grandriver/iStock through Getty Images

Thesis: After a 2020 modification in ownership, strong functional efficiencies, and presently beneficial financial conditions, Custom-made Truck One Source, Inc. ( NYSE: CTOS) need to provide double-digit returns in 2024. I rank it a Strong Buy based upon anticipated capital gains this year.

About Custom-made

The business describes itself as “one source” for specialized trucks and devices.

CTOS summary of devices (Q3 financier discussion)

It was established in 1996 as Custom-made Truck & & Devices and has actually been through a number of ownership models given that. In 2015, a bulk interest was acquired by The Blackstone Group Inc. ( BX), which went on to offer it to Nesco Holdings, Inc. (NSCO) for $1.475 billion in December 2020. Nesco was likewise in business of specialized trucks and heavy devices.

The following April (2023 ), Nesco altered its name which of the combined entity to Custom-made Truck One Source. At the exact same time, it altered the sign to CTOS.

Business runs through 3 sections, as laid out in the 10-K for 2022 and with income as mentioned in the 3rd quarter incomes report:

- Devices Rental Solutions [ERS]: $118.2 million (27.2% of overall income)

- Truck and Devices Sales [TES]: $283.1 million (65.2% of overall income)

- Aftermarket Components and Solutions [APS]: $33.1 million (7.6% of overall income)

Overall income was $434.5 million.

Since Wednesday, January 31, 2024, the stock cost was $6.54, and it had a market cap of $1.6 billion.

Rivals and competitive benefits

None of the sections above appear to have any substantial barriers to entry, so we need to anticipate each of them to run in extremely competitive and fragmented markets. Nevertheless, Custom-made does have some competitive benefits:

- As a big, openly traded business, it likely has much better access to capital than the majority of its rivals.

- As an incorporated entity, it can provide consumers more effective and economical services than a series of specific niche companies.

- It declares to have a young, well-kept rental fleet; at the end of 2022, it had a fleet of more than 10,000 systems, with a typical age of 3.7 years. These devices demographics need to offer greater dependability and lower expenses.

- Due to the fact that of its size and geographical footprint, it has the ability to offer services for nationwide accounts. That consists of teams of client service representatives and specialists.

- It uses direct-to-customer sales channels, while much of its rivals need to offer pre-owned devices through auctions. Getting greater costs for pre-owned devices minimizes capital investment.

To some degree, its margins recommend it has a moat, however just a narrow one. Its gross margin is 24.90%, which is listed below the Industrials sector typical of 30.31%; the EBITDA margin can be found in at 12.86%, listed below the sector typical of 13.68%; and the earnings margin is 3.58%, once again listed below the market typical of 6.03% (more on margins listed below).

Development

Custom-made surpasses the sector on development metrics, however. Income development [FWD] is 17.89%, well ahead of the sector typical of 7.61%. EBITDA development [FWD] is 62.19%, compared to 10.01% for the sector. And EPS [FWD] long-lasting development (3 to 5-year CAGR) is a large 37.00% while the sector typical is 11.44%.

Behind that development is a quickly increasing level of capital investment, from $25.9 million in 2018 to $158.7 million in 2023[TTM] That’s much better than a six-fold boost in simply 4 and three-quarter years. The business does not pay a dividend, so its capital can be devoted generally to development.

Over the exact same duration, Custom-made’s overall financial obligation released has actually grown from simply under $50 million to $190.6 million, an almost four-fold boost.

At the end of the 3rd quarter, it anticipated full-year 2023 income to variety in between $1.765 billion and $1.780 billion, compared to $ 1.573 billion for 2022.

It anticipated adjusted EBITDA of $425 million to $445 million, which would be much greater than 2022’s $181.3 million. 4th quarter and full-year 2023 outcomes are anticipated on March 12.

Looking forward, the experts who cover Custom-made anticipate income to strike $1.81 billion in 2023, $1.91 billion in 2024, and $1.97 billion in 2025.

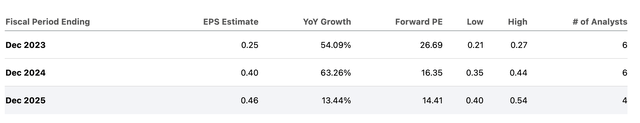

And, they anticipate high year-over-year enhancements in incomes per share:

CTOS EPS approximates table (Looking for Alpha)

Those are large boosts, however offered the increasing capex, its development method, and tailwinds from the Facilities Financial Investment and Jobs Act, in addition to lower rates of interest, they are not unreasonable forecasts.

Margins

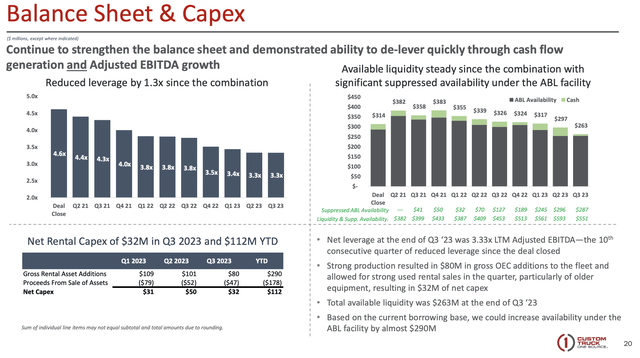

As kept in mind, Custom-made’s margins lag those of the Industrials sector. And, there is a big space in between its EBITDA and earnings margins, from 12.86% to 3.58%. The most significant bite out of EBITDA originates from interest expenditures; throughout Q3-2023, that total up to $34.1 million out of EBITDA of $53.0 million. To be reasonable, however, it has actually lowered its utilize for 10 successive quarters:

CTOS utilize chart (Q3 financier discussion)

As the business keeps in mind on the slide, it has actually a “shown capability to de-lever rapidly through capital generation and Changed EBITDA development”.

Management and method

Ceo Ryan McMonagle signed up with Custom-made in 2015, as an outcome of the financial investment by The Blackstone Group. Before signing up with Custom-made, he was the CFO of 2 business, where he was accountable for incorporating acquisitions. McMonagle began his profession at Bain and Business.

Fred Ross, who established Custom-made Truck & & Devices in 1996, stays with the business in the function of Creator.

Chief Financial Officer Chris Eperjesy has actually been with Custom-made given that 2022. Prior to that, he worked as CFO at a number of other business, consisting of a minimum of 2 that have connections with markets the business presently serves.

Method: It set out a five-part development method in its 10-K: Profit from beneficial patterns throughout a big addressable market; buy the rental fleet to satisfy growing need; grow devices sales throughout both existing and brand-new consumers, end-markets, and item offerings; boost penetration of aftermarket parts and service; and continue to pursue domestic geographical growth.

As kept in mind, the business’s development need to be helped by the Facilities Act, which supplies financing for numerous of completion markets it serves.

Given that the business has actually had the ability to create substantial money streams from its operations (assisted in part by financial obligation funding), it has the resources it requires to execute this method. It likewise delights in a number of tailwinds that will assist it preserve success and capital.

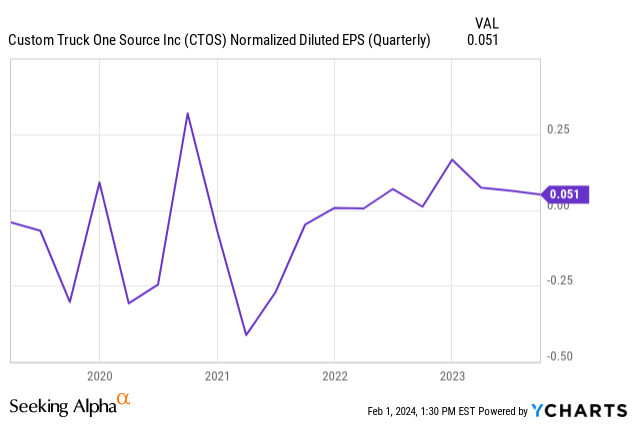

It appears the business might likewise take advantage of being less seasonal or cyclical than it has actually remained in the past. Not long after the mix with Nesco, its incomes started to level out:

By ending up being more foreseeable, which presumes the pattern will hold, it ought to end up being better to financiers and assist bring up share costs.

Appraisal

As a development stock, Custom-made ought to be examined by its PEG (price-earnings divided by 5-year EBITDA development rate) ratio instead of its P/E (price/earnings) ratio. Particularly, its PEG Non-GAAP ratio [FWD] is 0.66, which shows it is underestimated. In addition, it’s more affordable than the sector typical of 1.76.

It likewise succeeds on a number of other appraisal metrics. When it comes to EV/EBITDA [FWD], it is 8.51, well listed below the sector typical of 11.89. Price/Sales [FWD] is 0.88 versus 1.44 for the sector, and Price/Book is 1.76 while the sector typical is 2.69.

Due to the fact that of Custom-made’s financial obligation load, business worth likewise uses an essential viewpoint. Presently, the business worth is $3.65 billion, and the business multiple is 8.51, which is well listed below the sector typical of 11.89. It’s likewise listed below 10, suggesting a healthy business, and one that is underestimated.

And, with 246.5 million shares, the business worth per share exercises to $14.81 per share, which is considerably greater than the January 31 closing cost of $6.54. Certainly, the existing cost exercises to be 44.16% listed below the business worth per share.

All metrics point in the exact same instructions, informing us that Custom-made is an underestimated stock. Based upon the business worth per share, that undervaluation is $8.27.

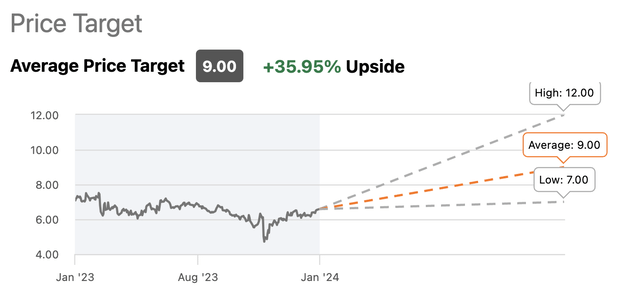

Quants have a Hold ranking, while Wall Street experts have actually released one Hold and 5 Strong Buys (there have actually been no other Looking for Alpha expert scores in the previous 90 days).

Behind the Wall Street experts’ bullish scores is a greater typical target cost for completion of the year: nearly 36%:

CTOS cost targets chart (Looking for Alpha)

Threats

There is high need and competitors for specialists, and a lack of them might increase Custom-made’s costs, hold-up shipments, and have other negative results.

It depends greatly on its supply chains, and any disturbances might cause functional difficulties. For instance, an automobile production strike that stops or slows the shipment of trucks.

Of its 246.5 million shares impressive, Platinum Equity Advisors owns 148.6 million, or 60%, of them. Platinum became part of the Nesco offer and, with a bulk of the typical shares, might act in manner ins which are not in the very best interests of other investors.

Although it has actually been lowering its utilize, Custom-made still brings a relatively heavy financial obligation load, and interest charges might be an even larger drain on success.

The business reports in the 10-K that it and its company have actually experienced cyberattacks, and anticipates more of them in the future.

Conclusion

Custom-made Truck One Source is an underestimated stock that is anticipated to kip down substantial fundamental development this year. There’s an excellent possibility that this development might rise the share cost by nearly 36%, to around $9.00.

That’s supported by greater incomes, increasing capital investment, development in the wider economy, and beneficial tailwinds.

For That Reason, I’m providing Custom-made a Strong Buy ranking.