Halfpoint/iStock by means of Getty Images

Sunworks, Inc. ( NASDAQ: SUNW), a business operating in the quickly growing solar power market, focuses on offering solar energy and storage systems for both domestic and business markets. This FY’ 22, SUNW’s domestic setups represented roughly 88% of its overall earnings, up from 77% a year earlier. In spite of this development, according to the management, dispersed domestic solar power has yet to attain broad market adoption, as it has actually permeated less than 5% of its overall addressable market in the U.S. domestic sector. Today’s much better Solar Financial Investment Tax Credit, integrated with the increasing need for eco-friendly and financially advantageous renewable resource sources, positions Sunworks for ongoing success in the broadening solar power market

Business Introduction

SUNW runs under 3 sectors: Residential Solar, Commercial Solar Power, and Corporate. Its primary organization is offering solar power services for houses. Its Residential Solar sector produced earnings of $139.9 million tape-recorded in FY’ 22, up from the $72.2 million in 2021. This boost was primarily due to greater setup volumes and the favorable effect of its acquisition, Solcius, in 2021. Nevertheless, we can see that its Business Solar power sector’s earnings decreased to $21.9 million from $28.8 million. According to the management, this was because of job hold-ups. In truth, the management boasted their exceptional development in stockpile, as priced estimate listed below.

And After That in our industrial organization, the pipeline I stated the stockpile is we have about $33 million in our stockpile today. We ‘d anticipate our stockpile to grow in Q1 based upon current order activity and discussions with consumers. So we’re preparing for earnings development throughout the year in our industrial organization. However once again, Q1 is going to be a little light since once again, earnings was affected and shipment dates were affected by the weather condition in California.

In general, SUNW ended FY ’22 with $161.9 million in overall earnings, representing a 60% year-over-year boost. This remarkable development can be credited to the business’s tactical concentrate on the domestic solar market. As the need for renewable resource continues to increase, Sunworks is well-positioned to profit from the broadening solar power market.

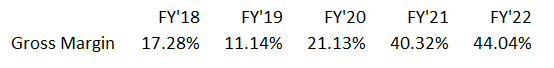

Furthermore, it is fascinating to see a growing gross margin in spite of today’s inflationary environment. In truth, taking a look at the image listed below, we can see an enhancing pattern.

SUNW: Improving Gross Margin ( Source: Information from SeekingAlpha. Prepared by the Author)

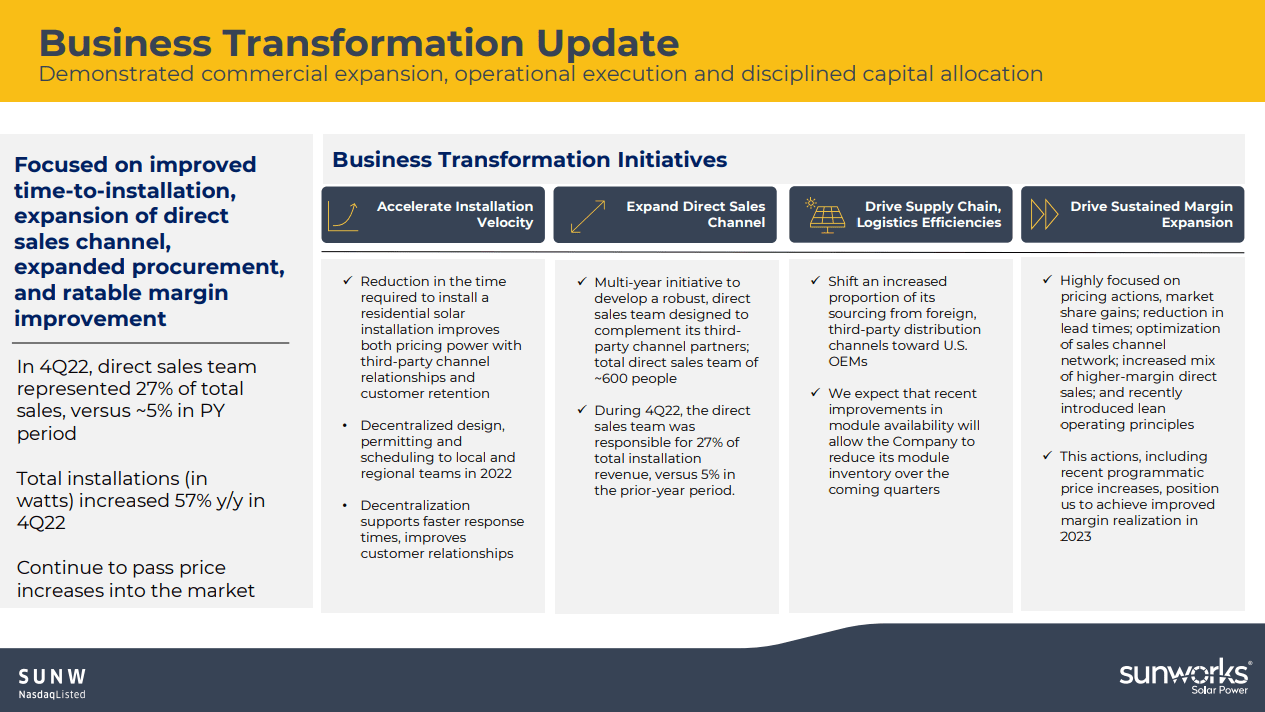

Sunworks is taking actions to enhance its operations and lower expenses while broadening its offerings in the solar services market, as priced estimate listed below.

Throughout 2022, we continued to construct a leading incorporated solar services platform throughout our core local markets, while continuing to advance our organization change technique. In 2015, we continued to drive an enhanced speed of setup, guaranteeing enhanced client retention in between job originations and setups.

We continued to reweight origination towards our direct sales channel, thus minimizing client acquisition cost. We broadened our procurement relationships with a focus on increased access to locally sourced products. And we moved even more towards a central operating design, one that even more places us to move rapidly in assistance of private client requirements.

– Source: Q4 ’22 Revenues Call Records

Much Better SUNW ( Source: Revenues Call Records)

The business is concentrating on different efforts, consisting of decentralizing style and establishing a direct sales group to enhance effectiveness and monetary efficiency. Management anticipates 2023 to be a pivot year of success as the business speeds up setup speed and sustains margin growth. If effective, these efforts might result in enhanced effectiveness and more powerful monetary efficiency.

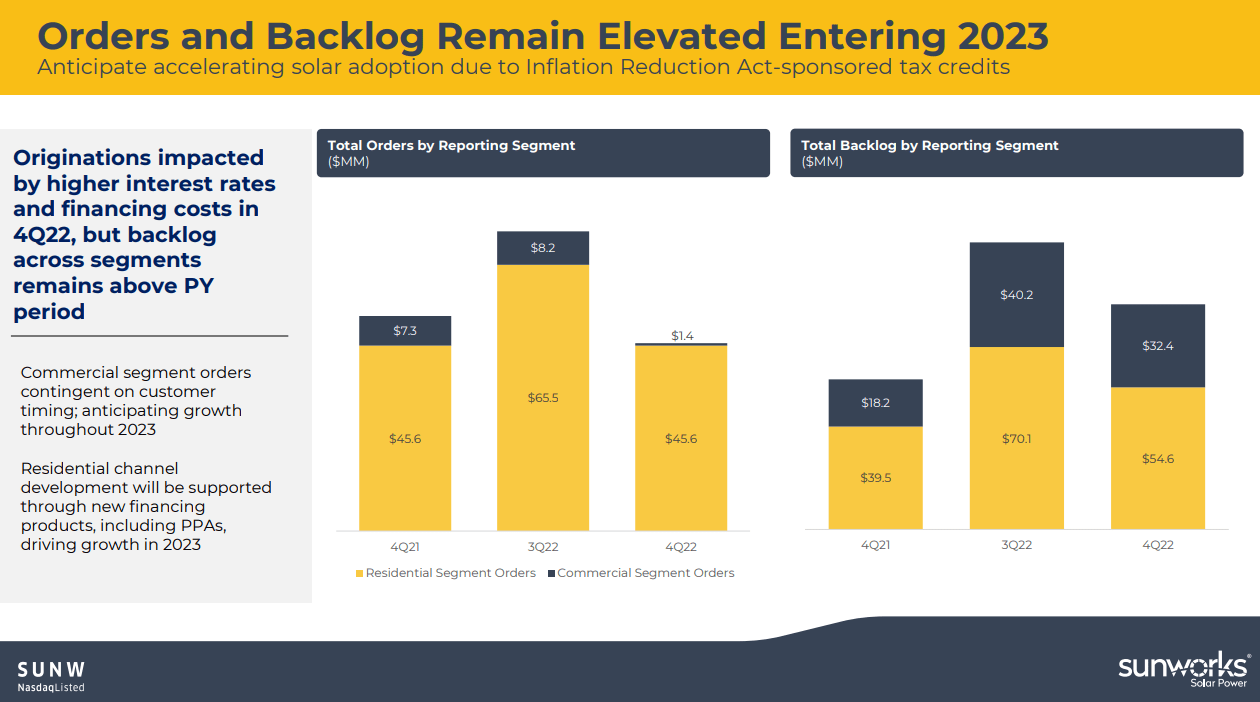

Furthermore, as displayed in the image listed below, SUNW has an exceptional stockpile on both of its primary operating sectors, which supports the business’s ongoing enhancement in monetary efficiency.

SUNW: Need Is Still There ( Source: Revenues Call Discussion)

In truth, management supplied a favorable adjusted EBITDA outlook, as priced estimate listed below.

On balance, I’m favorable on the outlook for our organizations going into 2023. A mix of continual market share gains, current rate actions and beneficial long-lasting need basics, especially with the included advantage of the individual retirement account, position us to move better towards EBITDA breakeven

– Source: Q4 ’22 Revenues Call Records

Possible Entry Point for Financiers In spite of Today’s Bearish Pattern

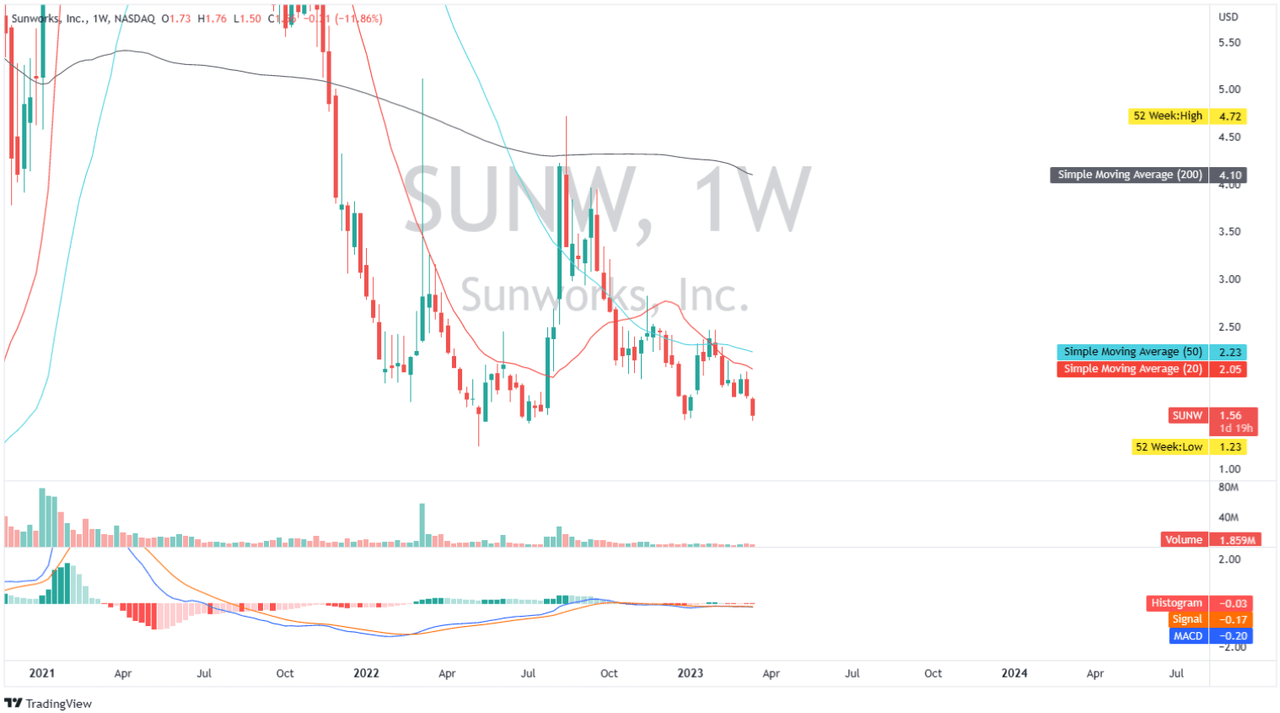

SUNW: Weekly Chart ( Source: Author’s TradingView Account)

SUNW is presently dealing with a strong bearish momentum as displayed in the chart above, where its 200-day Simple Moving Typical (” SMA”) is trading above the existing rate, which implies the stock may have problem getting greater. Furthermore, the 50-day SMA is listed below the 200-day SMA, which recommends an extension these days’s bearish pattern.

In spite of the existing market conditions, it appears that SUNW is presently going into a considerable assistance location. Since this writing, the stock is trading near the next assistance level of roughly $1.25, a level where it has actually revealed effective rebounds in the past. This shows that there might be prospective for favorable rate action in the future. The MACD line is listed below the signal line, suggesting the stock may decrease a bit more in the near term.

In my viewpoint, scaling in at these levels uses a more secure entry point, which supplies a favorable risk/reward ratio since this writing. Furthermore, a possible break of its 20-day and 50-day SMAs resistance levels might move the stock greater, making it an appealing stock.

SUNW’s favorable EBITDA in sight

According to SeekingAlpha Quant Rankings, SUNW has a appraisal grade of A, showing that the business is presently underestimated compared to its sector typical and considerably underestimated compared to its historic efficiency. These findings recommend that SUNW might provide a great financial investment chance for financiers wanting to purchase underestimated stocks.

Furthermore, SUNW seems underestimated by the market, as suggested by its forward and routing EV/Sales ratios of 0.28 x and 0.35 x, respectively, which are lower than its 5-year average of 1.36 x. Its low EV/Sales ratios and remarkable earnings development provides a beneficial chance. In truth, SUNW earnings’s 5-year CAGR of 15.90% considerably exceeds its peer SunPower Corporation’s (NASDAQ: SPWR) -0.60% 5-year CAGR, additional supporting the bullish case for buying SUNW.

It is essential to keep in mind, nevertheless, that SUNW’s monetary efficiency seems weak, with unfavorable EBIT, EBITDA, and earnings In addition, the business still has an unfavorable money circulation from operations totaling up to -$ 28.19 M. These aspects might suggest prospective threats for financiers and recommend that the business is not carrying out well economically. This is particularly real, particularly considering its approximated forward P/E in 2024 of -13.20 x than its peer SPWR’s of 19.35 x in 2024. In my viewpoint, provided SUNW’s broadening client base and their concentrate on enhancing setup procedures, there is a high possibility of continual earnings development, which in turn might drive enhancements in the business’s margin efficiency.

It deserves keeping in mind that experts are now forecasting a favorable EBITDA of $2.10 million for SUNW in 2024. This might have a considerable influence on the business’s money burn rate, which is anticipated to reduce significantly in the coming years. In truth, SUNW’s capital from operations is anticipated to enhance in 2023, with a favorable $ 2.0 million anticipated in 2024

Last Secret Takeaway

SUNW’s balance sheet stays liquid, without any long-lasting financial obligation on its balance sheet. This is appealing in today’s high-interest-rate environment, where business with high financial obligation levels might be at danger. The absence of long-lasting financial obligation on SUNW’s balance sheet might recommend that the business has a lower danger of default, which might make it more appealing particularly in today’s high rate of interest environment.

SUNW ended FY ’22 with $7.8 million in money, which is a favorable, however obviously the money burn rate might fret financiers. Nevertheless, management stays positive that they are still liquid and can money operations in the next complete year. If the worst-case situation were to take place, such as earnings development not fulfilling expectations, we might possibly see ongoing money burn, which might lead to a boost in financial obligation or dilution.

Another development motorist for the business is the passage of NEM 3.0, set to work on April 14, 2023, might function as another driver for worth addition. It is anticipated to possibly increase need for energy storage services, as it minimizes the export rate of excess solar power to the grid. This, in turn, might drive higher interest in energy storage services like battery storage, making it possible for consumers to save surplus solar power for later usage. This position SUNW well and might possibly take advantage of this pattern, as suggested listed below.

So California has actually been strong. We’re beginning to book out production slots or set up slots into Q2. So if we continue to see the strength that we have actually seen over the last numerous weeks, I would not anticipate a considerable drop off in Q3. At the exact same time, I simply wish to concentrate on we’re continuing to induce brand-new dealerships and broaden these direct sales.

– Source: Q4 ’22 Revenues Call Records

In summary, SUNW has actually revealed some weak points in its current efficiency, with an unfavorable money circulation from operations and a less beneficial appraisal compared to its peers. Nevertheless, the business’s growing client base and stockpile suggest a favorable pattern and make it an appealing financial investment chance. In addition, the management’s concentrate on constructing the direct sales channel is anticipated to lead to expense savings for the business in the long-lasting, challenging the concept of ongoing money burn. Because of these aspects, SUNW is thought about a bargain prospect in the existing bearish financial investment environment.

Thank you for reading and all the best everybody!

Editor’s Note: This short article covers several microcap stocks. Please understand the threats related to these stocks.