

- On reasonable, 4.9% of houses on the market every week had a value drop, up from 2% a yr previous.Â

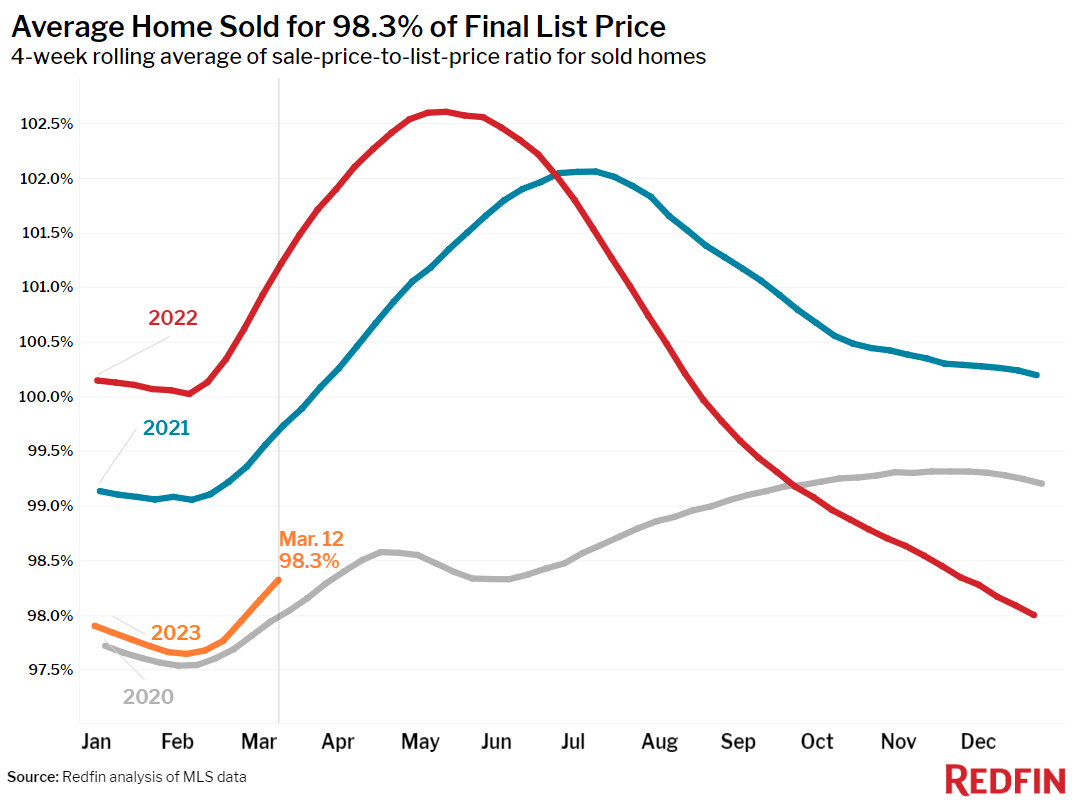

- The common sale-to-list fee ratio, which measures how shut houses are promoting to their ultimate asking costs, was once 98.3%, the very best degree in additional than 3 months however down from 101.2% a yr previous.Â

Discuss with our metrics definition web page for explanations of the entire metrics used on this record.