SOPA Images/LightRocket by means of Getty Images

Financial Investment Thesis

fuboTV ( NYSE: FUBO) is an extremely controversial stock. This service has really blended potential customers, which provides ammo to both the bulls and the bears. The bulls can indicate 2024 as being the year that fuboTV will eventually reach $2 billion in earnings as a forward run rate.

On the other hand, the bears quickly retort that this service is going to lack money in less than 18 months and will require to raise more capital on considerably challenging terms.

Quick Wrap-up

Back in October, I stated in a neutral analysis:

I discover it too tough to make a favorable get in touch with fuboTV. That’s not to state business is uninvestable. Rather, FUBO is one difficult bet.

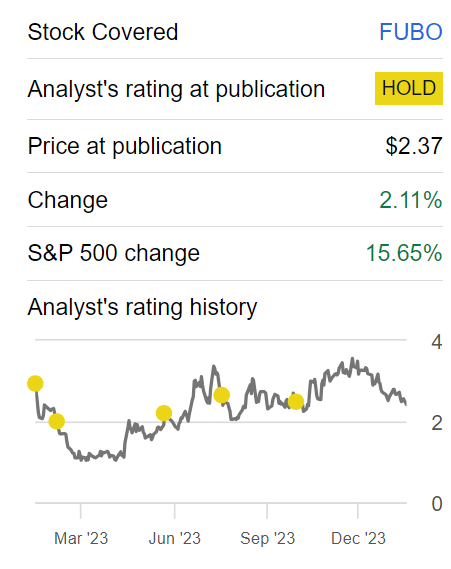

Author’s deal with FUBO

Because I penned those words, the stock has actually underperformed in a really strong booming market. More particularly, FUBO is up 2%, while the S&P 500 ( SPY) is up more than 15%.

And gradually, I have actually discovered that this bet has actually ended up being much more tough. Here’s why.

2024 Might Provide 20% CAGR

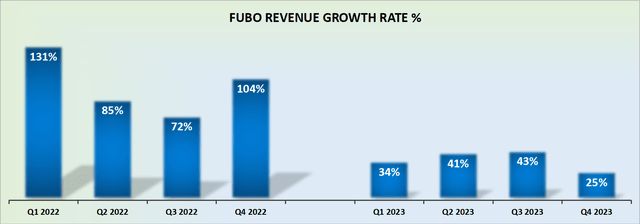

FUBO earnings development rates

FUBO’s 2023 development rates have actually considerably moderated relative to 2022. However what this indicates in useful terms is that these lower earnings development rates would suggest that 2024 will be up versus a simpler similar base.

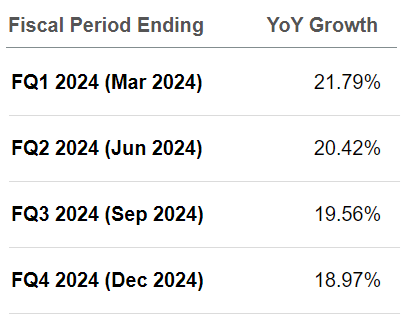

As A Result, it’s totally possible that in 2024, FUBO might provide around 20% CAGR. And to be clear, my quotes are absolutely nothing extravagant, in truth, they practically line up with what experts are likewise anticipating.

SA Premium

Nevertheless, what I think this insight isn’t adequately highlighting is how financiers in 2024 will look towards fuboTV as it continues to grow by 20% CAGR.

Basically, instead of FUBO being viewed as a business with quickly decreasing earnings development rates, as held true throughout 2023, it will be viewed as a company that has actually “discovered stability”.

And what do financiers yearn for about all else? Certainty! It does not even matter if problem is anticipated and eventually gets here. What financiers do not like is unpredictability. And on that basis, I can not provide fuboTV with a straight-out sell ranking.

However that’s not where the story ends.

FUBO Stock Evaluation – Too Challenging to Worth

In my previous analysis, I stated:

As it stands today, fuboTV’s is on a money burn run-rate of around $180 countless complimentary capital. This indicates that fuboTV will have utilized the bulk of the money on its balance sheet, which totals up to $300 million within 18 months.

After another set of quarterly outcomes, its Q3 results, we need to upgrade these figures. FUBO holds around $260 countless money, once we consider its financial obligation, FUBO in fact reaches around $140 countless net financial obligation.

For That Reason, I am inclined to think that on a forward run-rate now, FUBO might reach unfavorable $150 countless complimentary capital, instead of the unfavorable $180 million I formerly approximated.

However, it still appears affordable to compete that in about 18 months, around early 2025, if not previously, fuboTV will require to raise capital once again. And this is where the plot thickens.

In January of this year, FUBO exchanged its 2026 senior notes which brought a 3.25% rate of interest, with 2029 notes which bring a 7.5% rate of interest. This indicates that financial institutions are progressively strict with financing capital to FUBO. And if financial institutions end up being worried about providing more capital to fuboTV, fuboTV will be left in an exceptionally tough circumstance.

The Bottom Line

In conclusion, fuboTV provides a dissentious financial investment. While optimists picture a robust future with a forecasted $2 billion in earnings by 2024, doubters raise warnings about the business’s money position.

The business’s present money burn rate, showing a net financial obligation of around $140 million, magnifies my issues.

With a possible forward run-rate of unfavorable $150 million in complimentary capital within 18 months, the possibility of FUBO requiring to raise capital by early 2025 looms big.

Last but not least, the current shift to higher-interest notes signals a tightening up financing environment, making complex the business’s monetary outlook. This complexity, marked by progressing development rates and a difficult financial obligation situation, highlights the nuanced nature of FUBO’s financial investment proposal.