AscentXmedia

Co-produced with Treading Softly.

I revel in finding and securing distinctive price. In essence, taking pictures that price and benefitting from it for the lengthy haul.

From time to time, that suggests purchasing in bulk and taking part in it over an extended duration of time, figuring out that it enabled me to save cash vs. purchasing in small parts. Some other approach is by means of purchasing high quality leather-based boots, which I will be able to resole when wanted and can proceed to put on for many years to come back â they are heritage high quality.

Whilst locking in price might require more cash in advance, it ends up in a greater go back on my funding ultimately.

With regards to making an investment, I regularly to find myself aligning with price traders who’re additionally searching for price from mispricing or false impression, which abound out there.

These days, I wish to give you two very good price propositions which can be recently to be had out there. Those are alternatives it would be best to purchase as of late and lock up the worth for future years.

Let’s dive in!

Select #1: SACH-A – Yield 9.6%

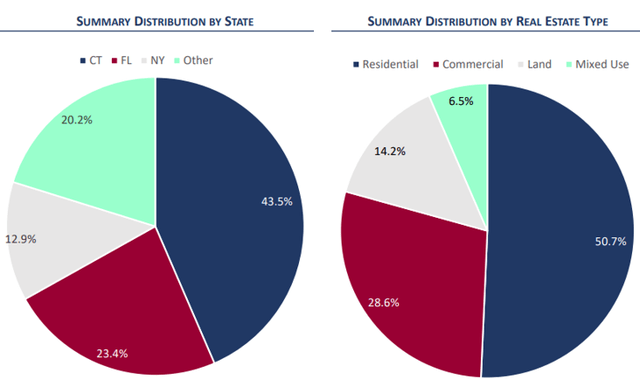

Sachem Capital Corp. (SACH) is a distinct segment loan actual property funding agree with (“MREIT”) that specializes in residential initiatives. Initially SACH was once zeroed in on fix-and-flip loans to smaller purchasers. As SACH has grown in dimension and lending features, they’ve additionally grown their clientele to bigger builders. Supply.

SACH – January Investor Presentation

As SACH has grown, they’ve different their portfolio’s mortgage kind and placement, increasing out of doors of its humble beginnings in Connecticut to achieve publicity to hastily rising states like Florida.

But, as we look ahead to an financial slowdown, traders are justifiably inquisitive about SACH’s endured skill to pay out a beneficiant dividend and proceed to have a solid portfolio of loans.

SACH has taken more than a few steps to handle those issues. In the beginning, SACH has been exceptionally strict on its lending practices. Whilst friends like Broadmark Realty Capital Inc. (BRMK) have been easing lending regulations to draw extra trade, SACH was once keen to look incoming trade sluggish to handle their portfolio’s integrity.

Secondarily, SACH finished an all-stock buyout of Urbane, which is now beneath the SACH umbrella. Urbane is a development corporate, and actual property corporate considering building and development, together with structure, design, contracting, and advertising and marketing. This permits SACH to take failing initiatives and purchase them outright, offering lending and of completion to maximise earnings whilst different corporations fail â or be purchased out, as now we have noticed happen with BRMK.

So whilst uncertainty is at the horizon, we particularly like their most well-liked safety as a center floor between the danger of the typical and the low attainable returns in their child bonds. This puts Sachem Capital 7.75% Sequence A Cumulative Redeemable Perpetual Most popular Inventory (SACH.PA) in a major place to supply sturdy source of revenue and attainable returns because of its present bargain to PAR.

SACH has coated their most well-liked dividends strongly with a 5.29x protection of Internet Source of revenue vs. most well-liked dividends throughout the primary 9 months of 2022; we think when income pop out later this month, SACH-A will proceed to look sturdy protection.

SACH’s control group is still conservative and efficient, no longer so conservative that they fail to seek out traction â like BRMK’s group gave the look to be â but additionally no longer so trigger-happy that they’re careening their corporate against crisis.

This makes being a most well-liked holder extraordinarily horny. We will accumulate a big dividend at a top yield whilst the typical shareholders enjoy the easiest stage of volatility.

Select #2: RVT – Yield 8.8%

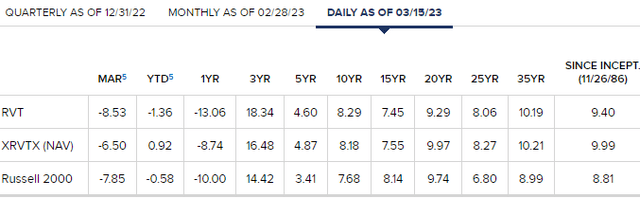

Royce Price Agree with (RVT) has an implausible historical past: it has crushed its index, the Russell 2000, for over 36 years: Supply.

It’s an outstanding fulfillment for a fund to nonetheless be round after 36 years â let by myself 36 years the place it has crushed the index extra regularly than no longer.

RVT makes a speciality of small-cap investments, on the lookout for undervalued investments. Founder Chuck Royce explains:

“Our process is to scour the massive and numerous universe of small-cap corporations for companies that glance mispriced and underappreciated, with the caveat being that they will have to even have a discernible margin of protection. We’re searching for shares buying and selling at a bargain to our estimate in their price as companies.”

I in the past defined in a Marketplace Outlook that the massive and mega-cap shares are buying and selling above pre-COVID valuations in response to value/income, whilst small and mid-cap shares are buying and selling at decrease valuations. RVT’s holdings have been buying and selling at a median value/income of 14.1x as of the top of 2022.

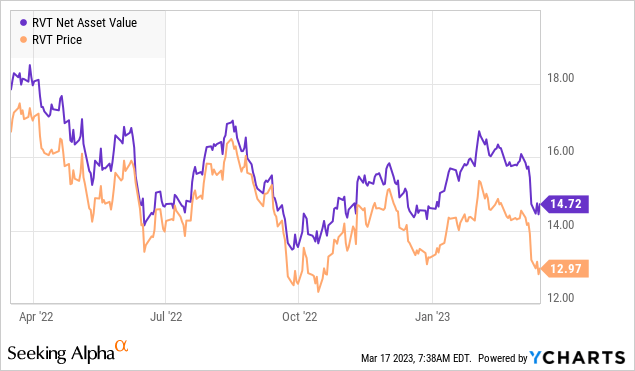

Since bottoming in October, the adaptation between RVT’s NAV and marketplace value has grown.

RVT is buying and selling at a 12%+ bargain to NAV â the most important bargain prior to now 52 weeks.

RVT’s NAV is necessary for predicting its distribution. RVT has a novel distribution coverage incorporating the rolling reasonable of quarter-end NAV for the previous 4 quarters. This coverage creates a variable distribution, making sure that the CEF is rarely paying out an excessive amount of of its capital whilst additionally offering assurance that traders will receive advantages upon restoration.

Prime Dividend Alternatives participants revel in a novel forecasting software that gives an outlook on long run distributions. We will leisure confident that as NAV recovers, the ones advantages will likely be handed alongside to us thru dividends with no need to depend on control to make the verdict.

The small-cap shares that RVT invests in are attractively priced, and RVT itself is buying and selling at a ravishing bargain.

Conclusion

SACH-A and RVT each be offering traders distinct price propositions. SACH-A supplies a path to revel in top ranges of source of revenue from an organization being controlled very prudently in a time-frame the place headwinds are expanding in that sector. The sturdy most well-liked dividend protection bodes neatly for SACH-A holders to revel in source of revenue as the typical faces further volatility. RVT gives index beating returns for many years as a way to turn control’s confirmed monitor file of luck in offering returns to its shareholders in addition to a variable stage of source of revenue which make sure that RVT isn’t overpaying its dividend.

Each are horny source of revenue investments in their very own proper and are a part of the ‘Prime Dividend Alternatives’ style portfolio, which recently carries an total yield of +9%. We hang them as a part of our retirement portfolio. In combination, either one of the dividend shares can assist propel your total source of revenue to new heights, one thing we will be able to all have the benefit of as we enjoy upper ranges of inflation and rates of interest hitting our wallets.

Retirement must be a time of leisure and pleasure. Whilst taking part in your spare time activities, do not fail to remember to take a couple of moments to fasten in price like now we have checked out as of late and no longer let it cross! It may well trip with you offering high quality source of revenue for future years.

That is the wonderful thing about source of revenue making an investment. That is the praise introduced by means of our Source of revenue Way.