French telco group Iliad has sent a proposition to UK-based Vodafone Group relating to the possible merger of their particular operations in Italy.

If effective, the merger will have a huge influence on the Italian mobile market, lowering it from 5 gamers to 4, while likewise integrating the repaired broadband operations of the 2 business.

The offer is by no methods ensured to go through, nevertheless. Even if Vodafone’s reaction is favorable, regulative authorities need to then study its impacts on competitors.

More Information

The proposition worths Vodafone Italy at EUR10.45 billion ($ 11.4 billion) and Iliad Italy at EUR4.45 billion.

Vodafone Group would acquire 50% ownership of the merged entity (called NewCo) together with a EUR6.5 billion money payment and a EUR2.0 billion investor loan. Iliad, on the other hand, would get 50% of NewCo together with a EUR500 million money payment and a EUR2.0 billion investor loan.

As part of the proposed deal, Iliad would have a call alternative on Vodafone Group’s equity stake in NewCo and would have the ability to get a block of 10% of the NewCo share capital every year at a rate per share equivalent to the equity worth at closing. In case Iliad picks to work out the call choices completely, this would produce an extra EUR1.95 billion in money for Vodafone Group.

Based Upon Vodafone Italy’s approximated EBITDA after Lease (EBITDAaL) of EUR1.34 billion for FY 2024 (based on broker agreement), the proposed deal indicates an EBITDAaL multiple of 7.8 x. This is greater than the 7.1 x EBITDAaL numerous provided by Iliad in its EUR11.25 billion takeover deal for Vodafone Italy in February 2022, which was rapidly turned down by Vodafone Group.

The merged organization would be anticipated to produce incomes of around EUR5.8 billion and EBITDAaL of approximatively EUR1.6 billion for the fiscal year ending March 31, 2024.

The merged organization would be anticipated to produce incomes of around EUR5.8 billion and EBITDAaL of approximatively EUR1.6 billion for the fiscal year ending March 31, 2024.

According to Iliad, the funding of the deal is supported by prominent worldwide banks and the offer has the consentaneous assistance of its board of directors plus its primary investor, Xavier Niel.

Thomas Reynaud, Iliad Group CEO, commented: “The marketplace context in Italy requires the development of the most ingenious telecom opposition, with capability to contend and develop worth in a competitive environment. Our company believe that the profiles and complementary knowledge of Iliad and Vodafone in Italy would enable us to construct a strong operator with the capability and monetary strength to invest for the long term.”

” NewCo would be totally devoted to speeding up the nation’s digital change and particularly fiber adoption and 5G release, with more than EUR4 billion of financial investment prepared over the next 5 years,” he included.

Vodafone Background

Vodafone has actually existed in Italy because September 1995, when it introduced as the very first competitors in the mobile market for incumbent operator Telecom Italia (TIM).

The business– at first called Omnitel– was established by a variety of investors, consisting of Olivetti, Bell Atlantic International (now Verizon Communications), and Telia International (now Telia Business).

It rebranded as Omnitel Vodafone in January 2001 and after that Vodafone Omnitel in Might 2002 in a quote to take advantage of the credibility of the UK-based Vodafone Group, which had actually come on board as a financier 2 years previously. In Might 2003, the Omnitel name was dropped completely, by which time Vodafone had actually been left as the 100% owner following the progressive departure of its partners.

Vodafone Italy introduced 3G in 2004, 4G in October 2012, and 5G in June 2019.

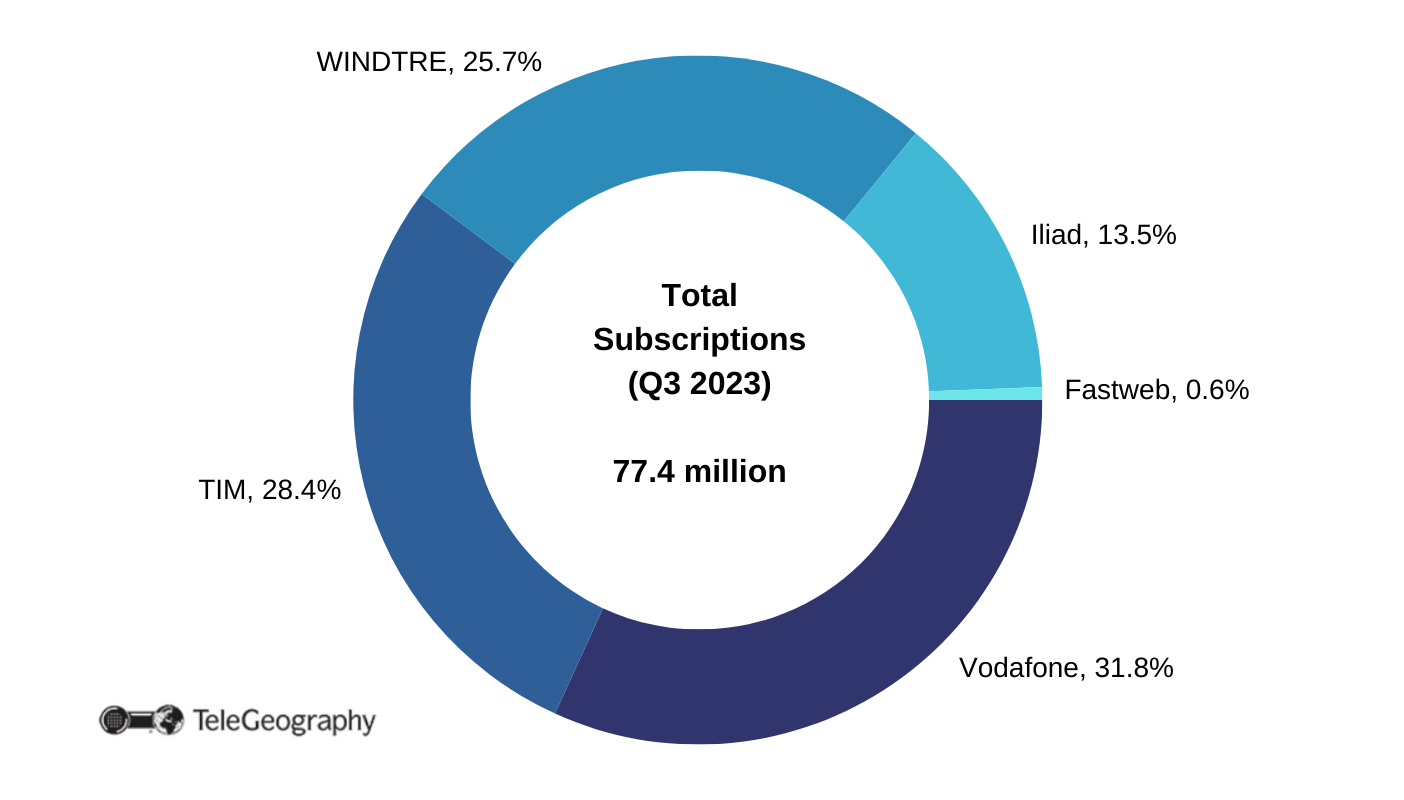

According to TeleGeography’s GlobalComms Database, at the end of September 2023, it had actually built up an approximated 24.6 million mobile memberships– consisting of clients of its MVNO partners however leaving out M2M connections– making it the nation’s biggest cellco with 32% of the marketplace.

In the repaired broadband sector, Vodafone provides a variety of gain access to items based upon VDSL and fiber-to-the-home innovations, utilizing its own networks plus those of wholesale partners. It likewise utilizes its 4G and 5G networks to link homes beyond the set network footprint.

Since September 30, 2023, Vodafone had actually 2.95 million repaired broadband memberships.

Newer Opposition

Iliad Italy is a much more youthful business, developed in 2016 to get spectrum and some network possessions from mobile network operators (MNOs) 3 Italia and Wind Telecomunicazioni, which had actually consented to a merger.

In order to calm regulators fretted about the offer’s impacts on competitors, the set produced a “treatment plan” to enable a brand-new MNO to sign up with the marketplace.

Iliad ultimately introduced mobile services in May 2018, going on to win 5% of the general market within twelve months and 10% by the very first quarter of 2021. Since September 30, 2023, Iliad had 10.48 million mobile memberships and a 13.5% market share.

Italy Mobile Market, Q3 2023

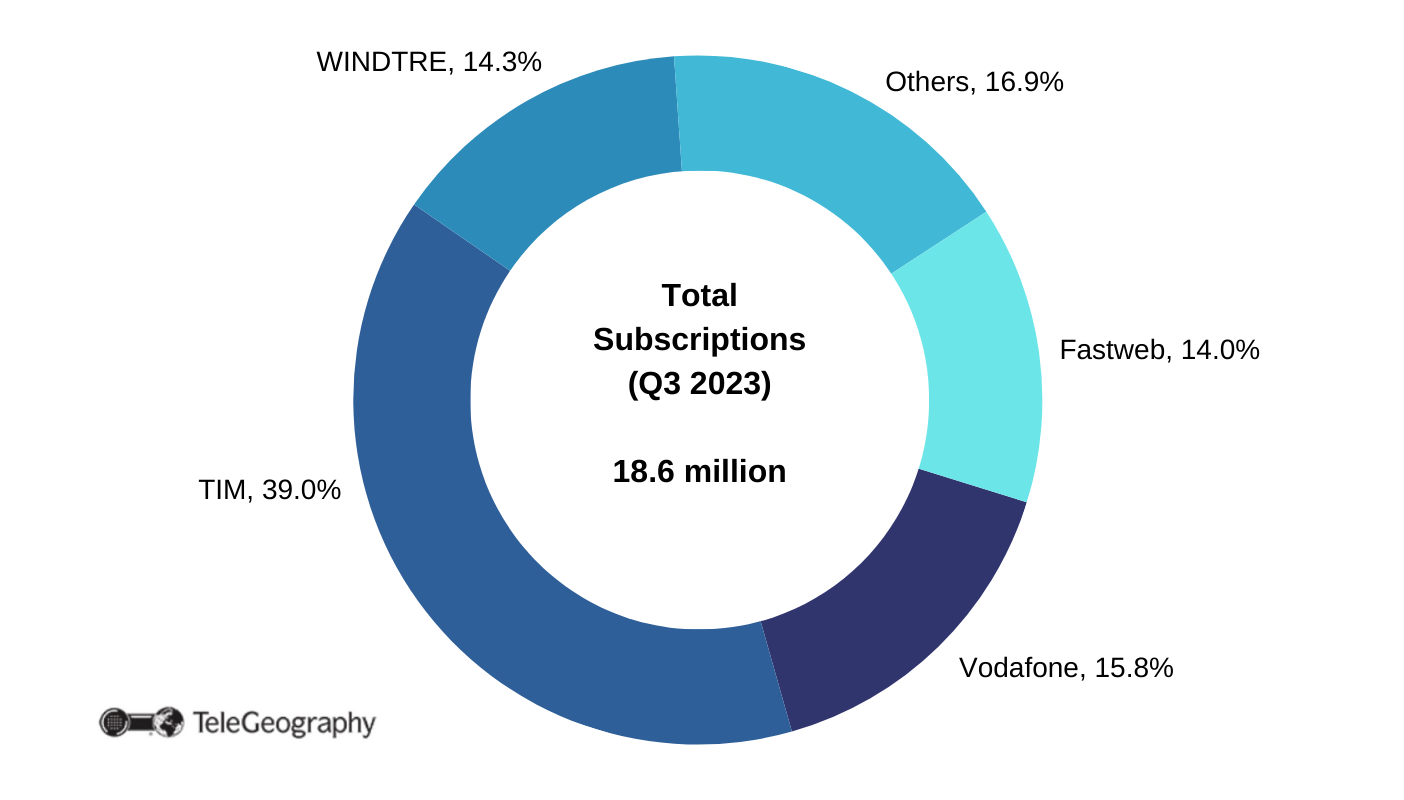

It signed up with Italy’s repaired broadband sector in January 2022, having actually signed wholesale arrangements with the similarity Open Fiber and TIM. It had 172,000 broadband clients by end-September 2023.

Italy Fixed Broadband Market, Q3 2023