Monetary conditions in the U.S. are looser than in September, states financial expert.

Getty Images/iStock.

The feel-good tone grasping markets in the home stretch of 2023 might not be what the Federal Reserve had actually booked for the vacations.

The stock exchange in December, as soon as again, has actually been knocking on the door of record levels, driven by optimism about alleviating inflation and prospective Fed rate cuts next year.

However while the possibility of double-digit equity gains this year would be a reprieve for financiers after a harsh 2022, the current rally likewise indicates looser monetary conditions.

Eventually, the danger of looser monetary conditions is that they might backfire, especially if they rub versus the Fed’s own objective of keeping credit limiting up until inflation has actually been decisively tamed.

Read: Inflation is falling however rates of interest will be greater for longer. Method longer.

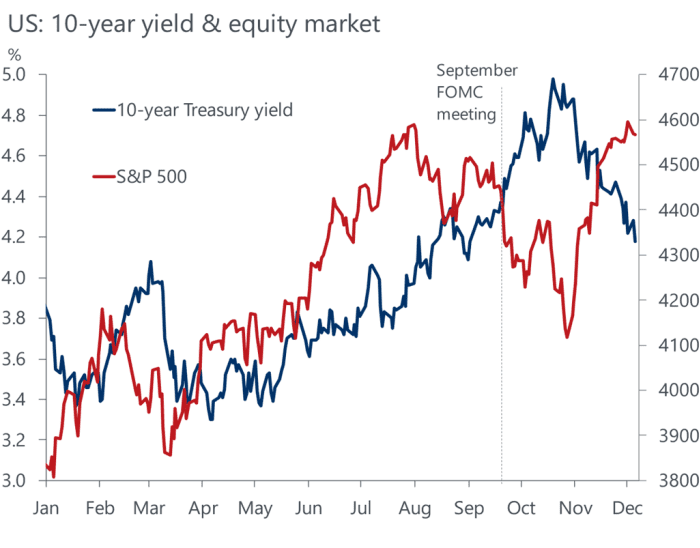

Particularly, the November rally for the S&P 500 index.

SPX

can be traced to the 10-year Treasury yield.

BX: TMUBMUSD10Y

dropping to 4.1% on Thursday from a 16-year peak of 5% in October.

Falling 10-year Treasury yields from a 5% peak in October accompanies a sharp rally in the S&P 500 at the tail end of 2023.

Oxford Economics.

The Fed just puts in direct control over short-term rates, however 10-year and 30-year Treasury yields.

BX: TMUBMUSD30Y

are essential due to the fact that they are a peg for prices vehicle loans, business financial obligation and home loans.

That makes long-lasting rates matter a lot to financiers in stocks, bonds and other properties, given that greater rates can result in increasing defaults, however likewise can crimp business profits, development and the U.S. economy.

Michael Pearce, lead U.S. financial expert at Oxford Economics, believes the November rally might put Fed authorities in a hard area ahead of next week’s Dec. 12 to 13 Federal Free market Committee conference– the 8th and last policy event of 2023.

” The decrease in yields and rise in equity rates more than totally relaxes the tightening up in conditions seen given that the September FOMC conference,” Pearce stated in a Thursday customer note.

The Fed next week isn’t anticipated to raise rates, however rather decide to keep its benchmark rate consistent at a 22-year high in a 5.25% to 5.5% variety, which was embeded in July. The hope is that greater rates will keep bringing inflation to the reserve bank’s 2% yearly target.

Ahead of the Fed’s July conference, stocks were extending a spring rally into summer season, mostly driven by shares of 6 meg-cap innovation business and AI optimism.

Rates in September were kept the same, however main lenders likewise drove home a ” greater for longer” message at that conference, by booking just 2 rate cuts in 2024, rather of 4 earlier. That alarmed markets and set off a string of regular monthly losses in stocks.

Pearce stated he anticipates the Fed next week to “press back versus the concept that rate cuts might come onto the program anytime quickly,” however likewise to “err on the side of leaving rates high for too long.”

That may indicate the very first rate cut is available in September, he stated, behind market chances of a 52.8% opportunity of the very first cut in March, as shown by Thursday by the CME FedWatch Tool.

Stocks were greater Thursday, poised to snap a three-session drop A day previously, the S&P 500 closed 5.2% off its record high set almost 2 years back, the Dow Jones Industrial Average.

DJIA

was 2% far from its record close and the Nasdaq Composite Index.

COMPENSATION

was nearly 12% listed below its November 2021 record, according to Dow Jones Market Data.

Related: What financiers can anticipate in 2024 after a 2-year fight with the bond market