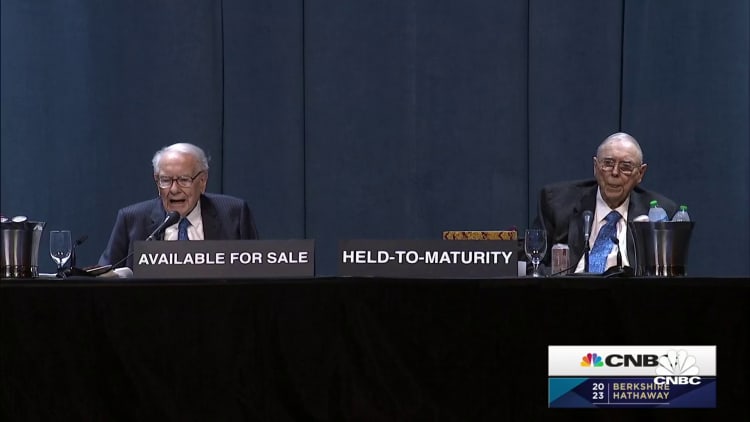

Berkshire Hathaway CEO Warren Buffett on Saturday assaulted regulators, political leaders and the media for puzzling the general public about the security of U.S. banks and stated that conditions might intensify from here.

Buffett, when inquired about the current tumult that caused the collapse of 3 mid-sized organizations considering that March, released into a prolonged diatribe about the matter.

” The scenario in banking is really comparable to what it’s constantly remained in banking, which is that worry is infectious,” Buffett stated. “Historically, in some cases the worry was warranted, in some cases it wasn’t.”

Berkshire Hathaway has actually owned banks from at an early stage in Buffett’s almost six-decade history at the business, and he’s stepped up to inject self-confidence and capital into the market on a number of events. In the early 1990s, Buffett worked as CEO of Salomon Brothers, assisting restore the Wall Street company’s scruffy track record. More just recently, he injected $5 billion into Goldman Sachs in 2008 and another $5 billion in Bank of America in 2011, assisting support both of those companies.

All set to act

He stays prepared, with his business’s powerful money stack, to act once again if the scenario requires it, Buffett stated throughout his yearly investors’ conference.

” We wish to exist if the banking system briefly gets stalled in some method,” he stated. “It should not, I do not believe it will, however it could.”

The core issue, as Buffett sees it, is that the general public does not comprehend that their bank deposits are safe, even those that are uninsured. The Berkshire CEO has actually stated regulators and Congress would never ever permit depositors to lose a single dollar in a U.S. bank, even if they have not made that assurance specific.

The worry of routine Americans that they might lose their cost savings, integrated with the ease of mobile banking, might cause more bank runs. On the other hand, Buffett stated that he keeps his individual funds at a regional organization, and isn’t concerned in spite of going beyond the limit for FDIC protection.

” The messaging has actually been really bad, it’s been bad by the political leaders who in some cases have an interest in having it bad,” he stated. “It’s been bad by the companies, and it’s been bad by the press.”

Very First Republic

Buffett likewise turned his ire on bank executives who took excessive threats, stating that there must be “penalty” for bad habits. Some bank executives might have offered business stock due to the fact that they understood problem was developing, he included.

For instance, First Republic, which was took and offered to JPMorgan Chase after a deposit run, offered its consumers jumbo home mortgages at low rates, which was a “insane proposal,” he stated.

” If you run a bank and screw it up, and you’re still an abundant man … and the world goes on, that’s not an excellent lesson to teach individuals,” he stated.

Berkshire has actually been discharging bank shares, consisting of that of JPMorgan Chase and Wells Fargo, considering that around the start of the 2020 pandemic.

Current occasions have actually just “reconfirmed my belief that the American public does not comprehend their banking system,” Buffett stated.

He restated a number of times that he had no concept how the present scenario will unfold.

” That’s the world we reside in,” Buffett stated. “It implies that a lighted match can develop into a blaze, or be burnt out.”