BrianAJackson/iStock through Getty Images

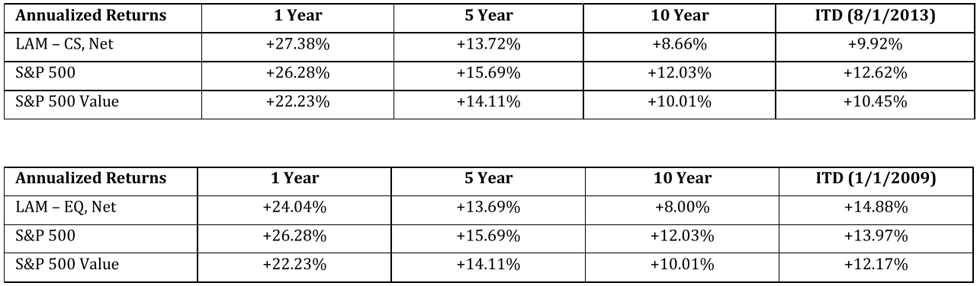

2023 was another great year for Lyrical. Our CS composite returned 27.2%, outshining the S&P 500 ( SP500, SPX) by 90 bps. It was an especially hard year to exceed offered the outsized efficiency contribution of the Spectacular 7 mega-cap development stocks. We, as worth financiers, do not own any of the Spectacular 7, however thankfully we did own other strong entertainers that more than offseted it. 2023 is now the 3rd fiscal year in a row our CS composite has actually exceeded the S&P 500.

Compared to our design criteria of the S&P 500 Worth, it was an even much better year. Our CS composite comfortably exceeded it by 500 bps, although that index likewise considerably taken advantage of mega-cap development stocks. Compared to other worth indices that were more style-pure, our outperformance margin was even broader. In 2023, we exceeded the U.S. large-cap worth indices from Russell, MSCI, and Feet Wilshire by more than 1,500 bps.

After a year of such strong returns, it is natural for financiers to be worried about assessment. With the S&P 500 forward P/E at almost 20x at year-end, we share that assessment issue about the marketplace, however with our CS composite at simply 11x, we have no assessment issues about our own portfolio. In truth, we continue to see considerable upside prospective.

3 YEARS IN A ROW

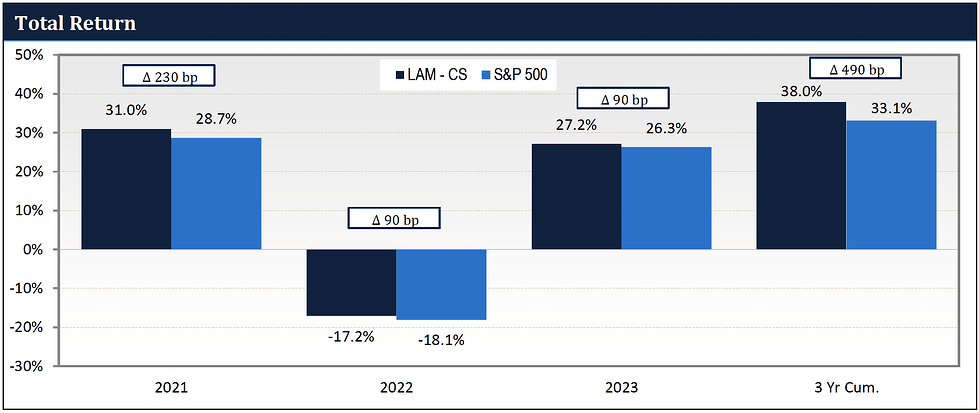

Lyrical’s CS composite has actually exceeded the S&P 500 in each of the last 3 fiscal year. As you can see in the chart listed below, in 2021 we exceeded by 230 bps, in 2022 by 90 bps, and now in 2023 by 90 bps once again.

Source: FactSet, Lyrical Analytics

We are really happy with these outcomes. Typically, we would not take pride in modest outperformance, as we desire provide a lot more than what we produced in this duration. Nevertheless, the marketplace background over these previous 3 years has actually consisted of: economic downturn worries, inflation, strong sector crosscurrents, a banking crisis, AI mania, and the Spectacular 7. Thinking about all that, we do take pride in these outcomes, and still think much higher outperformance lies ahead offered the development qualities of our portfolio and the large assessment spread relative to the S&P 500.

THE STUNNING 7

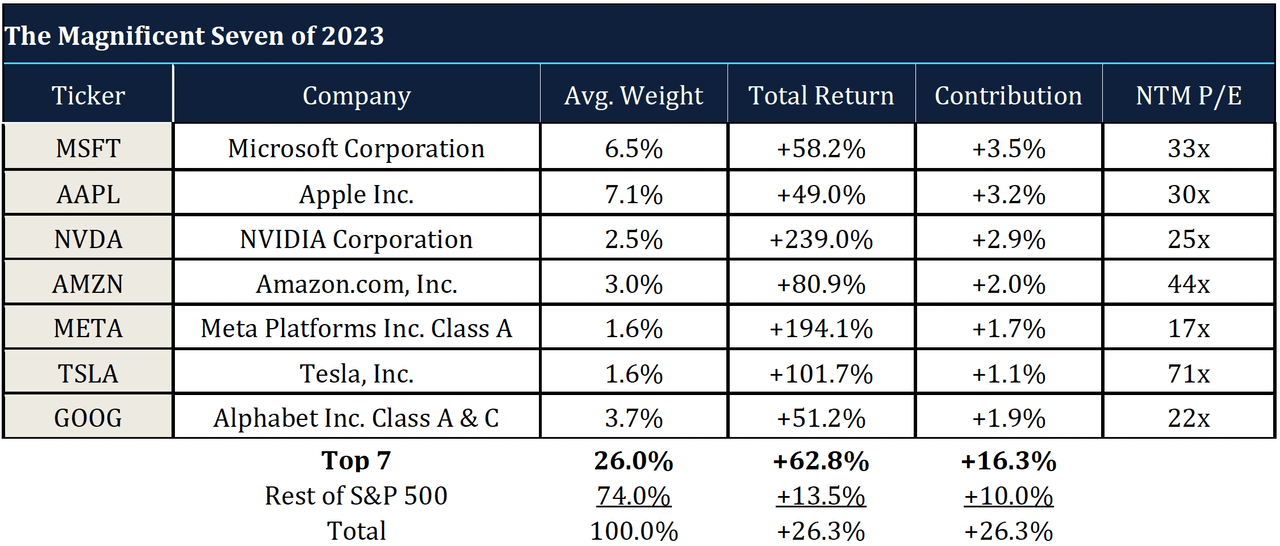

The Spectacular 7 is the popular label for the 7 mega-cap development stocks that drove much of the returns of the S&P 500 in 2023. Particularly, the 7 are: Microsoft ( MSFT), Apple ( AAPL), NVIDIA ( NVDA), Amazon ( AMZN), META, Tesla ( TSLA), and Alphabet ( GOOG, GOOGL).

We have actually not owned any of the Spectacular 7, that makes sense considered that we are disciplined worth financiers. As you can see by the P/Es in the table listed below, these stocks do not fit in the worth classification. The most costly of the 7 are Tesla at over 70x forward incomes and Amazon at 44x. Microsoft and Apple have P/Es in the 30s, and NVIDIA and Alphabet have P/Es in the 20s. META at 17x is the just one with a P/E listed below the S&P 500’s, however it is still more than 50% more expensive than our CS Composite P/E of 11x.

While we have actually seen FANG stocks move the S&P 500 over the last years, their influence on the return of the S&P 500 in any of those years fades in contrast to what the Spectacular 7 performed in 2023. With a weighted typical return of 62.8% and an integrated typical index weight of 26%, these 7 stocks contributed an impressive 16.3 portion points of the 26.3% index return.

The remainder of the S&P 500, what we call the “S&P 493,” returned 13.5%, which is almost 50 portion points lower. (Note: the S&P 493 return is really near to the 13.9% return of the S&P 500 Equal Weight index.)

While our CS composite exceeded the complete S&P 500 by simply 90 bps, it exceeded the S&P 493 by 1,370 bps, and the S&P 500 Equal Weight by 1,330 bps.

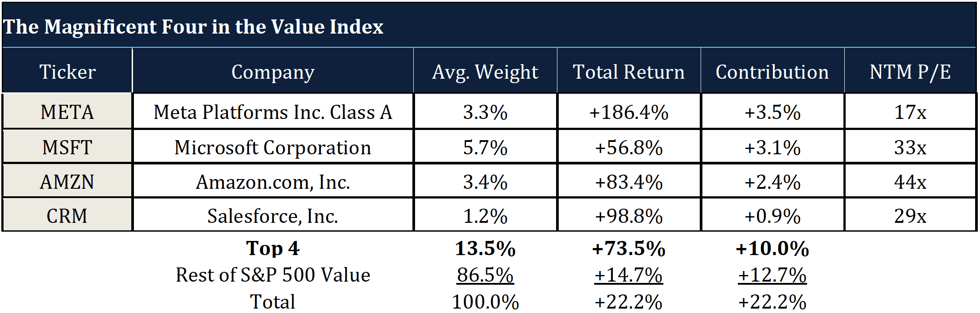

DEVELOPMENT STOCKS IN THE WORTH INDEX

Remarkably, the S&P 500 Worth index return was likewise considerably affected by mega-cap development stocks, in spite of the word “worth” in its name. The 4 biggest factors to the S&P 500 Worth index return were Meta, Microsoft, Amazon, and Salesforce, which you can see in the table listed below. These stocks had a typical index weight of 13.5%, and had an amazing typical return of 73.5%, contributing 10 portion points of the 22.2% index return. Without these 4 mega-cap development stocks, the index would have had a 14.7% return, 750 bps less.

Source: FactSet

Even with the S&P 500 Worth extremely gaining from these 4 mega-cap development stocks, our CS composite exceeded it by 500 bps, and omitting these 4 stocks it exceeded by 1,250 bps.

OUR UNCOMMON MIX

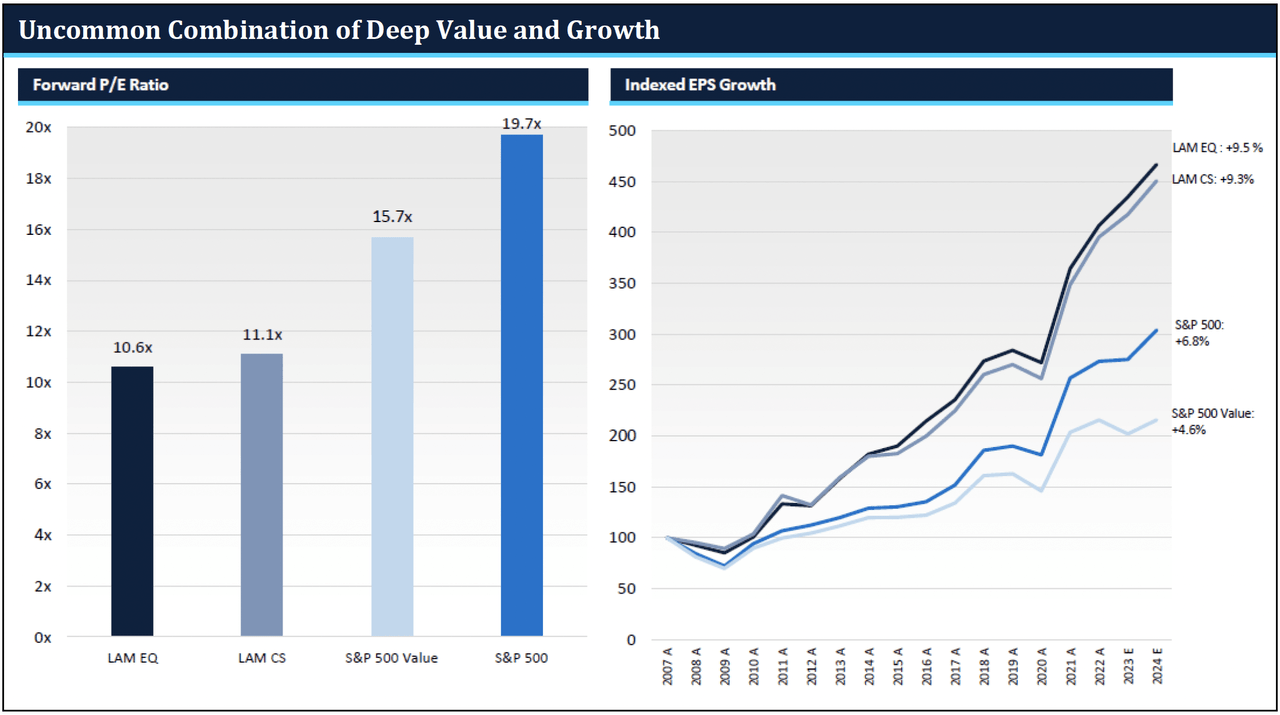

Throughout our firm history, our portfolios have actually had a lower forward P/E than the S&P 500 with equivalent development. Today, we do not simply have equivalent development, however remarkable development, as you can see in the line chart listed below.

The stocks in our portfolios have a development history of over 9% per year returning to 2007, compared to less than 6.8% for the S&P 500. Furthermore, the incomes history of our portfolio has actually displayed less financial level of sensitivity than either the S&P 500 or the S&P 500 Worth, with less incomes effect throughout the COVID shutdowns of 2020 and throughout the Global Financial Crisis of 2008-09.

Source: FactSet, See Notes listed below.

In the bar chart above, you can see the assessment of our portfolios compared to the S&P 500. Even after a 27.2% return, our CS composite ended 2023 with a forward P/E of 11.1 x. This unusual mix of both deep worth and appealing development is the signature attribute of Lyrical’s financial investment method.

ASSESSMENT SPREAD STILL EXCEPTIONALLY BROAD

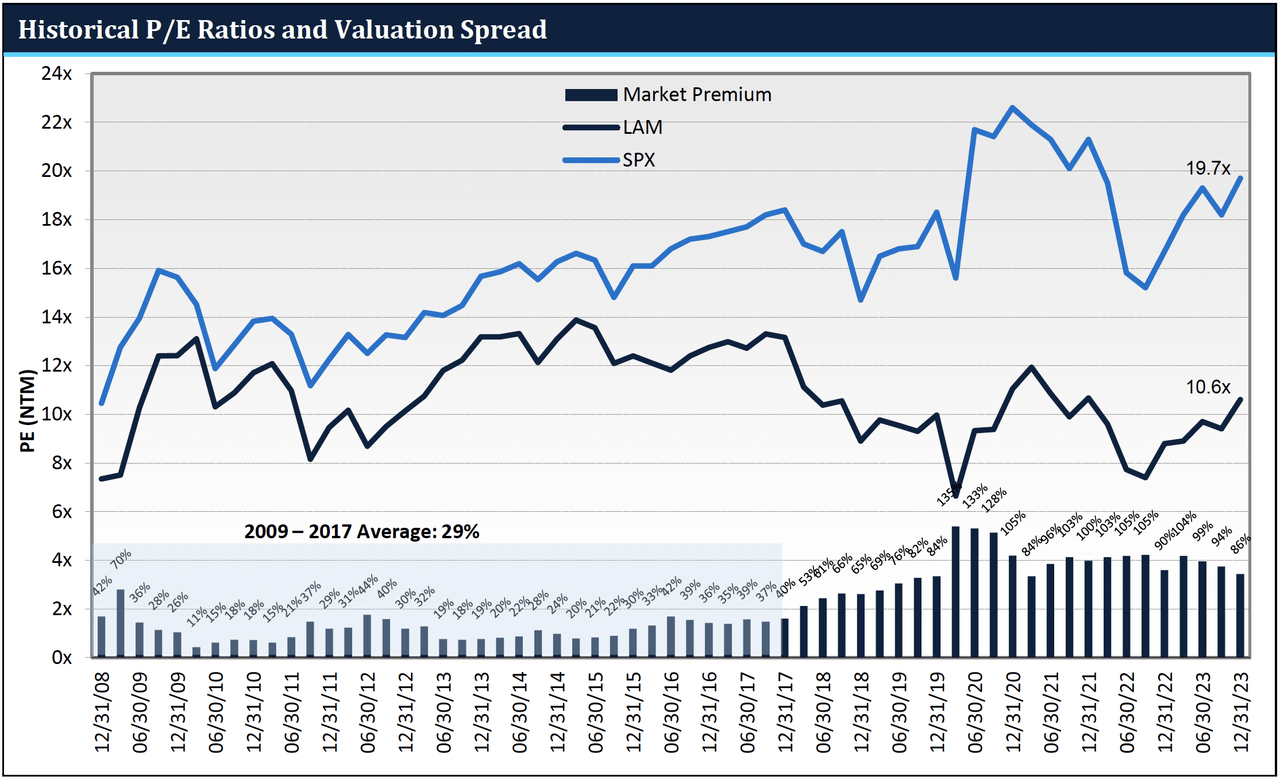

The S&P 500 ended 2023 with a forward P/E of 19.7 x, which is more than 25% above its 15-year average. By contrast, our CS composite forward P/E is not above, however in fact somewhat listed below our 15-year average.

Provided on the chart listed below are our existing and historic portfolio P/E ratios and the P/E of the S&P 500, with the bars at the bottom revealing the assessment spread in between the 2. (Note: In this chart we utilize our EQ composite which has a longer history than CS). The assessment spread of our portfolio relative to the S&P 500 stays incredibly large at 86%, and it is over 90% pro-forma for our current exit of Broadcom.

We continue to anticipate at some time this spread will go back to the pre-2018 average of about 30%, however we have no chance to understand when it may take place. Undoubtedly, the assessment spread has actually been stubbornly high for over 3 years now, however if we are best and the spread does go back from ~ 90% to ~ 30%, it might drive ~ 50 portion points of cumulative excess return, most likely expand over a number of years.

CONCLUSION

General, 2023 was an excellent year. Our CS composite produced strong outright returns of 27.2%, which exceeded the S&P 500 by 90 bps and our design criteria of the S&P 500 Worth by 500 bps. We accomplished this outperformance in spite of not owning any of the Spectacular 7 development stocks that considerably improved the returns of both those indices. Omitting the effect of those mega-cap development stocks would increase our outperformance to 1,370 bps vs. the S&P 500 and 1,250 bps vs. the S&P 500 Worth.

While it is reasonable to have assessment issues about the S&P 500, we have no such issues about our own portfolio, as our portfolio P/E is somewhat listed below our 15-year average. Our company believe we own an excellent collection of durable, growing business at deeply marked down assessments, and hence continue to see considerable upside prospective.

The assessment spread in between our portfolio and the S&P 500 stays incredibly large at 86% (90%+ proforma for our current exit of Broadcom). At some time, we anticipate that infect go back to where it remained in the past, and while doing so drive considerable outperformance.

We have actually been waiting a couple of years now for this to take place, and we still do not understand just how much more waiting may be needed. The wait has actually been frustratingly long, however on the other hand, it has actually not been all that bad either. While we have actually not produced the magnitude of outperformance we target, we have actually still exceeded the S&P 500 in each of the last 3 fiscal year.

Surpassing by a little is a respectable method to kill time while waiting to exceed by a lot.

Andrew Wellington, Handling Partner, Chief Financial Investment Officer

|

THIS IS NOT AN OFFERING OR THE SOLICITATION OF AN DEAL TO PURCHASE THE TECHNIQUE PROVIDED. ANY SUCH OFFERING CAN ONLY BE MADE FOLLOWING A ONE-ON-ONE DISCUSSION, AND ONLY TO QUALIFIED INVESTORS IN THOSE JURISDICTIONS WHERE ALLOWED BY LAW. THERE IS NO ASSURANCE THAT THE INVESTMENT GOAL OF THE TECHNIQUE WILL BE ACHIEVED. THREATS OF AN FINANCIAL INVESTMENT IN THIS TECHNIQUE INCLUDE, BUT ARE NOT LIMITED TO, THE THREATS OF INVESTING IN EQUITY SECURITIES GENERALLY, AND IN A WORTH INVESTING METHOD. PLEASE SEE WWW.LYRICALAM.COM/NOTES FOR A CONVERSATION OF PARTICULAR PRODUCT THREATS OF AN FINANCIAL INVESTMENT IN LYRICAL’S TECHNIQUES. PREVIOUS EFFICIENCY IS NOT NECESSARILY INDICATIVE OF FUTURE OUTCOMES. LAM – CS OUTCOMES ARE UNAUDITED AND TOPIC TO MODIFICATION, ARE FOR A COMPOSITE OF ALL ACCOUNTS. NET RETURNS CONSIST OF A 0.75% BASE COST. LAM – EQ OUTCOMES ARE UNAUDITED AND TOPIC TO MODIFICATION, ARE FOR A COMPOSITE OF ALL ACCOUNTS, AND PROGRAM ALL DURATION STARTING WITH THE FIRST FULL MONTH IN WHICH THE CONSULTANT HANDLED ITS FIRST FEE-PAYING ACCOUNT. NET RETURNS CONSIST OF A 0.75% BASE COST AND 20% REWARD ALLOWANCE ON RETURNS OVER THE S&P 500 WORTH ®, TOPIC TO A HIGH WATER MARK ARRANGEMENT.

THE S&P 500 ® IS COMMONLY CONSIDERED AS THE VERY BEST SINGLE GAUGE OF LARGE-CAP U.S. EQUITIES. THE INDEX THE INDEX CONSISTS OF 500 LEADING BUSINESS AND COVERS APPROXIMATELY 80% OF AVAILABLE MARKET CAPITALIZATION. THE S&P 500 ® WORTH DRAWS CONSTITUENTS FROM THE S&P 500 ®. S&P MEASURES WORTH UTILIZING 3 ELEMENTS: THE RATIO OF BOOK WORTH, REVENUES, AND SALES TO RATE. S&P DESIGN INDICES DIVIDE THE TOTAL MARKET CAPITALIZATION OF EACH MOMS AND DAD INDEX INTO DEVELOPMENT AND WORTH SECTORS. NOTES: ALL MARKET DATA IS THANKS TO FACTSET. INDEXED EPS DEVELOPMENT PORTRAYS THE HISTORIC MODIFICATION IN REVENUES PER SHARE OF THE BUSINESS IN THE LAM U.S. WORTH EQUITY TECHNIQUES UTILIZING WEIGHTS IN THE LAM-EQ COMPOSITE AS OF DECEMBER 31, 2022. REAL HOLDINGS, AND THEIR WEIGHTS, DIFFERED GRADUALLY. REVENUES PER SHARE IS COMPUTED UTILIZING AGREEMENT REVENUES DATA PER FACTSET, THAT INCLUDE PARTICULAR MODIFICATIONS FROM REPORTED, GAAP REVENUES. DURATIONS MARKED WITH AN “E” INCLUDE ESTIMATED REVENUES PER SHARE. THE HISTORIC PORTFOLIO P/E (NTM) CHART COMPARES THE WEIGHTED AVERAGE NEXT TWELVE MONTHS P/E RATIOS AS OF THE STARTING OF EACH QUARTER FOR THE LAM-EQ COMPOSITE AND THE S&P 500 INDEX. REAL STARTS OF QUARTER LAM-EQ COMPOSITE WEIGHTS ARE USED. |

Editor’s Note: The summary bullets for this short article were picked by Looking for Alpha editors.