Chasing After Efficiency

” … in some cases I have actually thought as lots of as 6 difficult things before breakfast“

— The White Queen, Through the Looking Glass

Should a possession supervisor depend on historic efficiency information to choose supervisors? The effectiveness of doing so depends upon the responses to 3 concerns:

- What portion of the supervisor universe is genuinely talented?

- How talented are they?

- How fortunate might the “common” supervisors be?

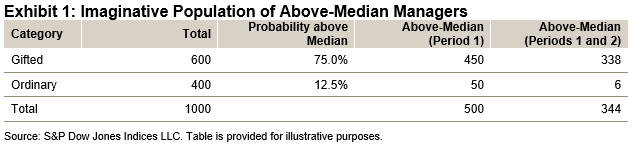

For instance: Expect we presume that 60% of all supervisors are “talented” and 40% are “common,” that a talented supervisor has a 75% likelihood of accomplishing above-median outcomes, which a common supervisor has a 12.5% possibility of doing the exact same. Display 1 reveals some ramifications of these presumptions for a 1000-manager universe.

Display 1 includes both excellent and problem for our theoretical possession owner. Fortunately is that after one duration, 90% (450/500) of the above-median supervisors are really talented; if our presumptions are appropriate, employing just from the above-median swimming pool will raise the chances of success. The problem is that our presumptions are probably inaccurate, not to state hugely impractical. Why? Since these presumptions indicate that 69% (344/500) of duration 1’s above-median supervisors will likewise be above average in duration 2– a perseverance rate far higher than those we really observe Display 1 is, regretfully, an artifact of wishful thinking.

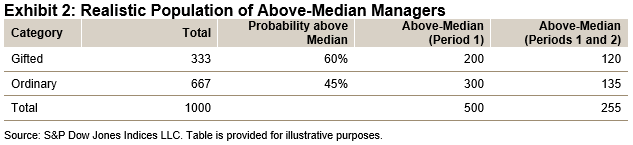

If Display 1’s presumptions are plainly incorrect, what options might be more reasonable? To be more modest, we can decrease the population of talented supervisors from 60% to one-third, decrease their likelihood of ranking above average from 75% to 60%, and narrow the space in between the talented and the common by setting the common supervisors’ possibility of being above average at 45%. As in the past, Display 2 includes both excellent and problem for our theoretical possession owner.

Fortunately is that utilizing Display 2’s presumptions, 51% (255/500) of duration 1’s above-median supervisors ought to duplicate that efficiency in duration 2. Although we do not typically see outcomes that excellent, 51% perseverance is not unprecedented, therefore Display 2 is at least a rather possible design of truth.

The problem in Display 2 is that just 40% (200/500) of duration 1’s above-median supervisors are really talented; 60% of them arrived through luck instead of ability. And possibly even worse news: just 47% (120/255) of the supervisors who are above average in 2 successive durations are really talented. To put it simply, a possession owner who employs from the above-median swimming pool is most likely to get a common supervisor than a talented one. Even if we presume that really talented supervisors exist– which they remain talented with time– employing an above-median entertainer offers a less-than-even possibility of discovering the talented supervisor we are looking for.

Active management is hard, as readers of our SPIVA Scorecards understand well; recognizing exceptional supervisors is possibly similarly tough. Depending on historic efficiency rankings is not likely to be practical.

The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

Get a Holistic Lens on Sustainability

-

Classifications

ESG -

Tags

Business Sustainability Evaluation, ESG, ESG information, ESG ratings, effect investing, Indexing ESG, indexing sustainability, S&P Global Corporate Sustainability Evaluation, S&P Global CSA, S&P Global ESG Ratings, S&P Global S1, S&P International Sustainability1, sustainability, sustainability information, sustainability indices

Make more educated sustainability choices with much deeper information– our indices are powered by analytics from the world-renowned S&P International Business Sustainability Evaluation.

The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

Creating the Global Energy Shift: An Index for Vital Metals

Look inside the S&P Global Vital Metals Producers Index, a pure-play index that tracks the business assisting the world create the future of energy development.

The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

Surveying the current SPIVA India Scorecard Outcomes

-

Classifications

Equities, Fixed Earnings -

Tags

Active vs. Passive, Benedek Voros, Bhavna Sadarangani, IIS, indexing, indexing India, India, Indian Composite Bond Funds, Indian ELSS Funds, Indian Federal Government Mutual Fund, institutional financier, S&P BSE 100, S&P BSE 200, s&& p indices versus active, SPIVA, SPIVA India Mid-Year 2023

Were active and set earnings fund supervisors able to stay up to date with their criteria in the most recent SPIVA India Scorecard? Dive into the most recent outcomes with S&P DJI’s Bhavna Sadarangani and Benedek Vörös.

The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

Delighted Days for The Length Of Time?

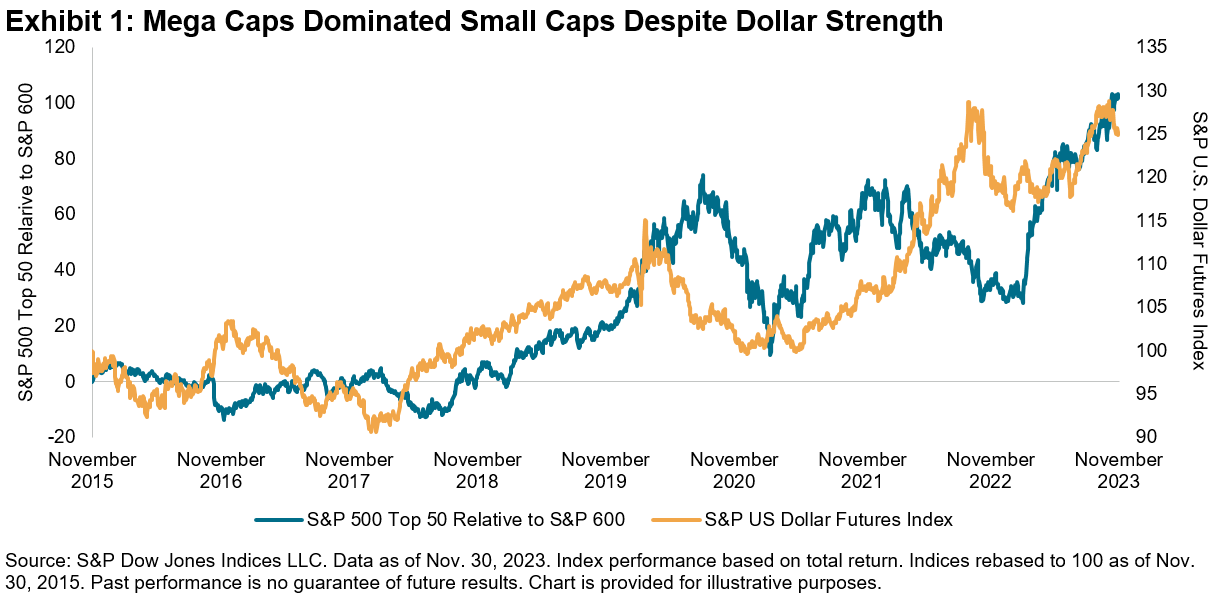

With less than a month delegated go to liquidate the year, it’s a great time to review the low and high that market individuals have actually experienced. While the year started with a rocky start due to the Silicon Valley Bank collapse, the marketplace continued to power forward, stumbling in Q3 as 10-year Treasury yields increased to a 15-year high, however recuperating with a bang in November, with the S&P 500 ® up 21% YTD. 1 One effect of increasing Treasury yields was the rise in the U.S. dollar, which generally is a currency headwind for mega caps, as U.S. multi-nationals tend to acquire the majority of their profits from abroad. However that didn’t obstruct the tear that mega caps were on this year, as Display 1 highlights, with the S&P 500 Leading 50 surpassing the S&P 600 ®(* ) by 28% YTD. While we just recently saw a pullback in 10-year yields together with the dollar, with the S&P U.S. Dollar Futures Index down 2% in November, if that pattern continues, that might possibly be an additional advantage to mega-cap strength. While little caps recuperated in November

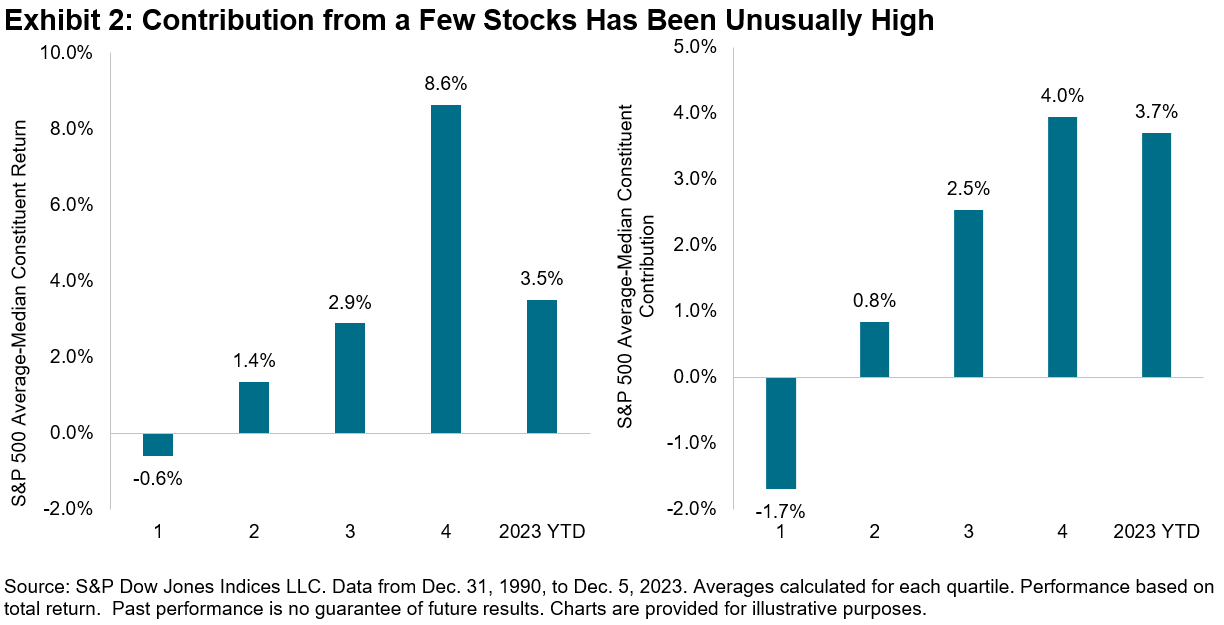

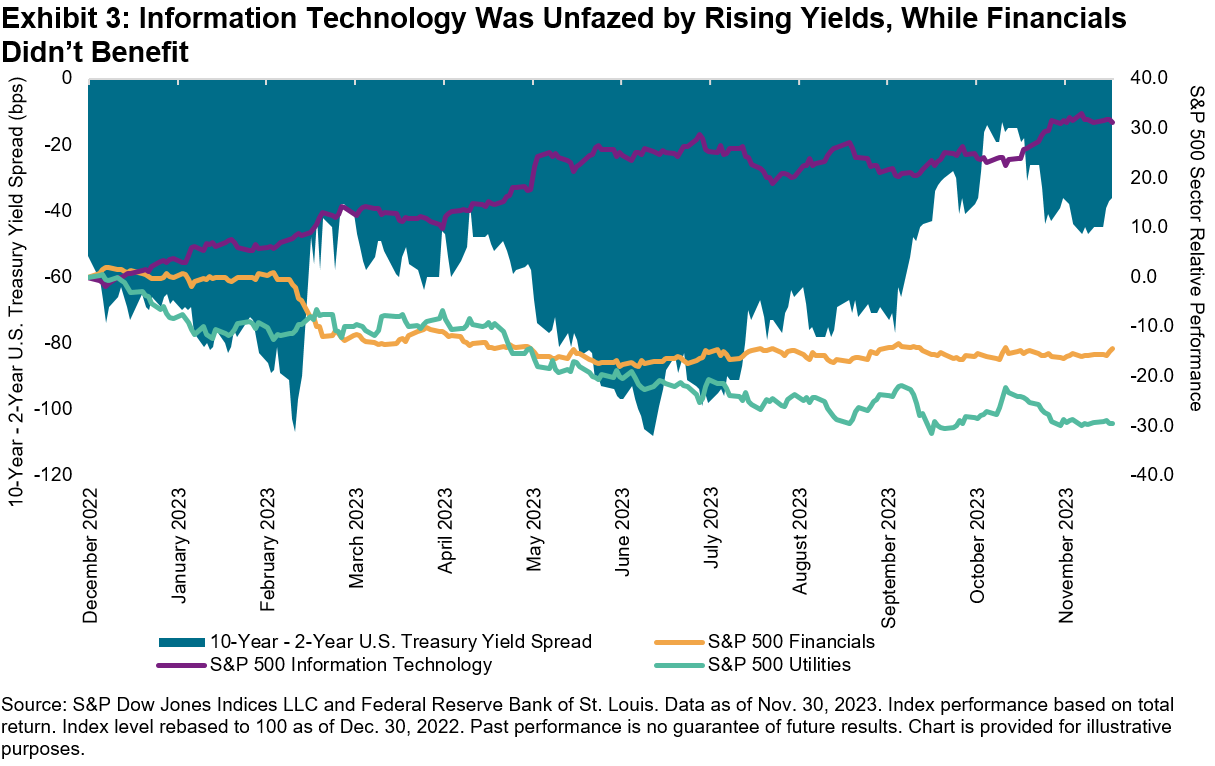

, this year’s large-cap-led rally has actually been uncommon in regards to its narrow breadth. We can picture this in Display 2, where we rank the historic yearly S&P 500 returns in our database by skewness of constituent returns, as determined by the distinction in between the typical versus average constituent return, and consequently divide them into quartiles. Then we carry out the exact same workout, now ranking by skewness of constituents’ return contribution. Up until now this year, the typical return has actually been higher than the average by 3.5%, in between the 3rd and 4th quartile, while the typical constituent contribution has actually been higher than the average by 3.7%, put right listed below the 4th quartile level. These reasonably severe outcomes follow the concentration of outperformance within the Stunning 7 stocks, which has actually been abnormally high relative to history, and possibly a headwind for more focused active supervisors that are underweight the biggest stocks Going back to the climb of 10-year Treasury yields, the increase was not restricted to the long end of the curve, with a substantial climb in short-term Treasury yields on the back of Fed rate walkings to fight inflation. However as 10-year yields got steam, the inverted yield curve started to disinvert. At a sector level, Display 3 reveals that the momentum in Infotech has actually continued in spite of the sector’s conventional level of sensitivity to greater rates, while Energies, generally more bond-like in nature, is unsurprisingly the worst sectoral entertainer YTD. What is unexpected is that while Financials must take advantage of the disinversion of the yield curve, which can enhance banks’ net interest margins, the sector has actually not handled to totally recuperate post the Silicon Valley Bank tumult.

In addition to magnificent equity efficiency, we experienced a strong healing in set earnings compared to in 2015’s abysmal efficiency, with the

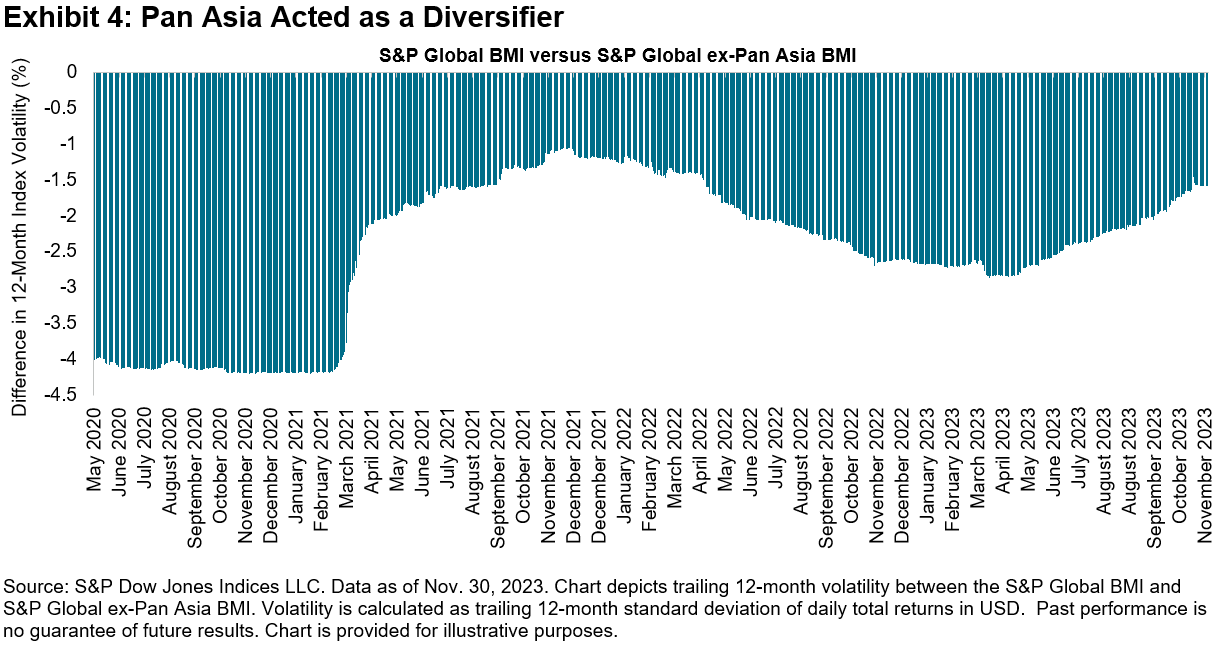

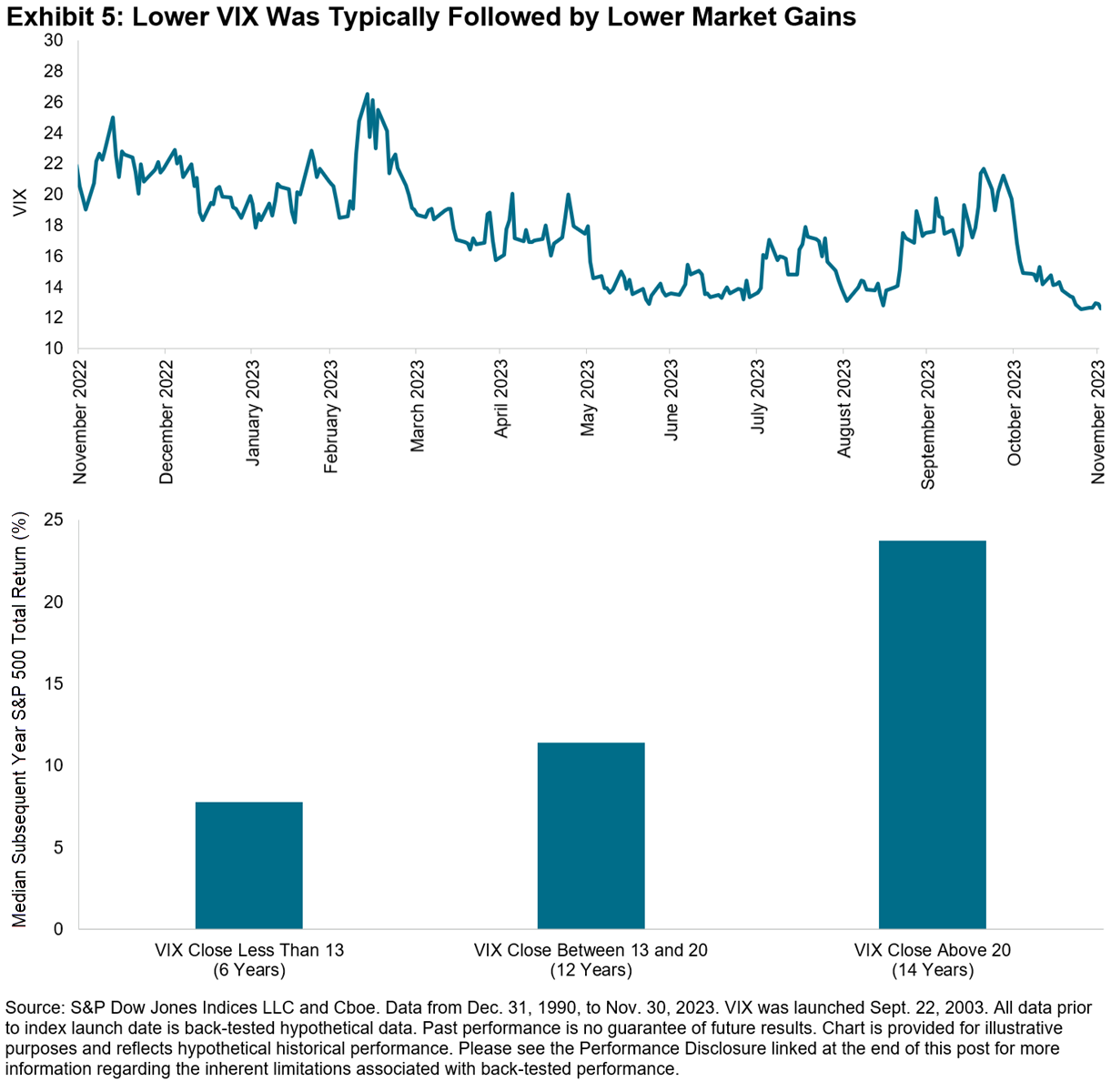

iBoxx Liquid Financial investment Grade up 8% in November, its finest regular monthly return considering that December 2008. However while outright efficiency has actually been rosy, risk-adjusted efficiency can be more tough provided continued favorable connections in between equities and bonds, a natural result of gains throughout both possession classes. On the other hand, in spite of China’s financial and realty problems, with the S&P China 500 down 14% in USD terms year-to-date, Asian markets provided some solace, as we see in Display 4, where a constant unfavorable spread in tracking 12-month volatility in between the S&P Global BMI and S&P Global ex-Pan Asia BMI shows Pan Asia has actually served as a diversifier. Putting threat into context, in spite of geopolitical stress combined with remaining inflation and economic crisis issues, Display 5 reveals that the marketplace has actually been at ease, with the

VIX ® trending downward in the previous 12 months, ending November listed below the 13 deal with. However what signal has low equity indicated volatility provided for future equity returns traditionally? We rank the exact same years in our database by VIX and divide them into 3 containers based upon a VIX level at year-end of less than 13, in between 13 and 20, and above 20. Historically, we see a direct relationship in between the year-end level of VIX and average subsequent year S&P 500 returns, suggesting that, usually, years ending with greater indicated volatility tended to be followed by greater returns. While forecasting the future has actually shown to be an useless workout

YTD since Dec. 5, 2023.

The posts on this blog site are viewpoints, not recommendations. Please read our