It has actually been a significant duration because product derivatives market regulator SEBI suspended more than half-a-dozen farming products.

In October 2022, the Product Derivatives Advisory Committee (CDAC) recommended relaunching futures trading for those suspended products whose rates are listed below the minimum assistance cost (MSP). Nevertheless, the extension of the suspension continues till December 2023.

For That Reason, a couple of concerns emerge for instant policy actions. (1) is extending the suspension practical? (2) can technical and essential analyses validate relaunching the acquired agreements? (3) is a periodic cancellation needed to bring back the energy of the product derivatives market?

An analysis of area cost motion in suspended derivatives and a contrast with MSPs followed by an essential analysis will respond to these concerns.

- Likewise check out: How is APEDA assisting India increase its farming exports?

Technical analysis.

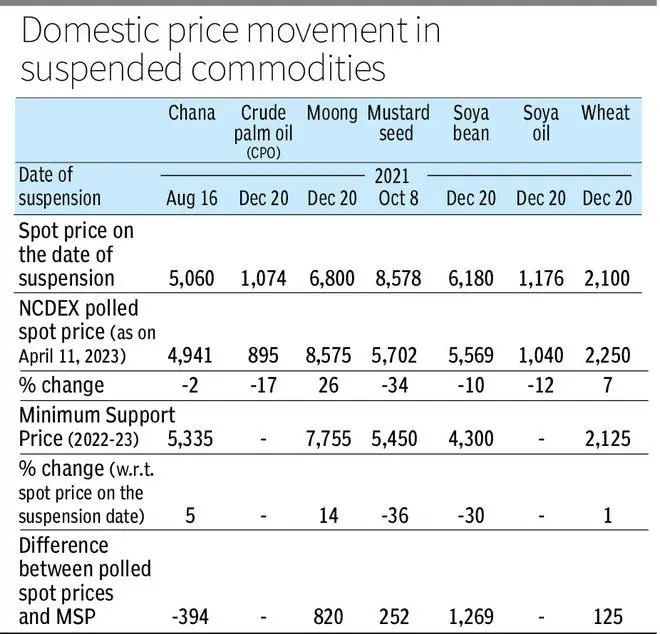

Table 1 provides domestic cost motion in suspended products from the date of suspension to April 12, 2023.

Chana, suspended in August 2021, observed an unfavorable 2 percent cost modification, while unrefined palm oil, mustard seed, soyabean, and soya oil observed a decrease in area cost motion, and moong and wheat experienced a portion modification of 26 percent and 7 percent, respectively.

Likewise, the surveyed area rates revealed co-movement with MSP for moong, mustard seed, soyabean, and wheat.

The distinction in between the exchange-polled area rates and MSP was optimum for soyabean, followed by moong, mustard seed, and wheat. The MSP for chana exceeded the surveyed area rates in April 2023.

Table 1.

- Likewise check out: Commemorating the successes and developments of Indian farming

Basic analysis.

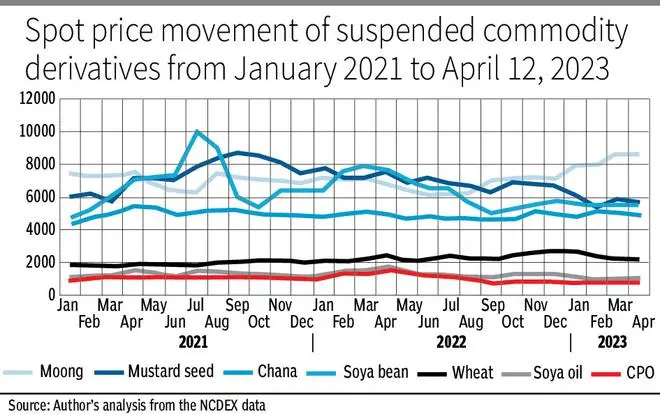

Think about the essential analysis of the suspended agri-derivatives. Rates stayed company for rather a long time for the significant products other than mustard seed post-suspension. Soyabeans, soya oil, and unrefined palm oil rates went up till April 2022 (see Figure 1).

Initially, the cost increase is credited to numerous aspects affecting macro-economic unpredictability and durability, specifically opening significant market economies, and enhancing customer need.

2nd, worldwide soybean production networks suffered a shock due to harsh weather condition in Brazil and Argentina, and dropped sunflower production in Ukraine due to geopolitical stress, labour shortage in Malaysia affecting palm oil production, and so on. Likewise, unrefined palm oil export limitation by Indonesia results in price increase internationally.

Chart (Figure 1).

Wheat rates illustrated an uptrend from February 2022 as the Russia-Ukraine war led to a cost rise due to fear of supply disturbance.

On the other hand, increased exports from India, diminishing buffer stock, and lower production quotes supported the cost uptrend.

Mustard revealing a drop in rates post-suspension is credited to increased supply on the increased production for 2 successive years. Futures agreements of mustard throughout the arrival season illustrated a fall in rates as they traded at backwardation to the area rates.

- Likewise check out: Can farming worth chains solve the agrarian crisis and construct simply rural futures?

Third, thinking about the duration from April 1, 2022, to April 11, 2023, the majority of suspended products’ area rates showed a cost correction, credited to the production excess of significant products such as chana, mustard seed, soybean, and so on

The increased supply of mustard for 2 successive years has actually resulted in cost correction. For edible oils, domestic rates have actually remedied in line with the worldwide rates.

There is a slump in worldwide rates of soya oil, unrefined palm oil, and soyabean. Indonesia’s elimination of export limitations on palm oil produced a stock stacking that moistened domestic rates.

Policy ideas.

Without agri-derivatives, barely any details was shared in between the derivative and its area market of suspended futures. This might impact the marketplace quality and the inspiration of arbitrage in cross-commodity sectors.

So, the regulator and the CDAC need to assist in resuming the derivatives trading for those products whose area rates reveal co-movement with MSP, or reach a particular threshold limitation of the optimum cost of the product in the pre-suspension duration.

- Likewise check out: How natural farming can assist the earnings and socio-economic advancement of the farming neighborhood in India

Margining, market– large position limitation, and security practices must be robust adequate to ring-fence deceitful market individuals and keep an organized performance of the product derivatives market.

To conclude, a sensible choice can prevent the existential crisis of agri-commodity exchange and the product market environment in basic.

( Dey teaches at IIM, Lucknow. Information provided by the NCDEX is acknowledged. Views are individual.)

.