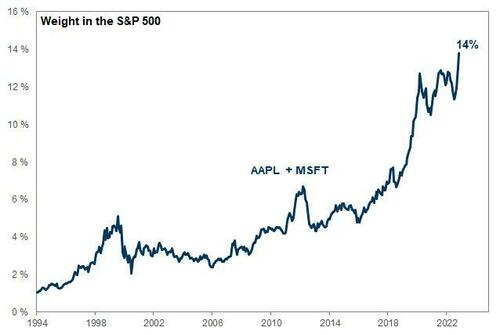

In the previous month we have actually gone over on numerous celebrations the unmatched collapse in market breadth, driven by a record outperformance of a handful of tech names …

… which has actually seen the Nasdaq’s advance/decline line plunge to perpetuity lows even as the Nasdaq is up more than 21% YTD …

… and where JPM just recently observed that “ Market Breadth Is The Weakest Ever” with Goldman’s David Kostin including that there rises danger of a sharp market drawdown as a outcome of the collapse in market breadth

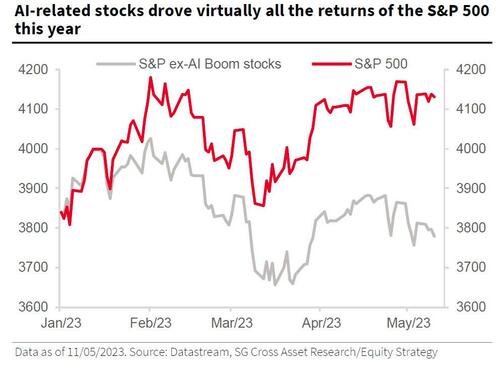

Today, we get a brand-new point of view on the marketplace’s efficiency when stabilized for the record collapse in breadth. According to SocGen it’s not a lot a handful of stocks that has actually brought the whole market this year: it’s simply one particular trade, Expert system (which will quickly stimulate numerous millions in margin-boosting layoffs throughout western nations).

As SocGen’s Manish Kabra composes, “ the AI boom and buzz is strong. So strong that without the AI-popular stocks, S&P 500 would be down 2% this year. Not +8%.”

Kabra reports that his upgrade on SocGen’s AI belief news sign keeps increasing significantly and more prolonged than when he initially discussed it simply a couple of weeks earlier.

What is amazing is that AI is absolutely nothing brand-new: as a style, Expert system has actually been with us for years (SocGen recommended being long SG Robotics and AI Equity as a nonreligious style in 2015), however what is going on now is unmatched, and it is essentially difficult to eliminate versus an extremely strong buzz on an extremely short-term, and according to Kabra, what one can own is the defensive-Growth stocks with the top-20 most AI-held stocks within the leading 15 AI ETFs.

Which brings us back to the subject of 2023’s record narrow management: The narrow efficiency is seen throughout the S&P 500 sectors with 8/11 wider sector groups seeing market-cap weighted indices exceeding equal-weighted indices. According to ScoGen computations, the S&P 500 ex-AI boom stocks would be listed below 3800.

Yet in spite of this relatively unsustainable collapse of market leaders, SocGen concludes that narrow management ought to continue: “ We do see the narrow efficiency in the United States equities to continue as the background remains undesirable for leveraged, Small-caps, Worth stocks, and business that have actually performed unsustainable buybacks.“

More in the complete note readily available to professional subs in the typical location.

Filling …