MediaProduction/iStock by means of Getty Images

Financial Investment Rundown

The previous couple of months have actually been rather the rollercoaster for Capital Item Partners L.P. ( NASDAQ: CPLP) as the stock rate went from under $14 in late December to now almost $18 in stock rate. The factor appears to have actually originated from increased hostilities in the Red Sea area which CPLP runs in in addition to quickly increasing shipping area costs. However possibly above all has actually been the closing of an arrangement to get vessels amounting to around $3.1 billion which was called the Umbrella Arrangement The offer has actually made sure the CPLP can broaden its possession base continue to develop out its profits capacity and provide investor worth.

The marketplace size of CPLP is not that huge, simply shy of $1 billion, however I do believe it provides a respectable chance to get some direct exposure to the international shipping market. The disputes in the Red Sea have actually indicated shipping area rates are quickly increasing and CPLP is an excellent method to gain from this volatility. I do believe it will balance out over the long-lasting however CPLP is taking a great deal of procedures to guarantee they hold a strong position in the future of this market, which brings me self-confidence to rate business a buy now.

Business Sectors

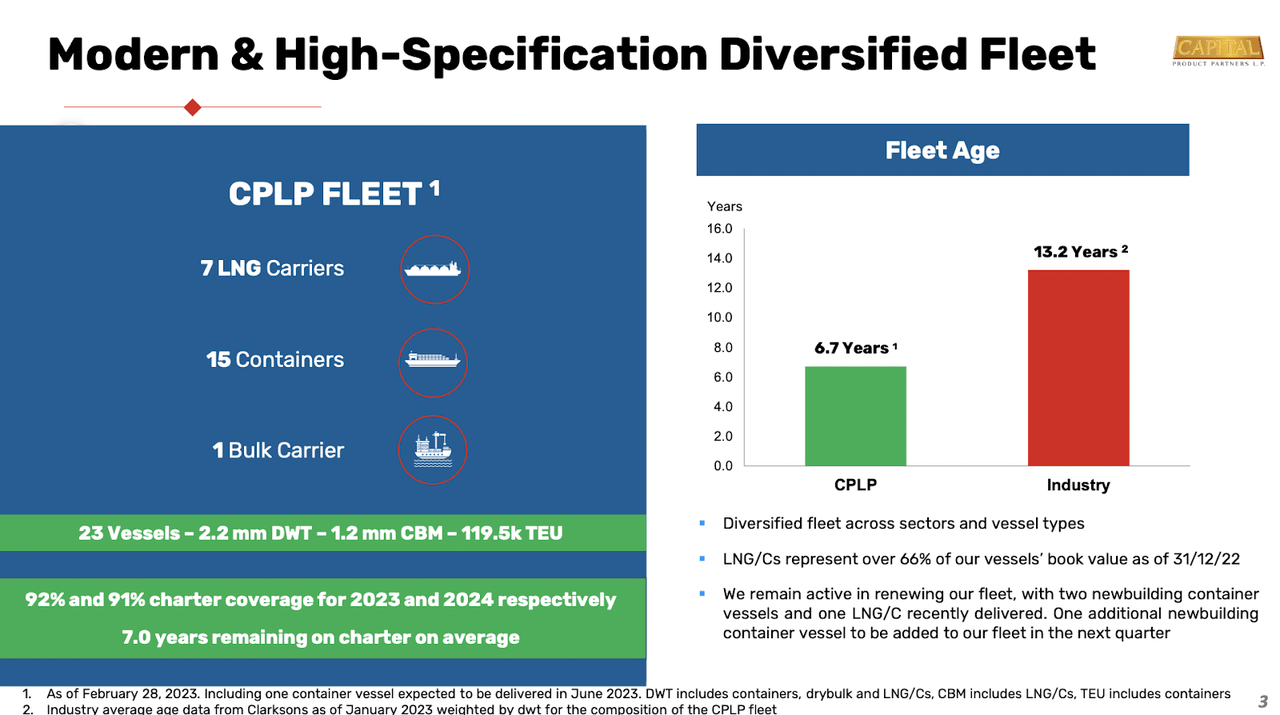

CPLP is a Greece-based shipping business providing marine transport services. The business’s fleet manages numerous freights, consisting of melted gas, containerized items, and dry bulk freight. It runs under trip and time charters and owns a varied series of vessels, such as Neo-Panamax and Panamax container vessels, cape-size bulk providers and LNG providers. In addition, it deals with the production and circulation of oil and gas items.

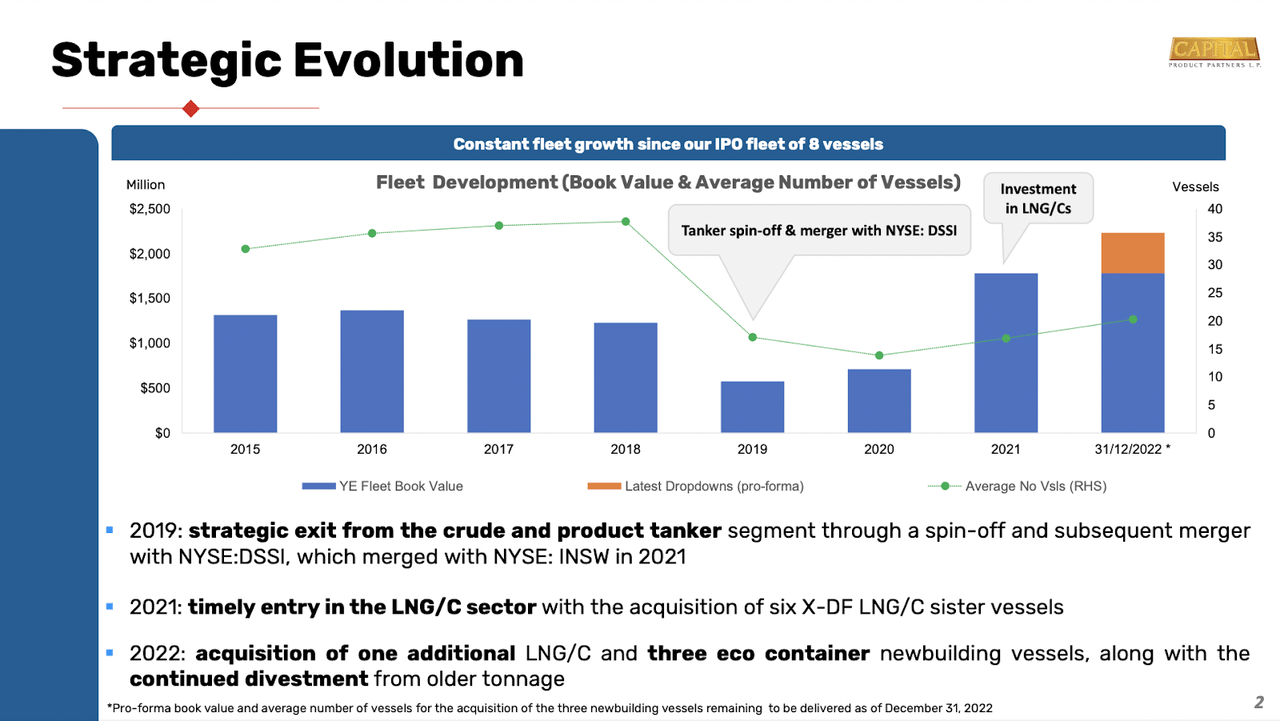

Business Advancement ( Financier Discussion)

Back in 2019, the business had a spin-off which remained in an effort made to assist diversify versus the crude and item tanker section the business had. In the previous couple of years, CPLP has actually made more tactical relocations like going into in the LNG/C sector as the business obtained 6 X-DF-LNG/C sis vessels. The acquisition was valued at $599 million and CLPL handled to money around $147 countless it with money the rest was bought with financial obligation, which indicated CPLP saw a quite fast boost in its long-lasting financial obligations, in FY2021 reaching over $ 1.2 billion Because CPLP has actually focused on paying for a great deal of this it’s now listed below $500 million.

Fleet Introduction ( Financier Discussion)

CPLP has actually likewise settled the acquisition of 11 newbuild melted gas provider vessels from Capital Maritime & & Trading Corp. for $3.13 billion, under an arrangement developed on November 13, 2023, as I discussed previously on. This favorable news guarantees that CPLP is actively growing its possession base and is something the marketplace views extremely favorably as the stock rate increases quick following the news. This relocation included CPLP participating in share purchase contracts for 100% equity interests in the business owning these vessels, marking a substantial growth of CPLP’s fleet and abilities in the LNG transport sector. On top of this, CPLP has actually been great in not acquiring or obtaining old fleets which would simply raise the devaluation expenses of the business rapidly. With a 6.7 years typical age compared to 13.2 years, the market has actually just seen an increasing devaluation due to the fact that of a broadening possession base. Devaluation increased to $79 million last 12 months, a CAGR of 33.8% because 2019, however the overall possessions grew by a CAGR of 49.6% throughout the exact same duration, mostly driven by growth in gross residential or commercial property, plant & & devices This is a pattern I will be supervising the next a number of years to see that CPLP handles to keep a young fleet, able to produce strong profits whilst keeping devaluation expenses low.

Profits Emphasizes

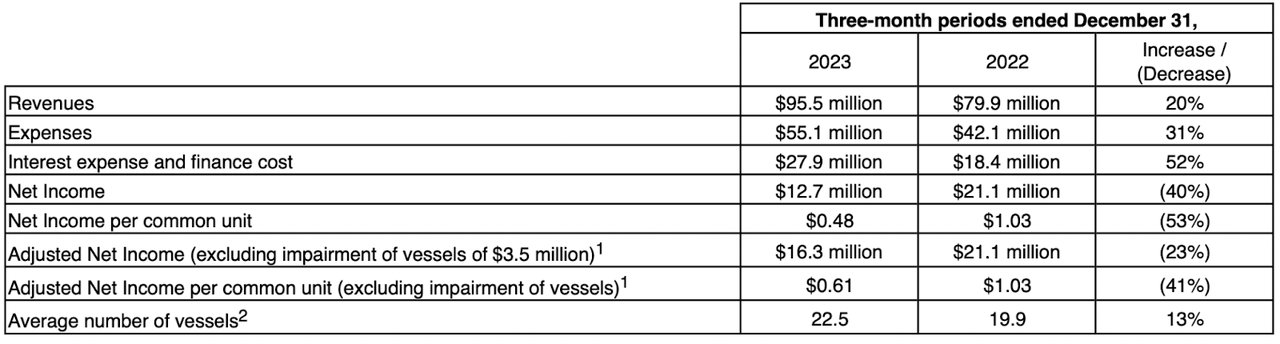

Profits Emphasizes ( Profits Report)

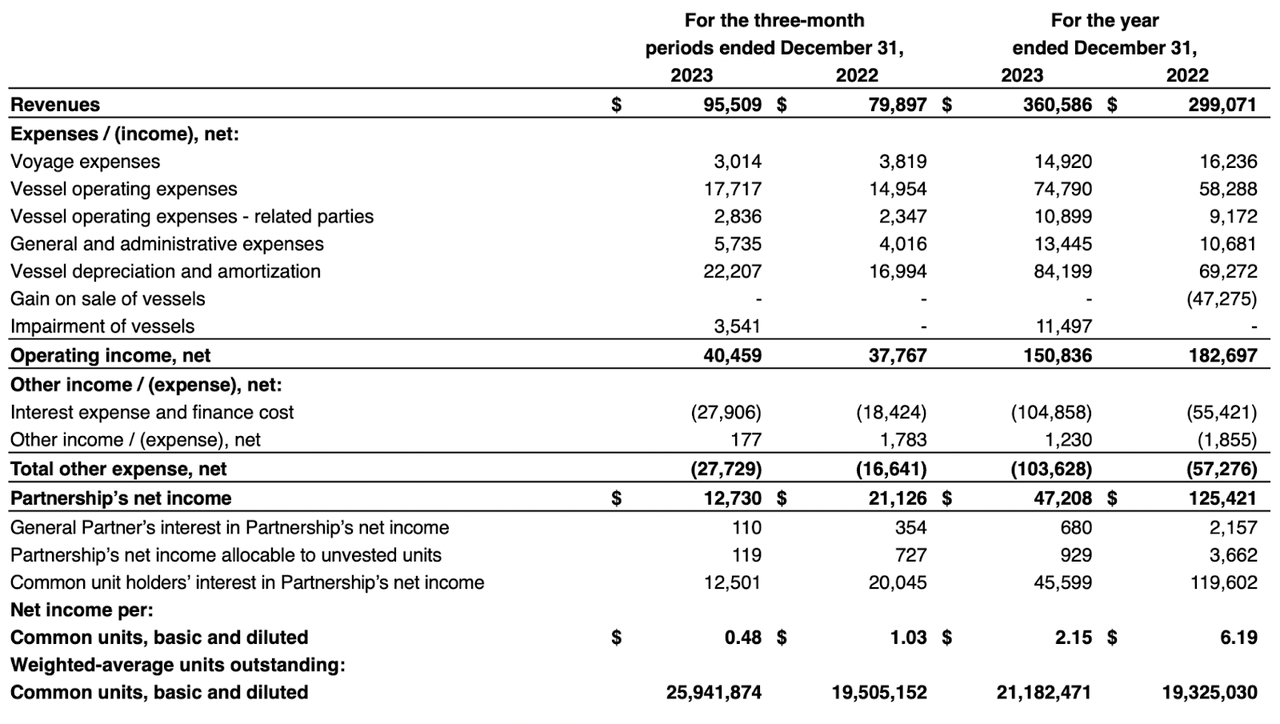

On February 2 CPLP launched its Q4 and full-year outcomes for 2023. Incomes grew progressively YoY to $95.5 million, a 20% boost. Earnings fell nevertheless greatly by 40% to $12.7 million for the quarter. However as I have actually made it clear, there is a great deal of vigor in the market and a few of the current increasing shipping area rates will not show up till the Q1 FY2024 report is launched later on this spring.

Earnings Declaration ( Profits Report)

Diving much deeper into the earnings declaration we can see that the increasing cost originated from vessel operating costs and vessel devaluation. These boosts were around $6 – 7 million more YoY however did not indicate that the operating earnings saw a decrease. Running earnings grew by 7.3% YoY, which naturally is less than the leading line, which reveals the effect that increasing cost has on the earnings declaration from CPLP. That indicated that CPLP would publish a substantial EPS decrease was increasing interest cost, the outcome of CPLP handling financial obligation to money some acquisitions these previous years. Last quarter it was $27.9 million in overall, or $104 million for the complete year, a near 100% boost compared to FY2022.

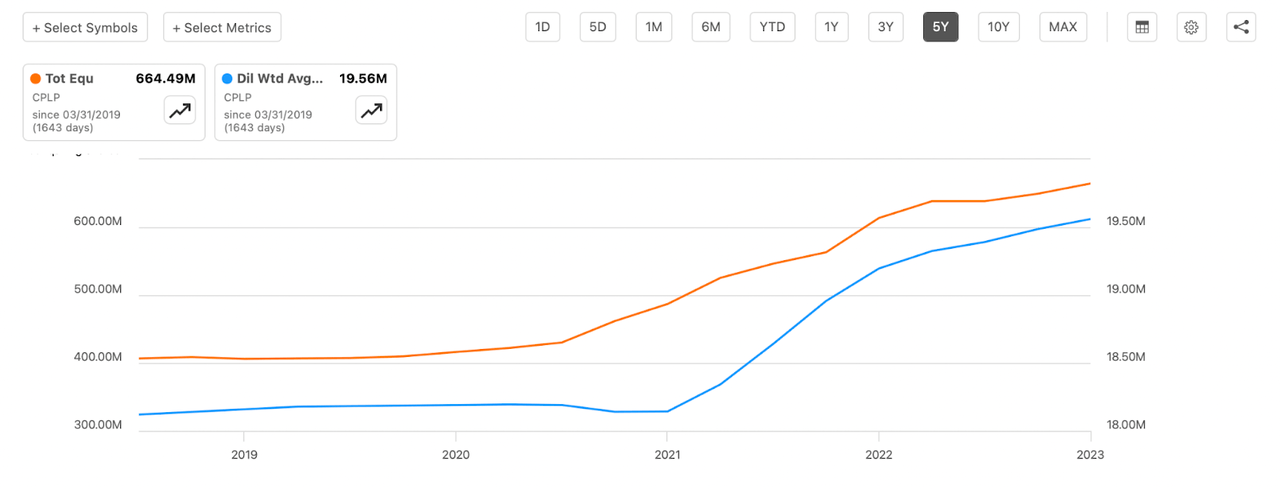

Equity & & Shares ( Looking For Alpha)

Over the previous couple of years, the shares exceptional by the business have actually been increasing, however not to a level that I believe need to require a great deal of issue. The dilution has actually been made to raise capital to money some acquisitions, like the one settled in December. What I wish to highlight with this chart is that CPLP is trading at a substantial discount rate on its equity worth. Equity per share comes out to $33.2 showing an 86% discount rate. This discount rate does not appear so necessitated as ROA has actually stayed high and steady in between 3 – 5% these previous couple of years. I do anticipate the next profits report to reveal a strong boost in ROA to around the 6% it had back in 2021. However, with that stated I am likewise mindful that the volatility in the market might require some discount rate today to get a strong financial investment case here. With a 15% discount rate on the equity per share, I would be landing at a cost target of $28.2 for CPLP, and this advantage is beneficial purchasing into today, even after the considerable run-up the previous month.

Dangers

Dangers with a business like CPLP are typically about high devaluation. CPLP has actually made an effort to have a low typical fleet age which need to in general lower expenditures rather. However what need to still affect business is if we participate in a duration of lower activity in the sector, which would still leave CPLP with a high cost however not always the exact same quantity of profits to assist cover this. I can see this publishing a danger to financiers in the short-term however I believe the qualitative possession base that CPLP has actually developed need to assist cancel this over the long-lasting. That is likewise how you require to see CPLP, a long-lasting choice that will change however still handles to provide worth through both a dividend and buybacks. Dangers are for that reason not adequate enough here to surpass the buy thesis I hold.

Last Words

I like to follow the shipping market rather a lot. It typically provides a really clear sign of how some economies are doing. A great deal of activity in the market typically implies a great deal of customer need. CPLP ended up a really essential handle late December which raised its variety of running vessels by a great deal of considerably increased its future profits capacity. Trading at a substantial discount rate to its NAV likewise supports a strong buy thesis here as financiers are getting a generous margin of security. I am starting protection on CPLP and will be doing so by ranking it a buy now.