PeopleImages/iStock by way of Getty Photographs

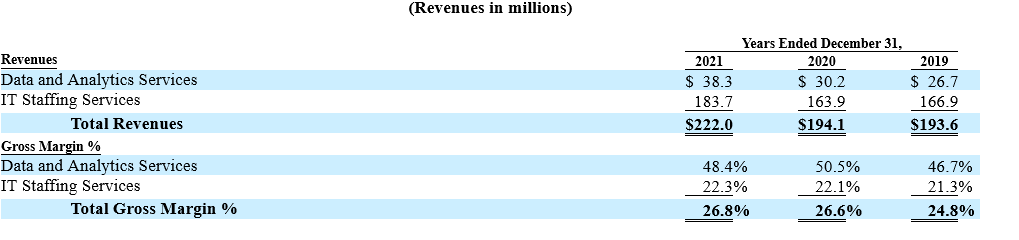

Mastech Virtual, Inc. (NYSE:MHH) is a supplier of IT staffing and information and analytics. They had been a by-product in 2008 from IGate, which is a subsidiary of Capgemini (OTCPK:CAPMF). The income and gross margin breakdown are beneath:

MHH 10-Ok 2021

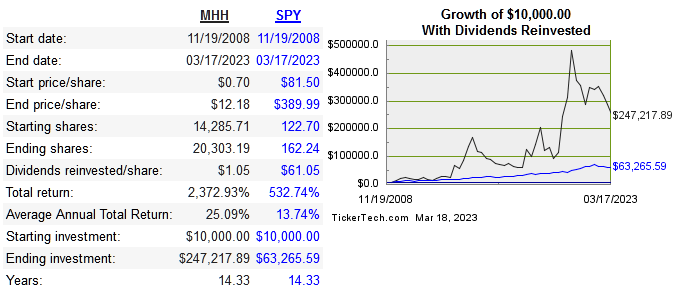

The proportion worth efficiency since IPO is subsequent up:

dividend channel

This mix of companies brings margins to decrease ranges, however the income expansion and ROIC make up for the margins. Under is the go back on capital metrics comparability amongst friends:

The IT staffing marketplace is estimated to develop at 3.6% to 2028, while the knowledge analytics marketplace is projected at 13% expansion until the tip of the last decade.

|

Corporate |

Income 10-12 months CAGR |

Median 10-12 months ROE |

Median 10-12 months ROIC |

EPS 10-12 months CAGR |

FCF/Proportion 10-12 months CAGR |

|

MHH |

10.3% |

18.9% |

13.1% |

10.9% |

5.2% |

|

23.2% |

13.4% |

7.4% |

n/a |

25.8 |

|

|

14.5% |

20.3% |

12% |

4.7% |

n/a |

|

|

14% |

-38.6% |

-11.8% |

n/a |

n/a |

Gross margins have expanded some over the last decade, and running margins were moderately solid. Theyâve been successful yearly as a public corporate and just one yr of damaging unfastened money drift.

Capital Allocation

MHH will pay no dividend and has no energetic repurchase coverage. Theyâve made two acquisitions thus far and used most commonly debt to fund the purchases. It is unclear whether or not they’re going to use much less debt sooner or later, because of emerging charges. Both means I believe they have got treated M&A responsibly till now.

Long term expansion will come organically in conjunction with extra acquisitions. They’re nonetheless a protracted techniques from returning capital to shareholders, and I’m hoping they maximize their reinvestment runway first.

Chance

The principle problem is that doubtlessly expansion slows significantly because of macro elements which can be out of the corporateâs keep an eye on. The devastation to the tech sector, along with the somewhat well-liked expectation of recession has without a doubt affected the present expansion of the corporate. Connected to this chance is a concentrated buyer base. That is by no means a perfect signal, as the wider financial problems may motive vital income loss if a kind of large shoppers go away, and once more now not their very own fault. I donât see execution chance right here, the CEO has already confirmed to be excellent for this position.

Long run debt is at an excessively low stage of $2 million, they have got effectively paid down a large number of debt used for earlier acquisitions.

One facet I in point of fact like on this tale is the prime stage of insider possession and having a well-qualified CEO. Whilst the danger discussed above is actual, the velocity of possession displays that incentives must be aligned between buyers and control. This stage of possession mitigates the danger to a big extent, and is a brilliant signal for a smaller expansion corporate like this.

Valuation

Stocks reached an all-time prime in June of 2020 and are actually 53% not up to that top. First weâll have a look at the multiples comp adopted via the DCF style:

|

Corporate |

EV/Gross sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

MHH |

0.6 |

11 |

41.2 |

1.6 |

n/a |

|

DLHC |

1 |

9.2 |

13 |

1.5 |

n/a |

|

BGSF |

0.5 |

7.8 |

-47.9 |

1.2 |

5.4% |

|

JOB |

0.1 |

2.9 |

3.8 |

0.4 |

n/a |

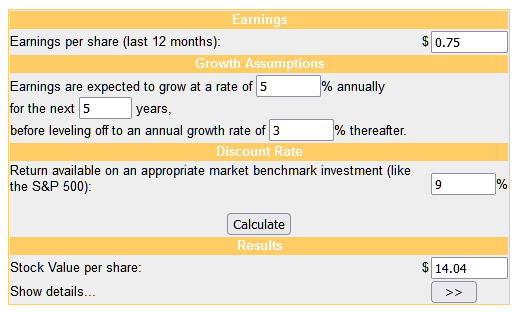

cash chimp

On account of the combination of segments inside the corporate, multiples arenât moderately as useful for the reason that friends donât have the similar knowledge and analytics element as MHH. Despite this, there isnât any obvious cut price when having a look on the multiples.

On an intrinsic foundation, I used a extra conservative estimate of EPS expansion. That is to issue within the likelihood of a recession, which I shouldn’t have a definitive name on both means. So the usage of a conservative forecast, the present proportion worth is decently undervalued. Bearing in mind the expansion price alternatively, I will be able to be ready to look if there generally is a better cut price introduced sooner or later.

Conclusion

MHH has no doubt been a perfect performer since turning into publicly traded. The most important going ahead is a recession dragging down their expansion price, however both means the corporate has balance and hasn’t been susceptible to cyclical swings so far as basics cross.

Stocks are undervalued at this time, however for this stage of expansion I’d nonetheless like to look extra of a cut price. It isn’t laborious to look a shiny long term for this corporate, and the incentives are in position with a prime stage of insider possession, and the CEO is completely certified and has accomplished a commendable activity thus far.

MHH inventory is a hang for me at this time, however I love the potential of the long term.