spawns/iStock by means of Getty Images

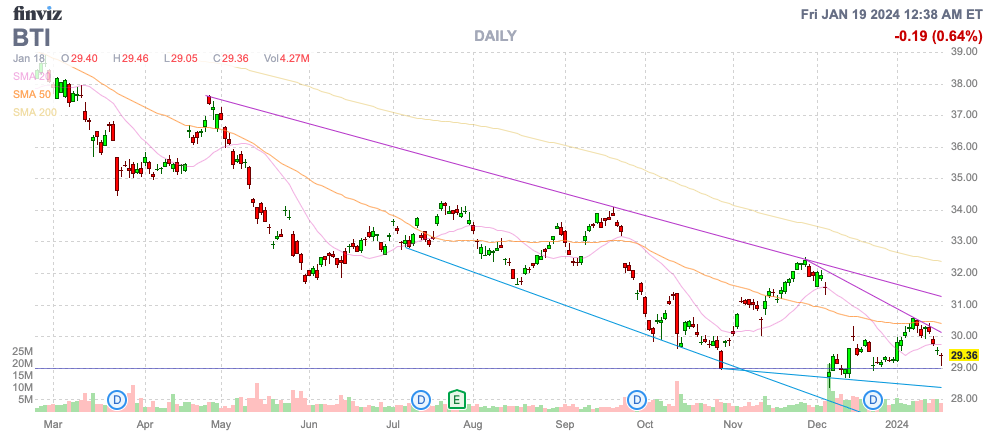

Regardless of the huge dividend payment, British American Tobacco p.l.c. ( NYSE: BTI) has actually been a substantial catastrophe for investors for a very long time now. The business has actually been strongly investing into marijuana and describing strategies to make a note of U.S. flammable brand names in indications management fears completion video game of the primary service line now. My financial investment thesis is a little Bullish on the stock after the unreasonable collapse to end 2023.

Source: Finviz

Unusual Signals

The business just recently revealed an extra financial investment in Organigram ( OGI) in spite of a dreadful financial investment back in March 2021. BTI goes over the objective for a smokeless world, however marijuana moves the business right back into a customer base frequently smoking joints.

BAT will invest another ⤠74m (C$ 125 million) in between January 2024 and January 2025 and increase its equity position from 19% to 45%. The initial financial investment was ⤠126 million and priced shares at C$ 3.79 for a stock now trading at C$ 2.25 following a rally after the BAT financial investment increase.

BAT requires to discover alternative items from cigarettes being disallowed all over the world. The UK is attempting to carry out a law where 14-year olds will never ever have the ability to lawfully buy cigarettes in a prepared smoking cigarettes restriction.

The tobacco business simply made a note of U.S. tobacco brand names to the enormous tune of $ 31.5 billion BAT strategies to totally cross out these brand names worth $80 billion on the balance sheet over the next thirty years in a statement in December that triggered the stock to crash.

Presently, BAT just acquires 12% of sales from brand-new item classifications recommending the business isn’t sending out an excellent signal to investors by documenting the important U.S. brand names to no by 2053. Not to point out, the vape and menthol items in the brand-new classifications aren’t without examination.

In reality, the CEO totally opposed the make a note of recommending he thinks cigarettes will not disappear in this period based upon this declaration on the current teleconference with experts.

I’m not stating that we – the flammable, the cigarettes will vanish in thirty years in the United States. I actually do not think that, however you can not validate the worth of those brand names corresponding to a number as comparable to what we have today in the balance sheet.

In either case, BAT has actually made ruthless financial investments in Organigram in an effort to get in the marijuana area to assist change business from combustibles. The initial financial investment in 2021 was down over 50% throughout this duration. In addition, BAT is purchasing a Canadian marijuana business without any access to the huge U.S. marijuana market lowering a great deal of the advantage for purchasing marijuana.

The combined relocations need to question whether management is making sound judgements on the future. The stock has actually collapsed in spite of the projection for low single digit natural development and a 2024 sales target around 3% development.

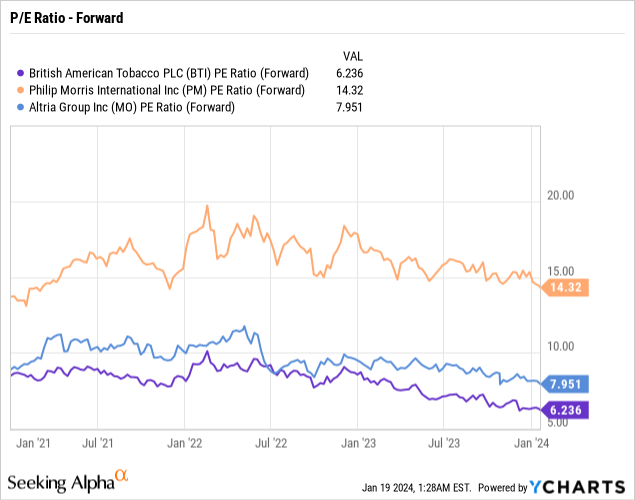

With a dividend yield around 10%, the stock should not be being up to brand-new lows. BAT now just trades at 6x EPS targets. At 4% EPS development from a $4.67 base in 2023, the business would strike a 2026 EPS of $5.25.

At this moment, BAT is anticipating reaching 50% of sales from non-combustible items in the brand-new classifications by 2035. Over a years away, the business will still be extremely depending on combustibles in spite of all of the strategies to change business.

Dividend Has A Hard Time

BAT is a prime example of the battles business have actually dealt with in making big dividend payments while having big financial obligation balances. As no huge shock, the marketplace hasn’t been really gratifying of stocks not focused more on paying back financial obligation versus treking dividend payments.

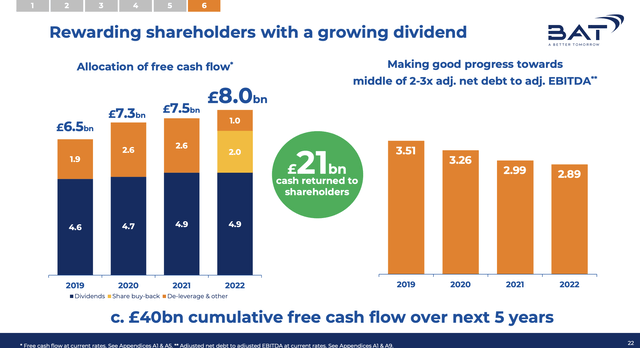

The tradition tobacco business has actually treked the dividend payment from ⤠4.6 billion in 2019 to ⤠4.9 billion in 2022 while the utilize ratio stays reasonably high at 3x. Even even worse, management invested over $1.0 billion yearly on share buybacks throughout the duration.

While this appears investor friendly, the very best relocation for investors in a service having a hard time to grow is to decrease financial obligation. The only method a business producing FCF can enter into problem is by viewing money streams all of a sudden turn south while financial obligation increases due to bad capital allowance strategies.

BAT still has ⤠37,259 million in net financial obligation and the business scared the marketplace recommending important brand names had a minimal future. In such a situation, BAT would have a difficult time paying back financial obligation and naturally the marketplace will worry.

The basic option is to pay back financial obligation and increase capital by means of reducing interest expenditures. Share buybacks can take place when financial obligation levels are far lower and the threat of any future default is significantly decreased, even under a situation where earnings are weaker.

BAT stays a huge discount rate to Phillip Morris International ( PM) and Altria ( MO) due to the restricted non-combustible earnings presently and the business startling the marketplace. Likewise, Phillip Morris is anticipated to produce faster development ahead calling for the greater forward P/E several, though the development rates aren’t big enough to require the present big evaluation space.

The low dividend payment ratio in the 65% variety must be another increase for BAT, however just after the financial obligation levels are cut, even listed below the present target of reaching 2.5 x EBITDA before changing the capital allowance method. The business recommends a strategy of utilizing excess money streams for share buybacks and bolt-on M&An offers. The idea is that BAT will think about these strategies when the utilize ratio strikes around 2.5 x EBITDA, however the business needs to think about pressing towards the lower end utilize target.

Takeaway

The essential financier takeaway is that BAT is reasonably inexpensive and the big dividend yield of 10% must draw in financiers, however management requires much better messaging to prevent startling the marketplace once again. The unreasonable financial investments into Canadian marijuana and the make a note of of U.S. brand names send out a baseless signal for business. The truth is that sluggish development will reward financiers in time, if the business properly assigns the money streams to merely paying back financial obligation versus chasing bad financial investments, even in their own stock.

A huge yield of 10% normally indicates weak point, however BAT has actually made a number of relocations making the business appear weak that were unneeded. The stock needs to provide a strong return moving forward, presuming the business begins making much better choices.

.