Gold Strikes All-Time Highs and DJCI Silver Tops 10% in November

” Silver and gold, silver and gold,

Everybody wants silver and gold.”

– Burl Ives

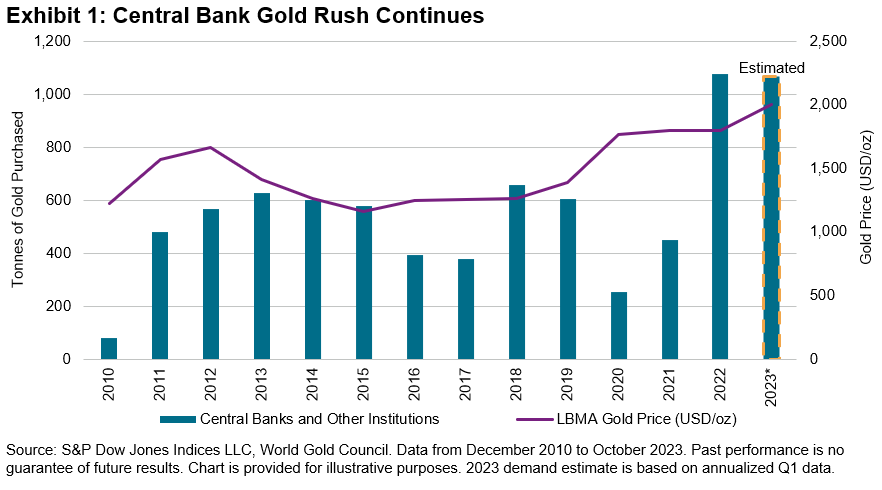

My all-time preferred stop-motion animation program was the 1964 television unique Rudolph the Red-Nosed Reindeer, told by Burl Ives. Playing the function of Sam the Snowman, Ives sang “Silver and Gold,” commemorating the work of Yukon Cornelius, a prospector mining near Santa’s workshop. Those tracking the Dow Jones Product Index Silver struck it abundant, as the index published a 10.6% gain in November. The Dow Jones Product Index Gold, not to be outshined, struck an all-time high before settling on thin volumes. Reserve banks continued to include 800 lots of gold to their portfolio in the very first 3 quarters of the year, led by the Individuals’s Bank of China. Purchases so far drove gold to an all-time high, as inflation ruined fiat currencies. Following a year of record gold purchases, reserve banks are on rate to almost match 2022 levels. Financiers seem combating the U.S. Fed, nevertheless, as net redemptions in physical gold ETFs have actually seen USD 12 billion in outflows YTD.

Beyond rare-earth elements, restored optimism of a rebounding Chinese economy led commercial metals to a strong month-to-month efficiency. Industrial metals, consisting of the S&P GSCI Lead, S&P GSCI Zinc and S&P GSCI Copper, got 2%, 3% and 4%, respectively.

While “silver bells” called 10% returns, cocoa and coffee signed up 12% and 13%, respectively, with the S&P GSCI Coffee striking double-digit returns for the 2nd successive month. Minimized production due to heavy rains in the Ivory Coast increased the S&P GSCI Cocoa to 72% YTD; integrated with the S&P GSCI Sugar, which was up over 50% YTD, the 2 will undoubtedly sweeten the holiday. Simply do not exaggerate it, else Yukon Cornelius will need to bring you to the dental professional to take out that craving for sweets.

The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

What Do Insurance Provider Required to Understand About SPIVA?

How and when are insurance companies carrying out index-based techniques as they look for liquidity, diversity, and danger mitigation? S&P DJI’s Raghu Ramachandran and Anu Ganti sign up with BlackRock’s Andrew Masalin to discuss what’s driving passive outperformance and making use of ETFs by insurance companies through the lens of SPIVA.

The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

The Gold Requirement of Indices Meet’s Today’s Innovation

Fulfill the S&P 500 FC Index, an ingenious index developed to change allowances based upon intraday volatility signals as it looks for to increase stability, limitation direct exposure to drawdowns, while enhancing direct exposure to the S&P 500 by means of BofA’s Quick Merging innovation.

The posts on this blog site are viewpoints, not recommendations. Please read our Disclaimers

Finding Charge Cost Savings in Fixed Earnings

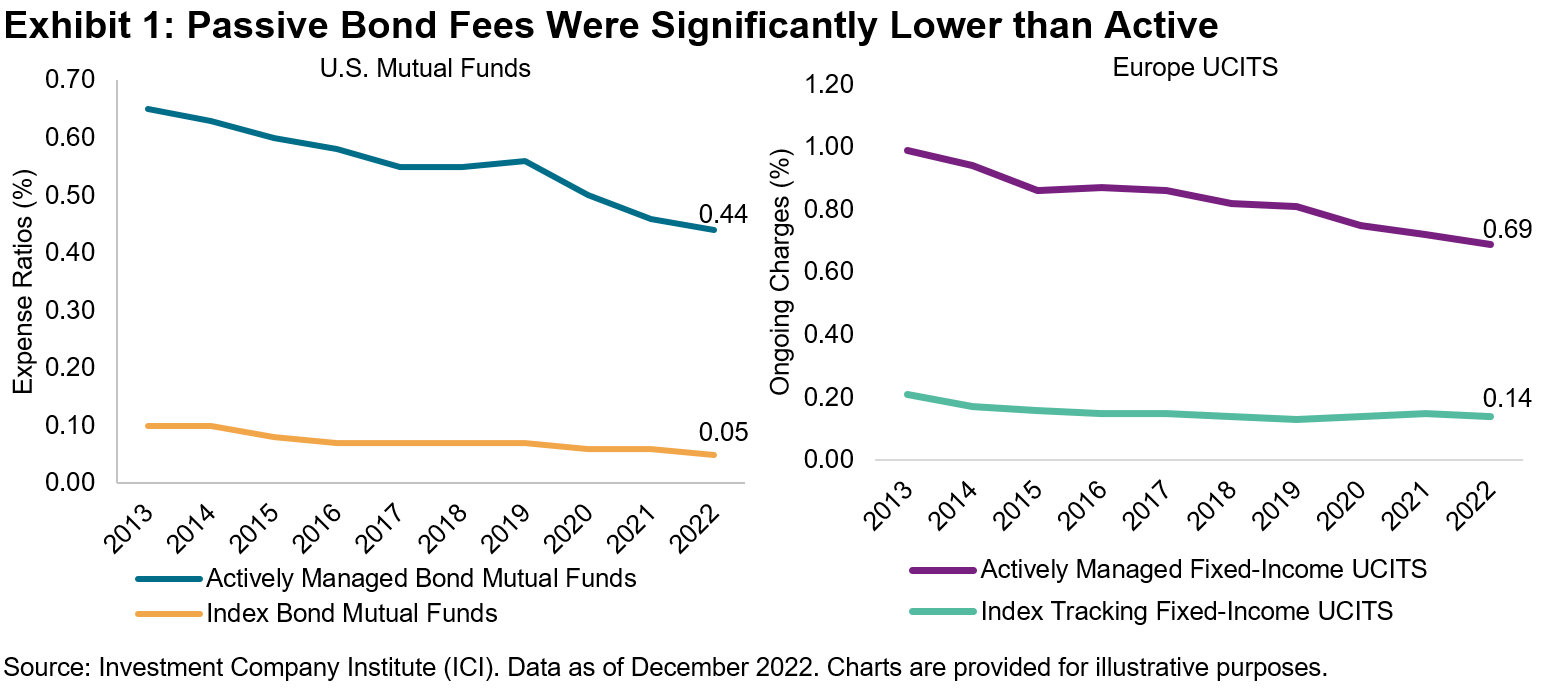

Among the advantages of indexing is its low expense relative to active management. As indexing has actually grown, financiers have actually benefited considerably by minimizing costs and preventing active underperformance. These advantages are not restricted simply to equities however have actually likewise encompassed other property classes consisting of the set earnings area, where costs can play an especially essential function

In Exhibition 1, we see that index mutual fund costs in the U.S. and Europe have actually been regularly lower than their active equivalents for the previous years. While that spread has actually narrowed over the last few years, we still observe a cost differential of 39 bps in the U.S. and 55 bps in Europe since 2022.

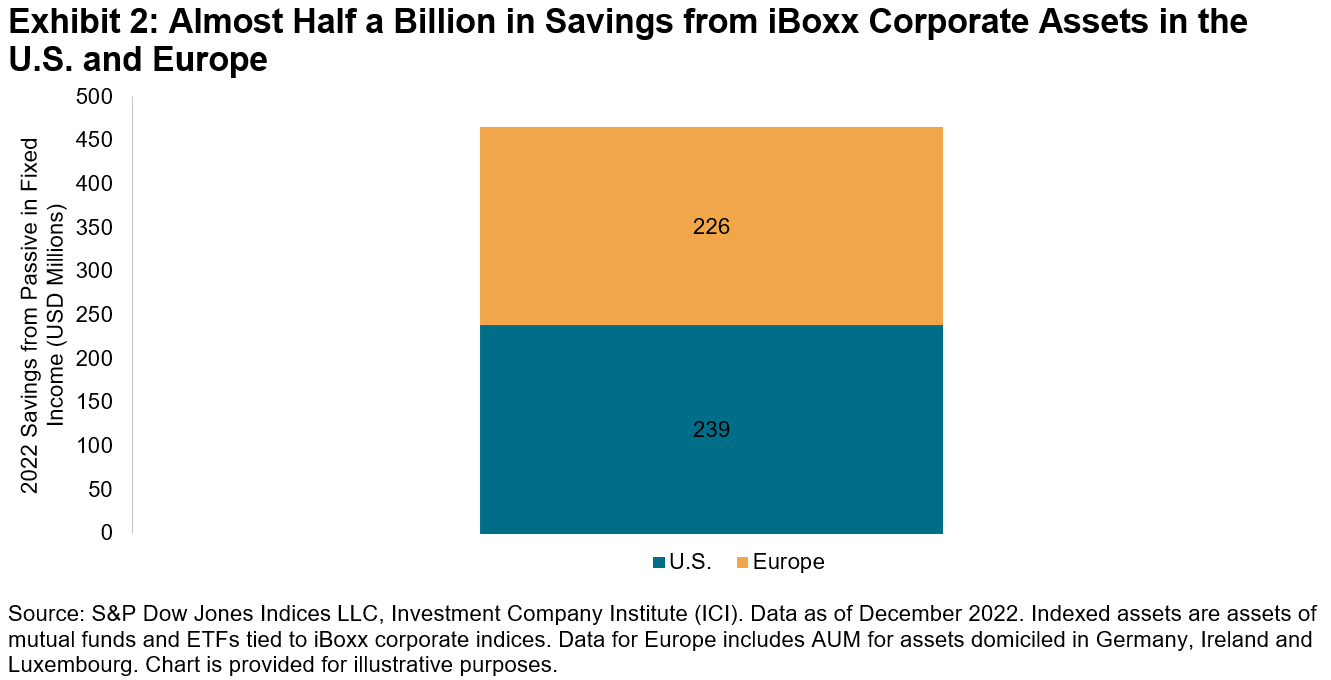

Utilizing the exact same typical cost differentials in between active and passive set earnings funds in the U.S. and Europe, as used regionally to roughly USD 102 billion of properties bought shared funds and ETFs tracking iBoxx business bond indices in both areas, we can approximate a present run rate of equivalent to a minimum of USD 465 million each year in cost cost savings made by passive financiers thanks in part to the iBoxx series (see Exhibition 2).

Obviously, this USD 465 million price quote downplays the complete expense savings of the set earnings index market, because it incorporates funds tracking just choose indices from S&P Dow Jones Indices in the U.S. and Europe.

Our Yearly Study of Indexed Possessions programs international properties tracking our iBoxx Corporate indices were USD 121 billion since December 2022 (this likewise consists of institutional segregated requireds, in addition to properties outside the U.S. and Europe). To supply context on the size of the passive market in set earnings, this number comprises just 1% of the international overall of USD 11.5 trillion in properties of all open-end mutual fund 1 and just around 0.5% of international ranked business financial obligation exceptional. 2 To put it simply, there is a lot of headroom for future passive development in set earnings, and the potential customers for higher cost cost savings are appealing.

Undoubtedly, the cost savings produced by the shift from active to passive management would be of no alleviation if financiers lost more in efficiency shortages than they got in decreased costs. As readers of our SPIVA ®(* )reports might understand, in the 15 years ending in June 2023, 94% of all actively handled General Financial investment Grade mutual fund lagged the iBoxx $ Liquid Financial investment Grade Index High Yield outcomes were practically similarly frustrating. As indexing in set earnings has actually gotten momentum, bond market individuals have actually taken advantage of cost cost savings and avoidance of active underperformance, an effective mix. 1

2023 Investment Firm Reality Book , Investment Firm Institute. Controlled open-end funds consist of shared funds, exchange-traded funds (ETFs) and institutional funds. 2

Credit Trends: Global State of Play: Financial Obligation Development Diverging by Credit Quality. Level of international ranked business financial obligation reached USD 23.2 trillion since July 1, 2023. The posts on this blog site are viewpoints, not recommendations. Please read our

The

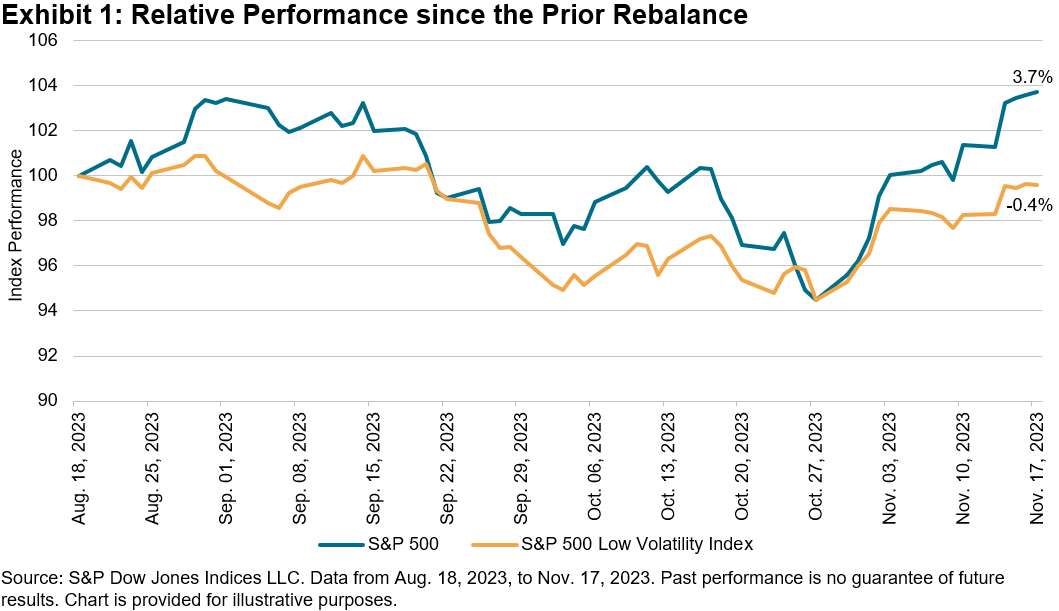

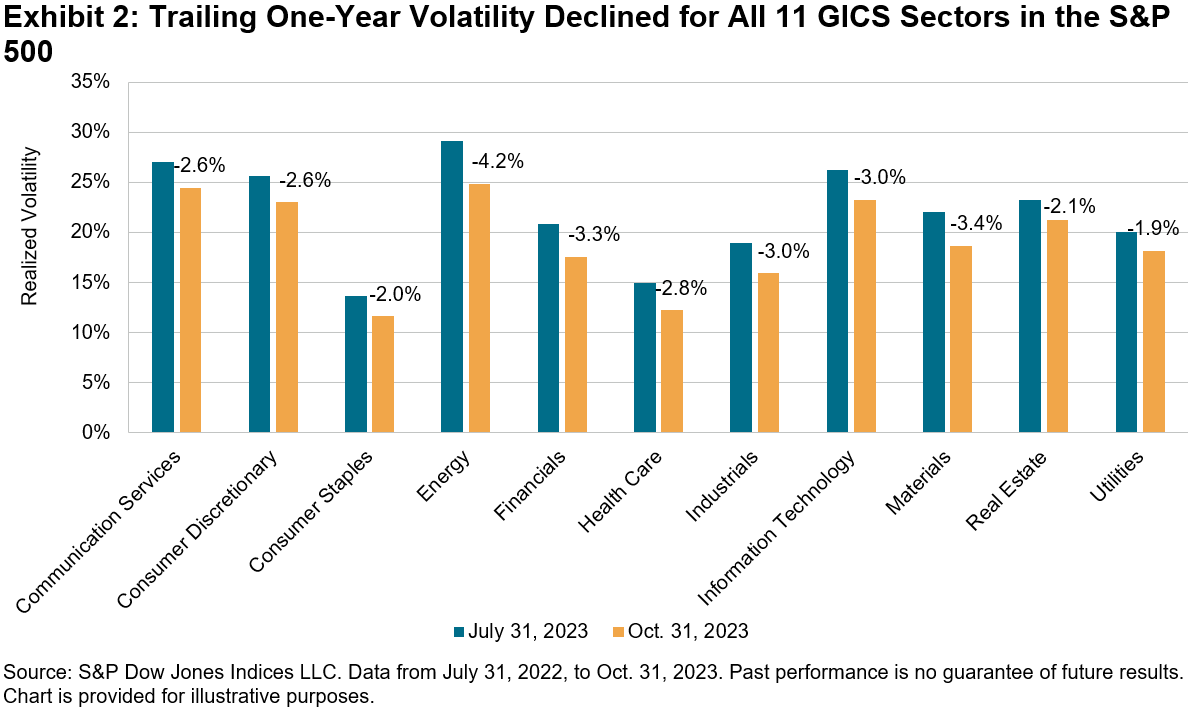

S&P 500 ® continued its strong efficiency this year after publishing a 9.8% gain in a period of less than 3 weeks from Oct. 30 to Nov. 17, 2023. Throughout this duration, the 10-year U.S. Treasury yield dropped roughly 45 bps 1 and October’s year-over-year heading CPI inflation cooled to 3.2%. 2 As Exhibition 1 reveals, because the previous rebalance for the S&P 500 Low Volatility Index on Aug. 18, 2023, through the most current rebalance on Nov. 17, 2023, the S&P 500 was up 3.7%, versus a decrease of 0.4% for the S&P 500 Low Volatility Index. This kind of divergence can take place specifically throughout durations of strong efficiency and low volatility for the S&P 500. Throughout this duration, the annualized day-to-day basic variance for the S&P 500 was a reasonably low 13.6%. As Exhibition 2 programs, the tracking 1 year volatility reduced for all 11 GICS sectors from July 31, 2023, to Oct. 31, 2023. The prevalent decrease in volatility throughout all 11 GICS sectors followed the exact same pattern in the 3 months prior to this duration. Determined in outright terms, volatility reduced the most for the Energy sector, although it stayed the most unpredictable sector at 24.9%. Since Oct. 31, 2023, Customer Staples was the least unpredictable sector, with a day-to-day understood volatility of just 11.6%.

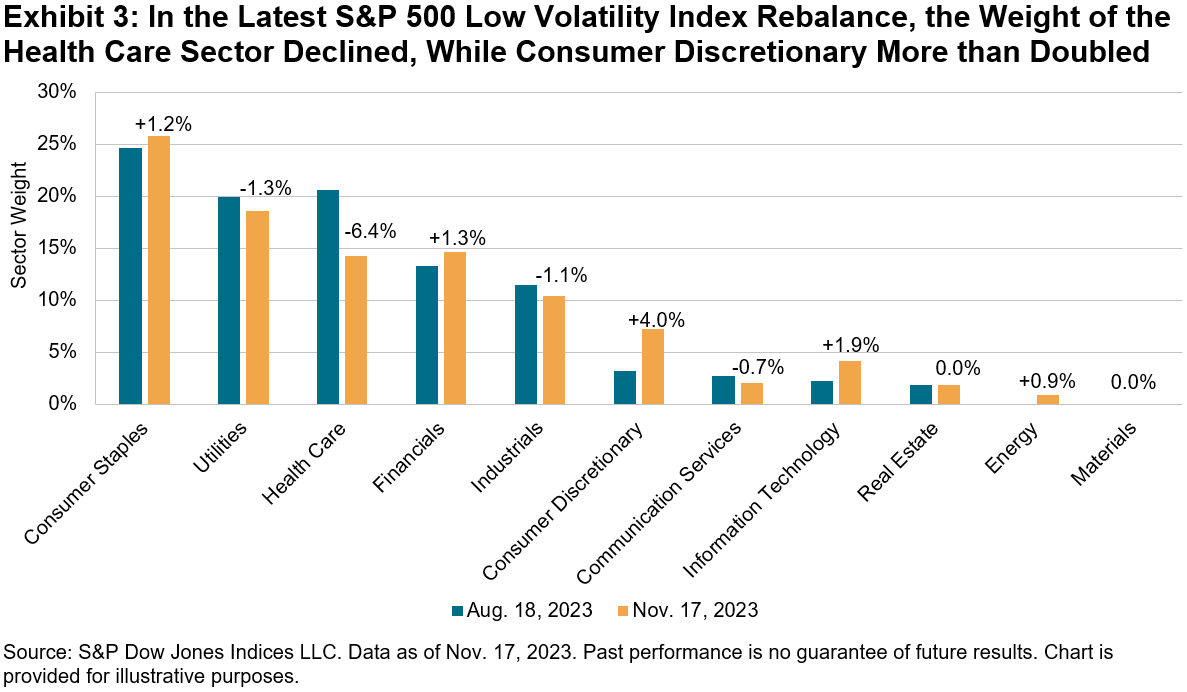

Amidst the general reduction in volatility, the current rebalance of the S&P 500 Low Volatility Index brought some product modifications to sector weightings, most significantly in the Healthcare and Customer Discretionary sectors.

Following the most current rebalance, Healthcare’s weight stopped by 6.4%. Around 4.0% moved to the Customer Discretionary sector, more than doubling its weight to 7.3%. Other significant receivers were the Infotech sector, which saw its weight practically double from 2.3% to 4.2%, in addition to the Customer Staples sector, which increased its weight to 26%.

After the Energy sector got a little allotment of roughly 1%, the Products sector is now the only sector without any allotment in the S&P 500 Low Volatility Index. The most recent rebalance ended up being efficient after the marketplace close on Nov. 17, 2023.

1

https://fred.stlouisfed.org/series/DGS10 2

https://www.bls.gov/news.release/cpi.nr0.htm The posts on this blog site are viewpoints, not recommendations. Please read our